Question

You are an analyst working at a large Canadian bank, and your job is to evaluate the financial condition of potential corporate clients and make

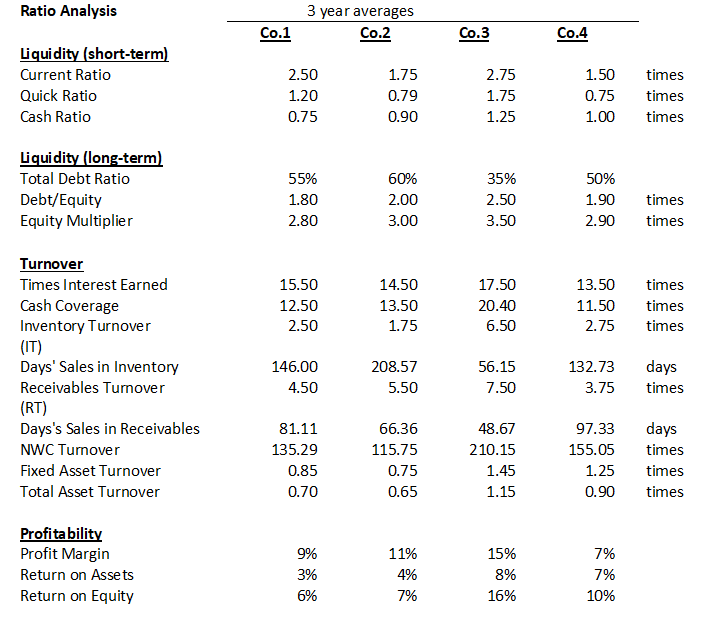

You are an analyst working at a large Canadian bank, and your job is to evaluate the financial condition of potential corporate clients and make a recommendation as to whether they should be approved for a loan.Your task is to review the financial data for four potential borrowers and decide which of the four you would recommend for a loan -you can only recommend one of the four.The four applicants are companies operating in the manufacturing sector, and the financial data provided are 3-year averages for each of the companies.

Required:

(1)For each group of ratios (Liquidity(s/t), Liquidity(l/t), Turnover, and Profitability), summarize your analysis of how each company's ratios compare to one another.(10 marks)

(2)Based on your analysis in (1) above, identify which company has the most favorable ratios in that group of ratios.(5 marks)

(3)Which company would you approve for a loan and why?Which companies would you reject for a loan and why?(5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started