Question

You are an advisor to The Cheesecake Factory. It is late December 2017, and you are dining with their executive team at one of their

You are an advisor to The Cheesecake Factory. It is late December 2017, and you are dining with their executive team at one of their restaurants, celebrating a successful year. As you take another bite of delicious cheesecake, their CFO asks you for your thoughts on the recently enacted corporate tax legislation.

The CFO is referring to the Tax Cuts and Jobs Act (TCJA), which youve heard is a major tax overhaul.

While you are not a tax specialist, you quickly recall

some key changes from the TCJA and apply principles you learned from the Taxes and Business

Strategy course you took a few years earlier.

The key tax changes you recall are:

1. The corporate tax rate will go from 35% to 21%.

2. Tax depreciation will become much more favorable, with a lot of capital expenditures

(i.e., purchases of equipment but not real estate) becoming eligible for immediate

expensing for tax purposes.

3. The net operating loss rules will change from a 2-year carryback period to no carrybacks,

and from a 20-year carryforward period to no limit on the carryforward period.

4. The effective date will be January 1, 2018.

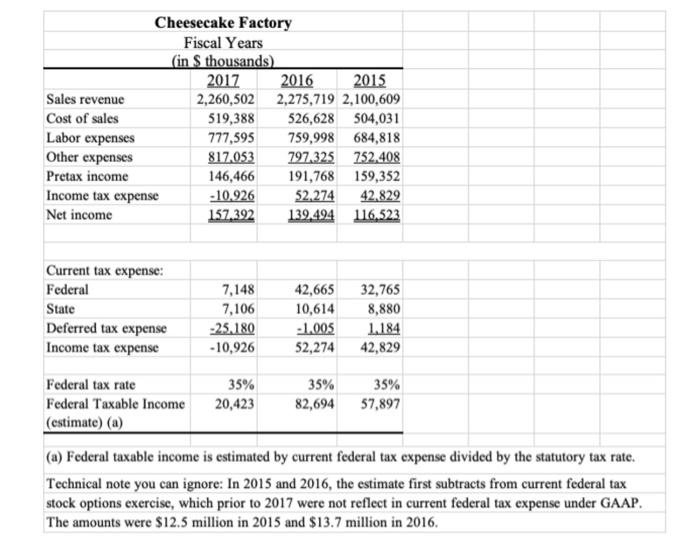

You know the company expects to be profitable in 2018, with sales and expenses growing at roughly the same pace as the past couple years. Having spent a lot of time with their financials, you have a basic recollection of the following:

You begin to formulate your response. You recall that one of the four kinds of income tax planning is shifting income over time from a high tax rate year to a low tax rate year.

1. Is there any incentive for The Cheesecake Factory in 2017 to shift income? If so, what is the incentive?

2. How might The Cheesecake Factory shift income or expenses? Be as specific as possible.

3. What are tax benefits of the income shifting you consider?

4. What are the tax and nontax costs of the income shifting you consider?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started