You are an accountant hired to complete the tpt-ez form for your client Tacos Locos. Tacos Locos is a restaurant that sells food and beverages. In addition, Tacos Locos rents part of their building to EZ Street. Based on the details below, you must complete the tpt-ez form using the January 2019 rates listed on the Arizona Department of Revenue website. Figure out the protentional deduction(s) on schedule A. Determine if Tacos Locos is allowed an accounting credit. What form does Tacos Locos need to complete for its vendor Big Market for exemption of sales tax? Find the form and complete it for Tacos Locos. In addition to completing the tpt-ez form and the exemption certificate, help Taco Locos complete the business property statement form. After completion of the above mentioned forms, you must provide answers to the questions listed below.

Tacos Locos

1 Pollo Way

Mesa, AZ 85202

480-555-5555

EIN45-398686

License 223689

Food sales for January 2019 is $10,253

Beverage sales for January 2019 is $4,532

Rent collected from EZ Street $2,000

Cost of food $4,000

Cost of beverages $665

Sales Tax Collected Food $1,331

Rental tax collected $36

Enter your name for preparer.

Vendor used to supply food and beverages:

Big Market

23 Super Store Drive

Mesa, AZ 85202

480-667-7777

Account # 25869

Inventory:

Business property Account number 456234.

None of the items were transferred from another location and taxes were not already paid.

