Question

You are an accounting trainee with Chandler LLP, a firm of Chartered Accountants. Lenine Jenson, a client of the firm, is a sole trader who

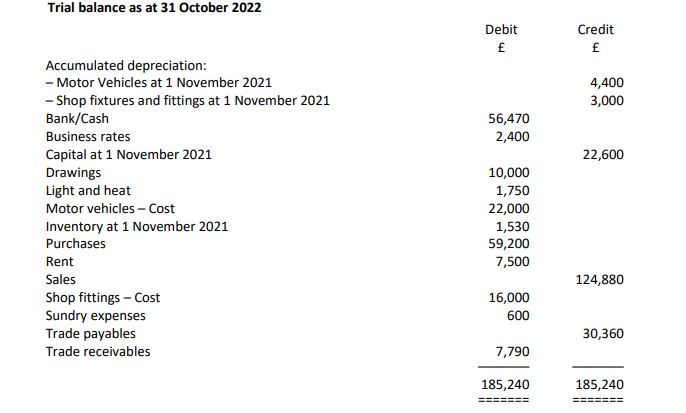

You are an accounting trainee with Chandler LLP, a firm of Chartered Accountants. Lenine Jenson, a client of the firm, is a sole trader who set up her own shop Leni Handmade three years ago. The business sells handmade garments as well as knitting, sewing and haberdashery supplies. She has accounted for the transactions of her business during the year and has provided you with the following trial balance which she extracted from her books of accounts:

Lenine has also provided information about some transactions that occurred during the year but she did not have time to account for them. Transactions that occurred during the year but not yet accounted for:

1. On 1 November 2021, Lenine negotiated a business loan from the NatEast Bank and the bank transferred 15,000 into Leni Handmades business bank account.

2. On 5 November 2021, Lenine purchased a significant amount of garments for resale from Russell Ltd ahead of the Christmas period. The garments cost 4,800, half of which purchased on credit.

3. On 1 December 2021, Lenine hired a shop assistant, Jackie, for two months. She paid Jackie 1,200 per month in cash from the shop on the last day of each month. She took the cash from the shop till before banking the rest of the days cash takings.

4. On 15 December 2021, Lenine used some of the money in the bank to purchase a computer for the shop for 1,600.

5. On 1 April 2022 Lenine paid rent for 18,000 by electronic transfer from the business bank account.

6. On 1 May 2022 Lenine paid business rates of 5,760 by standing order from the business bank account.

7. On 18 May 2022, she restructured her website to make it more appealing for online sales. She paid 600 to a graphic designer. By mistake she used her own card rather than the business card.

8. On 20 June 2022 Lenine paid Russell Ltd 500 from the business bank account.

9. On 25 June 2022 a direct bank transfer of 7,240 was received. It was from a customer paying for previous credit sales.

10. On 4 July 2022 Lenine purchased 2,590 worth of goods from Ray Ltd on credit. The day after she returned 420 of goods because the wool colour was not the one requested. Ray Ltd didnt have the colour she ordered so offered a discount of 100 to compensate for the inconvenience.

11. On 9 August 2022 Lenine has transferred 2,000 from her personal bank account to the business bank account.

12. Since June 2022 she made online sales of 9,800. She received bank transfers of 6,250 from her online orders in advance of dispatching the goods. The remainder were credit customers.

13. The total van repairs for the year cost 900, and the road tax and insurance cost 1,120. The diesel to run the van cost 880 for the year. All motor expenses were paid for from the business bank account.

14. On 30 September 2022, the bank charged 500 of interest on the loan and took it from the business bank account.

15. Lenine paid herself 12,000, which she took from the business bank account throughout the year. She also took a couple of handmade garments as gifts for her parents 50th wedding anniversary which cost the business 330 in total.

Requirement:

Perform the following tasks:

(a) Prepare the journals for the transactions that occurred during the year but have not yet been accounted for in the format used in lectures and seminars.

(b) Write up all the ledger accounts (T accounts) for the business by posting the journal entries in part (a) into the relevant accounts and close off the T accounts ready to prepare a revised trial balance. Use the templates for this part supplied at the end of the question.

(c) Prepare a revised trial balance as at 31 October 2022 from your answer to part (b) in the format used in lectures and seminars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started