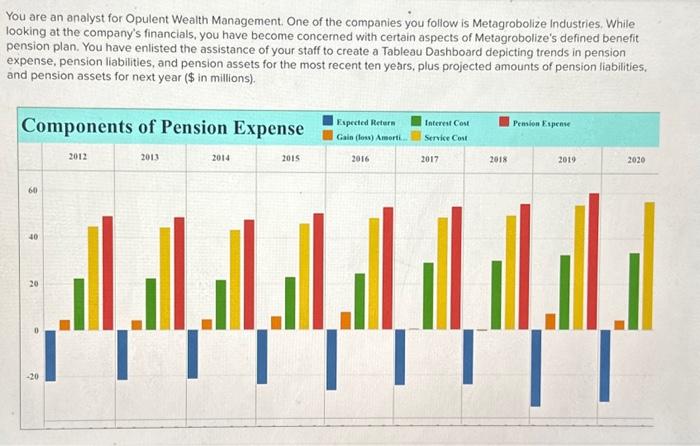

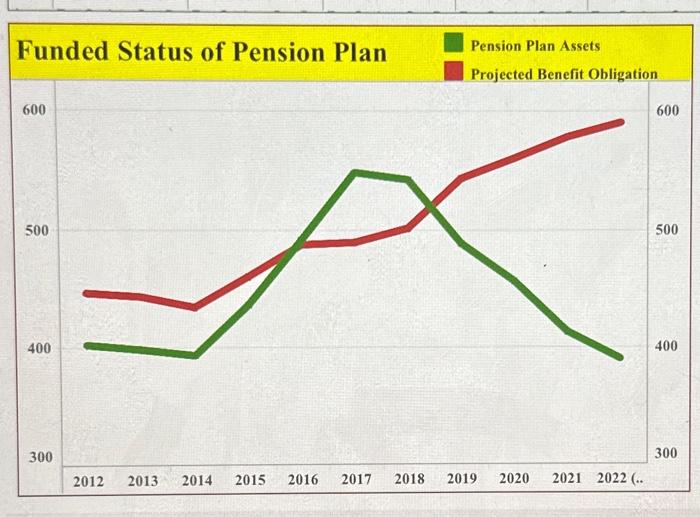

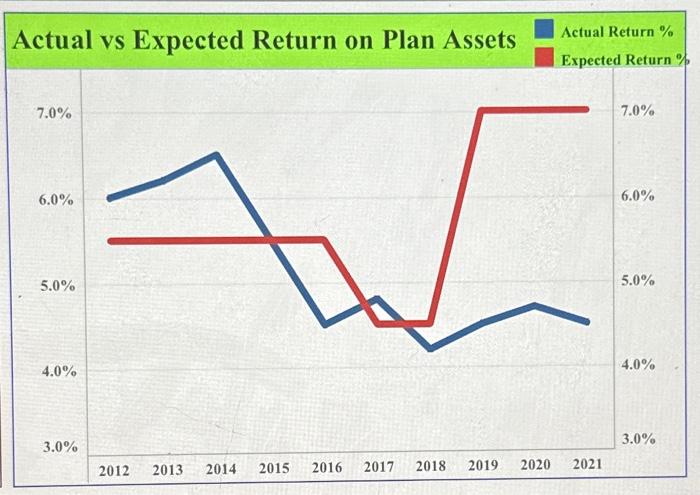

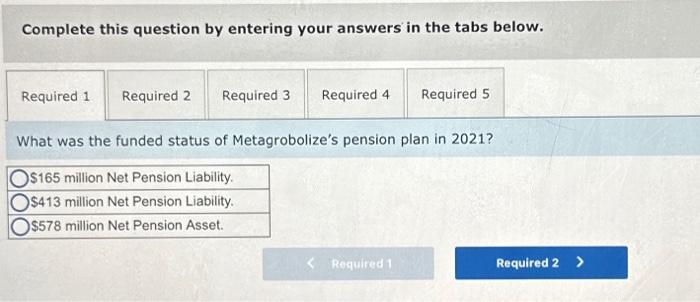

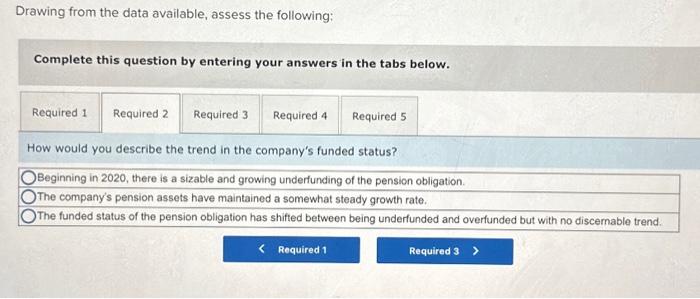

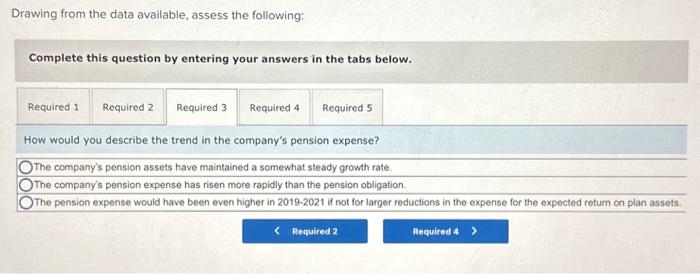

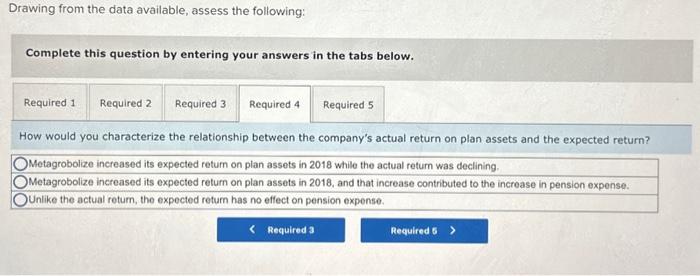

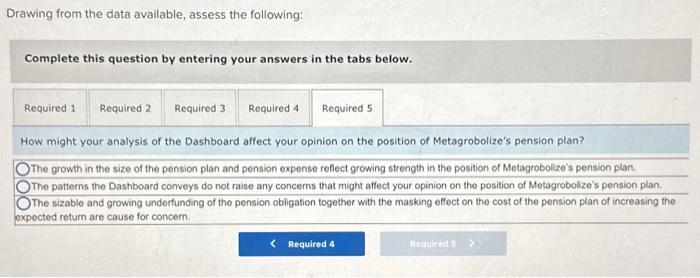

You are an analyst for Opulent Wealth Management. One of the companies you follow is Metagrobolize Industries. While looking at the company's financials, you have become concerned with certain aspects of Metagrobolize's defined benefit. pension plan. You have enlisted the assistance of your staff to create a Tableau Dashboard depicting trends in pension expense, pension liabilities, and pension assets for the most recent ten years, plus projected amounts of pension liabilities, and pension assets for next year ( $ in millions). Funded Status of Pension Plan Pension Plan Assets Actual vs Expected Return on Plan Assets Complete this question by entering your answers in the tabs below. What was the funded status of Metagrobolize's pension plan in 2021? Drawing from the data available, assess the following: Complete this question by entering your answers in the tabs below. How would you describe the trend in the company's funded status? Beginning in 2020, there is a sizable and growing underfunding of the pension obligation. The company's pension assets have maintained a somewhat steady growth rate. The funded status of the pension obligation has shifted between being underfunded and overfunded but with no discernable trend. Drawing from the data available, assess the following: Complete this question by entering your answers in the tabs below. How would you describe the trend in the company's pension expense? Drawing from the data available, assess the following: Complete this question by entering your answers in the tabs below. How would you characterize the relationship between the company's actual return on plan assets and the expected return? Metagrobolize increased its expected retum on plan assets in 2018 while the actual return was declining. Metagrobolize increased its expected return on plan assets in 2018, and that increase contributed to the increase in pension expense. Unlike the actual retum, the expected return has no effect on pension expense. Drawing from the data available, assess the following: Complete this question by entering your answers in the tabs below. How might your analysis of the Dashboard affect your opinion on the position of Metagrobolize's pension plan? The growth in the size of the pension plan and pension expense reflect growing strength in the position of Metagrobolize's pension plan. The patterns the Dashboard conveys do not raise any concems that might affect your opinion on the position of Metagrobolize's pension plan. The sizable and growing underfunding of the pension obligation together with the masking effect on the cost of the pension plan of increasing the lexpected retum are cause for concem