Question

You are an analyst in a major investment bank and have been assigned the task of determining the share price of Foodmart, a national

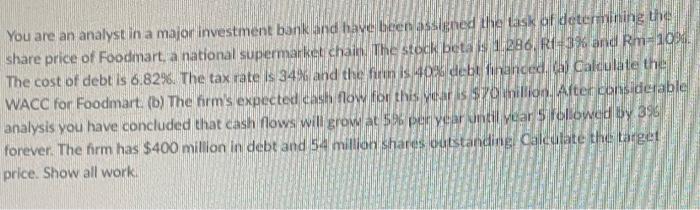

You are an analyst in a major investment bank and have been assigned the task of determining the share price of Foodmart, a national supermarket chain. The stock beta is 1,286, Rf-3% and Rm-10%. The cost of debt is 6.82%. The tax rate is 34% and the firm is 40% debt financed. (a) Calculate the WACC for Foodmart. (b) The firm's expected cash flow for this year is $70 million. After considerable analysis you have concluded that cash flows will grow at 5% per year until year 5 followed by 396 forever. The firm has $400 million in debt and 54 million shares outstanding Calculate the target price. Show all work.

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a WACC 1 Tax Rate Cost of Debt Debt Debt Equity Cost of Equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Core Concepts

Authors: Raymond M Brooks

2nd edition

132671034, 978-0132671033

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App