Purchased 9/5/18 Stove $1,300

Sold 12/1/18 Grill $2,500

Purchased 5/5/18 Beverage Machine $1,000

Purchased 6/12/17 listed Booths $5,000

Balance as of 12/31/18 Food $3,000

Balance as of 12/31/18 Beverages $2,250

Balance as of 12/31/18 Office Supplies $1,400

Enter your name as authorized agent

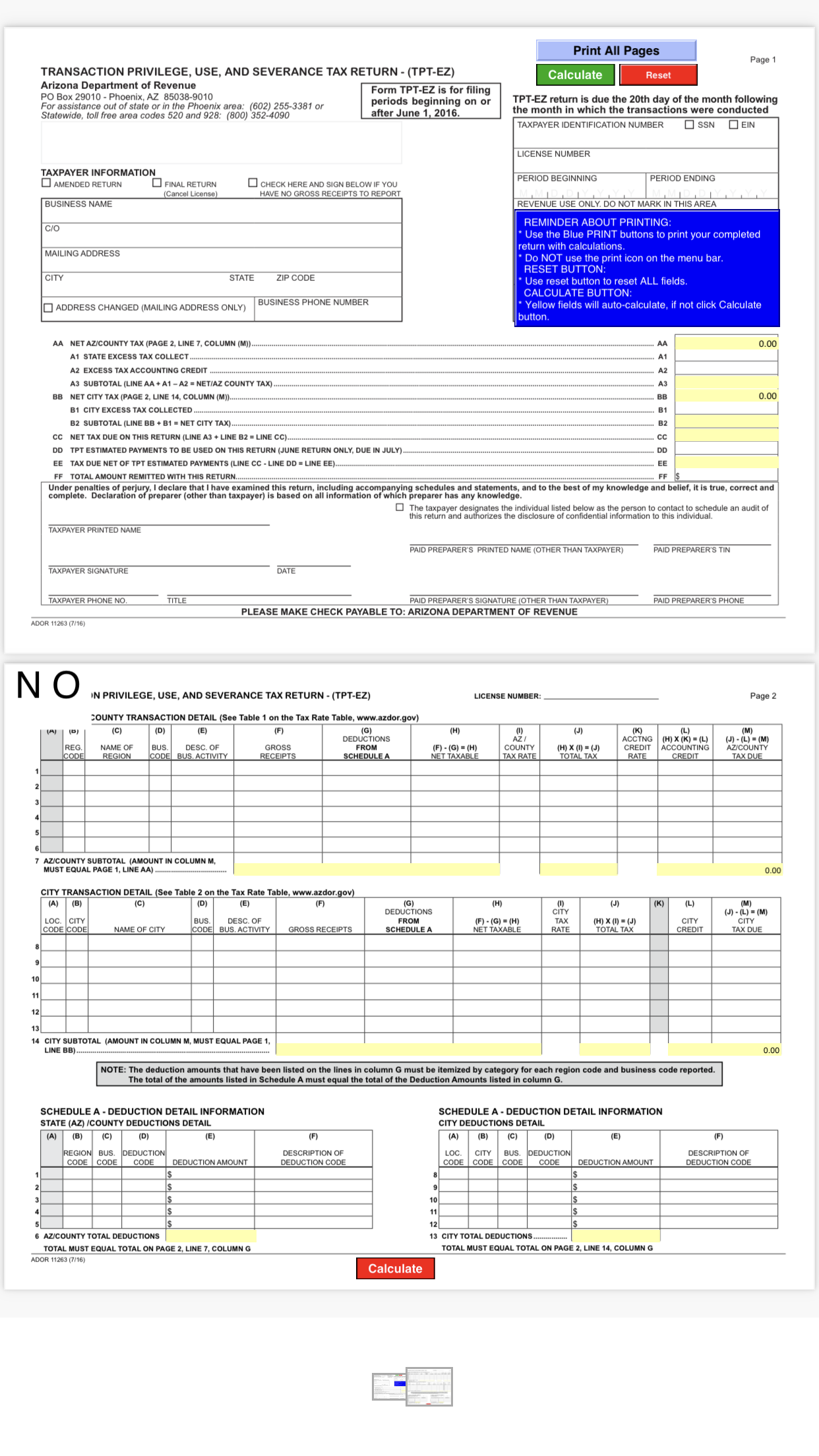

Print All Pages Page 1 TRANSACTION PRIVILEGE, USE, AND SEVERANCE TAX RETURN - (TPT-EZ) Calculate Reset Arizona Department of Revenue PO Box 29010 - Phoenix, AZ 85038-9010 Form TPT-EZ is for filing For assistance out of state or in the Phoenix area: (602) 255-3381 or periods beginning on or TPT-EZ return is due the 20th day of the month following Statewide, toll free area codes 520 and 928: (800) 352-4090 after June 1, 2016. the month in which the transactions were conducted TAXPAYER IDENTIFICATION NUMBER SSN EIN LICENSE NUMBER TAXPAYER INFORMATION AMENDED RETURN FINAL RETURN CHECK HERE AND SIGN BELOW IF YOU PERIOD BEGINNING PERIOD ENDING (Cancel License) HAVE NO GROSS RECEIPTS TO REPORT BUSINESS NAME REVENUE USE ONLY. DO NOT MARK IN THIS AREA C/O REMINDER ABOUT PRINTING: Use the Blue PRINT buttons to print your completed MAILING ADDRESS return with calculations. " Do NOT use the print icon on the menu bar. RESET BUTTON: CITY STATE ZIP CODE Use reset button to reset ALL fields. CALCULATE BUTTON: ADDRESS CHANGED (MAILING ADDRESS ONLY) BUSINESS PHONE NUMBER * Yellow fields will auto-calculate, if not click Calculate button. AA NET AZ/COUNTY TAX (PAGE 2, LINE 7, COLUMN (M)). . AA D.00 A1 STATE EXCESS TAX COLLECT.. A1 A2 EXCESS TAX ACCOUNTING CREDIT . . A2 A3 SUBTOTAL (LINE AA + A1 - A2 = NET/AZ COUNTY TAX) . . A3 BB NET CITY TAX (PAGE 2, LINE 14, COLUMN (M)). BB 0.00 B1 CITY EXCESS TAX COLLECTED .. B1 B2 SUBTOTAL (LINE BB + B1 = NET CITY TAX). B2 CC NET TAX DUE ON THIS RETURN (LINE A3 + LINE B2 = LINE CC).. cc DD TPT ESTIMATED PAYMENTS TO BE USED ON THIS RETURN (JUNE RETURN ONLY, DUE IN JULY). DD EE TAX DUE NET OF TPT ESTIMATED PAYMENTS (LINE CC - LINE DD = LINE EE). EE FF TOTAL AMOUNT REMITTED WITH THIS RETURN. .. FF $ er penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. The taxpayer designates the individual listed below as