Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an accounting student who has been hired as a co-op student with Howard Communication Ltd (HCL), a public company that operates as a

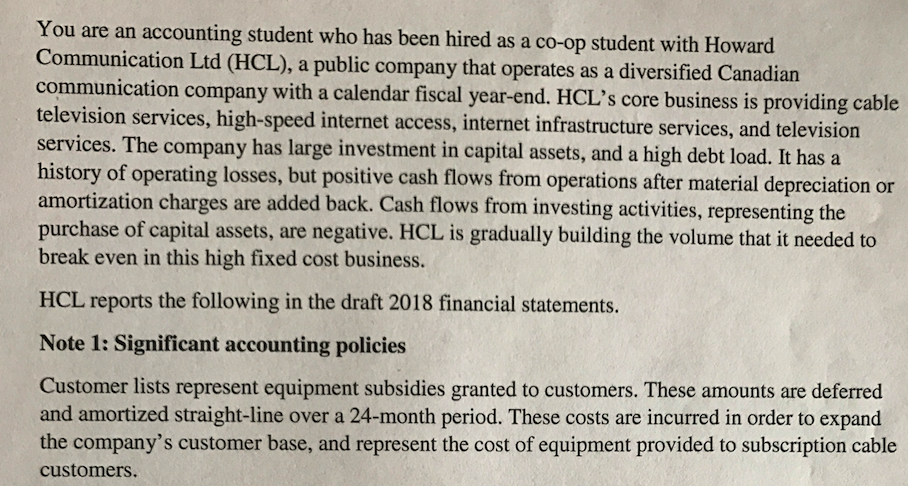

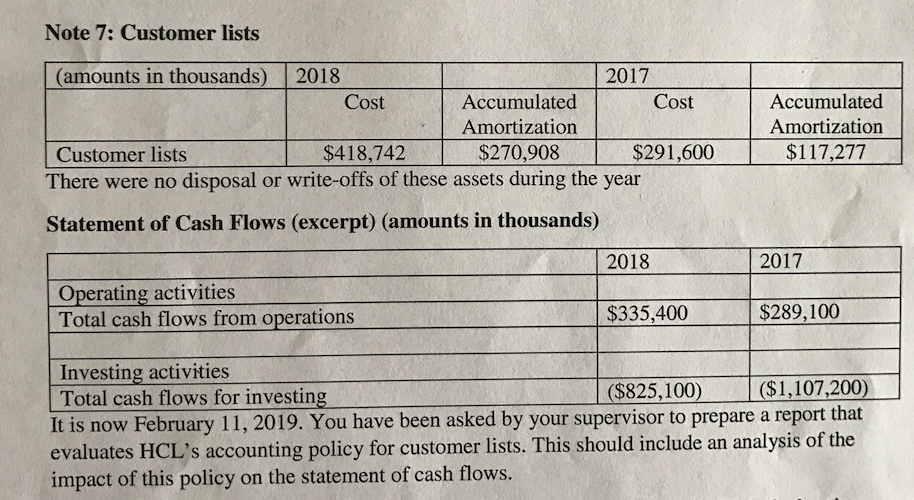

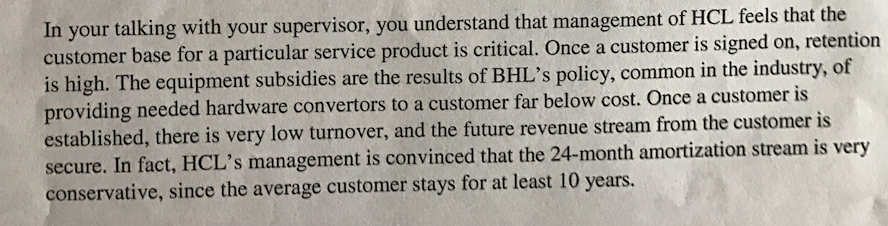

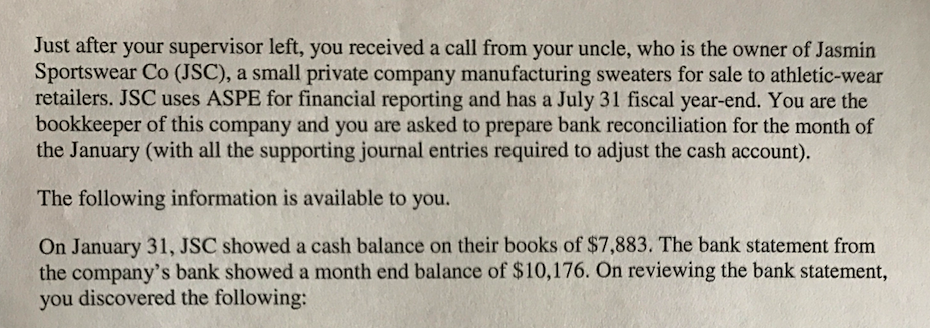

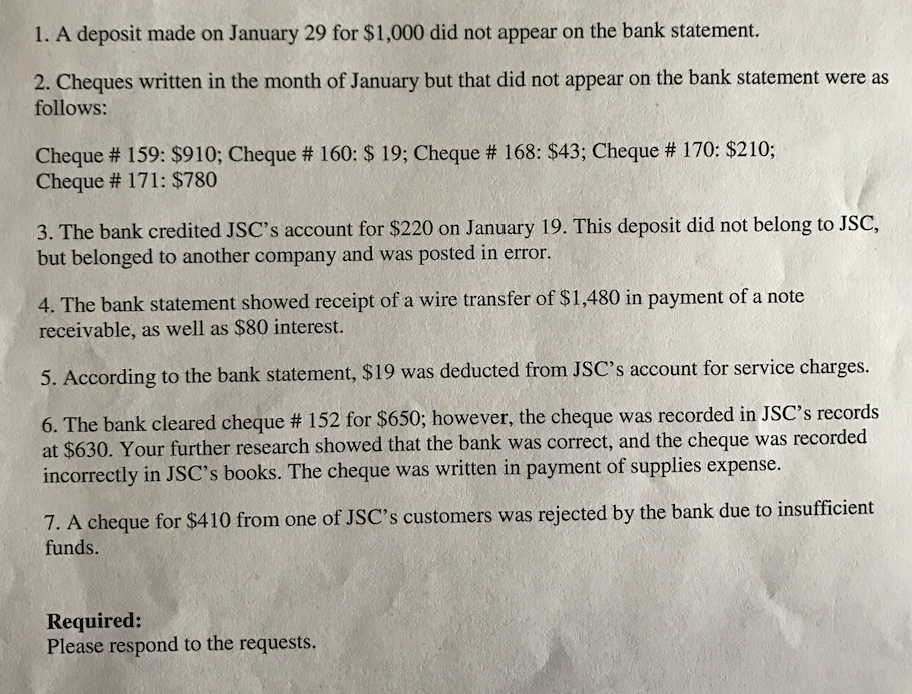

You are an accounting student who has been hired as a co-op student with Howard Communication Ltd (HCL), a public company that operates as a diversified Canadian communication company with a calendar fiscal year-end. HCL's core business is providing cable television services, high-speed internet access, internet infrastructure services, and television services. The company has large investment in capital assets, and a high debt load. It has a history of operating losses, but positive cash flows from operations after material depr amortization charges are added back. Cash flows from investing activities, representing the purchase of capital assets, are negative. HCL is gradually building the volume that it needed to break even in this high fixed cost business. HCL reports the following in the draft 2018 financial statements. Note 1: Significant accounting policies Customer lists represent equipment subsidies granted to customers. These amounts are deferred and amortized straight-line over a 24-month period. These costs are incurred in order to expand the company's customer base, and represent the cost of equipment provided to subscription cable customers Note 7: Customer lists (amounts in thousands) 2018 2017 Cost Accumulated Amortization Cost Accumulated Amortization $418,742 $270,908 $291,600 Customer lists There were no disposal or write-offs of these assets during the year Statement of Cash Flows (excerpt) (amounts in thousands) 2018 2017 Operating activities Total cash flows from operations $289,100 $335,400 Investing activities Total cash flows for investin It is now February 11, 2019. You have been asked by your supervisor to prepare a report that evaluates HCL's accounting policy for customer lists. This should include an analysis of the impact of this policy on the statement of cash flows. ($825,100)(S1,] ($1,107.200) In your talki customer base for a particular service product is critical. Once a custom is high. The equipment subsidies are the results of BHL's policy, common in the industry, of providing needed hardware convertors to a customer far below cost. Once a customer i established, there is very low turnover, and the future revenue stream from the secure. In fact, HCL's management is convinced that the 24-month amortization stream is very conservative, since the average customer stays for at least 10 years. ing with your supervisor, you understand that management of HCL feels that the er is signed on, retention Just after your supervisor left, you received a call from your uncle, who is the owner of Jasmin Sportswear Co (JSC), a small