Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an acquisitions analyst for Intel and have been asked to pass judgment on whether a potential target firm is under valued. The

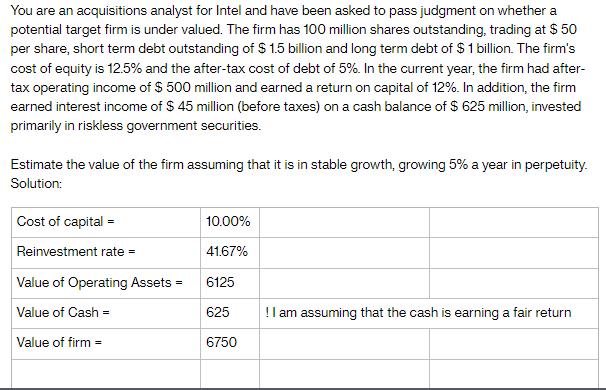

You are an acquisitions analyst for Intel and have been asked to pass judgment on whether a potential target firm is under valued. The firm has 100 million shares outstanding, trading at $ 50 per share, short term debt outstanding of $ 1.5 billion and long term debt of $1 billion. The firm's cost of equity is 12.5% and the after-tax cost of debt of 5%. In the current year, the firm had after- tax operating income of $ 500 million and earned a return on capital of 12%. In addition, the firm earned interest income of $ 45 million (before taxes) on a cash balance of $ 625 million, invested primarily in riskless government securities. Estimate the value of the firm assuming that it is in stable growth, growing 5% a year in perpetuity. Solution: Cost of capital = Reinvestment rate = Value of Operating Assets = Value of Cash = Value of firm = 10.00% 41.67% 6125 625 6750 ! I am assuming that the cash is earning a fair return

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help you with that Here is the solution Step 1 Calculate the weighted average cost of cap...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started