the person to contact to schedule an audit of ofidential information to this individual. this return and authorizes the disclosure of confidential informati TAXPAYER PRINTED NAME PAID PREPARER'S PRINTED NAME (OTHER THAN TAXPAYER) PAID PREPARER'S TIN TAXPAYER SIGNATURE DATE TAXPAYER PHONE NO. TITLE PAID PREPARER'S SIGNATURE (OTHER THAN TAXPAYER) PAID PREPARER'S PHONE PLEASE MAKE CHECK PAYABLE TO: ARIZONA DEPARTMENT OF REVENUE ADOR 11263 (7/16) NO N PRIVILEGE, USE, AND SEVERANCE TAX RETURN - (TPT-EZ) LICENSE NUMBER: Page 2 COUNTY TRANSACTION DETAIL (See Table 1 on the Tax Rate Table, www.azdor.gov) (C) (D) (E) (F) (G) (H) ( J) DEDUCTIONS (K) ACCTNG REG. NAME OF BUS. DESC. OF GROSS FROM (F) - (G) = (H) COUNTY (H) X (1) = (J) CREDIT (H) X (K) = (L) ( J ) - (L) = (M) ACCOUNTING AZ/COUNTY CODE REGION CODE BUS. ACTIVITY RECEIPTS SCHEDULE A NET TAXABLE TAX RATE TOTAL TAX RATE CREDIT TAX DUE AZ/COUNTY SUBTOTAL (AMOUNT IN COLUMN M, MUST EQUAL PAGE 1, LINE AA) .. 0.00 CITY TRANSACTION DETAIL (See Table 2 on the Tax Rate Table, www.azdor.gov) (A) (B) (C) (D) (E) (F) (H) DEDUCTIONS CITY (K) (L) (M) LOC. CITY BUS. DESC. OF FROM (J) - (L) = (M) (F) - (G) = (H) TAX CITY CITY CODE CODE NAME OF CITY CODE BUS. ACTIVITY GROSS RECEIPTS SCHEDULE A NET TAXABLE RATE (H) X (1) = (J) TOTAL TAX REDIT TAX DUE 10 12 13 14 CITY SUBTOTAL (AMOUNT IN COLUMN M, MUST EQUAL PAGE 1, LINE BB) .. 0.00 NOTE: The deduction amounts that have been listed on the lines in column G must be itemized by category for each region code and business code reported. The total of the amounts listed in Schedule A must equal the total of the Deduction Amounts listed in column G. SCHEDULE A - DEDUCTION DETAIL INFORMATION SCHEDULE A - DEDUCTION DETAIL INFORMATION STATE (AZ) /COUNTY DEDUCTIONS DETAIL CITY DEDUCTIONS DETAIL ( A ) (B) (C) (D) (E (F) (A) (B) (C) (D) (E) (F) REGION BUS. DEDUCTION DESCRIPTION OF LOC. CITY BUS. DEDUCTION DESCRIPTION OF CODE CODE CODE DEDUCTION AMOUNT DEDUCTION CODE CODE CODE CODE CODE DEDUCTION AMOUNT DEDUCTION CODE 12 6 AZ/COUNTY TOTAL DEDUCTIONS 13 CITY TOTAL DEDUCTIONS . TOTAL MUST EQUAL TOTAL ON PAGE 2, LINE 7, COLUMN G TOTAL MUST EQUAL TOTAL ON PAGE 2, LINE 14, COLUMN G ADOR 11263 (7/16) Calculate