private company manufacturing sweaters for sale to athletic-wear retailers. JSC uses ASPE for financial reporting and has a July 31 fiscal year-end. You are the bookkeeper of this company and you are asked to prepare bank reconciliation for the month of the January (with all the supporting journal entries required to adjust the cash account). The following information is available to you. On January 31, JSC showed a cash balance on their books of $7,883. The bank statement from the company's bank showed a month end balance of $10,176. On reviewing the bank statement, you discovered the following: 1. A deposit made on January 29 for $1,000 did not appear on the bank statement. 2. Cheques written in the month of January but that did not appear on the bank statement were as follows: Cheque # 159: $910; Cheque # 160: $ 19, Cheque # 168: $43; Cheque # 170: $210; Cheque # 171: $780 3. The bank credited JSC's account for $220 on January 19. This deposit did not belong to JSC, but belonged to another company and was posted in error 4. The bank statement showed receipt of a wire transfer of $1,480 in payment of a note receivable, as well as $80 interest. 5. According to the bank statement, $19 was deducted from JSC's account for service charges. 6. The bank cleared cheque # 152 for $650; however, the cheque was recorded in JSC's records at $630. Your further research showed that the bank was correct, and the cheque was recorded incorrectly in JSC's books. The cheque was written in payment of supplies expense. 7. A cheque for $410 from one of JSC's customers was rejected by the bank due to insufficient funds. Required: Please respond to the requests. You are an accounting student who has been hired as a co-op student with Howard Communication Ltd (HCL), a public company that operates as a diversified Canadian communication company with a calendar fiscal year-end. HCL's core business is providing cable television services, high-speed internet access, internet infrastructure services, and television services. The company has large investment in capital assets, and a high debt load. It has a history of operating losses, but positive cash flows from operations after material depr amortization charges are added back. Cash flows from investing activities, representing the purchase of capital assets, are negative. HCL is gradually building the volume that it needed to break even in this high fixed cost business. HCL reports the following in the draft 2018 financial statements. Note 1: Significant accounting policies Customer lists represent equipment subsidies granted to customers. These amounts are deferred and amortized straight-line over a 24-month period. These costs are incurred in order to expand the company's customer base, and represent the cost of equipment provided to subscription cable customers Note 7: Customer lists (amounts in thousands) 2018 2017 Cost Accumulated Amortization Cost Accumulated Amortization $418,742 $270,908 $291,600 Customer lists There were no disposal or write-offs of these assets during the year Statement of Cash Flows (excerpt) (amounts in thousands) 2018 2017 Operating activities Total cash flows from operations $289,100 $335,400 Investing activities Total cash flows for investin It is now February 11, 2019. You have been asked by your supervisor to prepare a report that evaluates HCL's accounting policy for customer lists. This should include an analysis of the impact of this policy on the statement of cash flows. ($825,100)(S1,] ($1,107.200) In your talki customer base for a particular service product is critical. Once a custom is high. The equipment subsidies are the results of BHL's policy, common in the industry, of providing needed hardware convertors to a customer far below cost. Once a customer i established, there is very low turnover, and the future revenue stream from the secure. In fact, HCL's management is convinced that the 24-month amortization stream is very conservative, since the average customer stays for at least 10 years. ing with your supervisor, you understand that management of HCL feels that the er is signed on, retention Just after your supervisor left, you received a call from your uncle, who is the owner of Jasmin Sportswear Co (JSC), a small private company manufacturing sweaters for sale to athletic-wear retailers. JSC uses ASPE for financial reporting and has a July 31 fiscal year-end. You are the bookkeeper of this company and you are asked to prepare bank reconciliation for the month of the January (with all the supporting journal entries required to adjust the cash account). The following information is available to you. On January 31, JSC showed a cash balance on their books of $7,883. The bank statement from the company's bank showed a month end balance of $10,176. On reviewing the bank statement, you discovered the following: 1. A deposit made on January 29 for $1,000 did not appear on the bank statement. 2. Cheques written in the month of January but that did not appear on the bank statement were as follows: Cheque # 159: $910; Cheque # 160: $ 19, Cheque # 168: $43; Cheque # 170: $210; Cheque # 171: $780 3. The bank credited JSC's account for $220 on January 19. This deposit did not belong to JSC, but belonged to another company and was posted in error 4. The bank statement showed receipt of a wire transfer of $1,480 in payment of a note receivable, as well as $80 interest. 5. According to the bank statement, $19 was deducted from JSC's account for service charges. 6. The bank cleared cheque # 152 for $650; however, the cheque was recorded in JSC's records at $630. Your further research showed that the bank was correct, and the cheque was recorded incorrectly in JSC's books. The cheque was written in payment of supplies expense. 7. A cheque for $410 from one of JSC's customers was rejected by the bank due to insufficient funds. Required: Please respond to the requests

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started