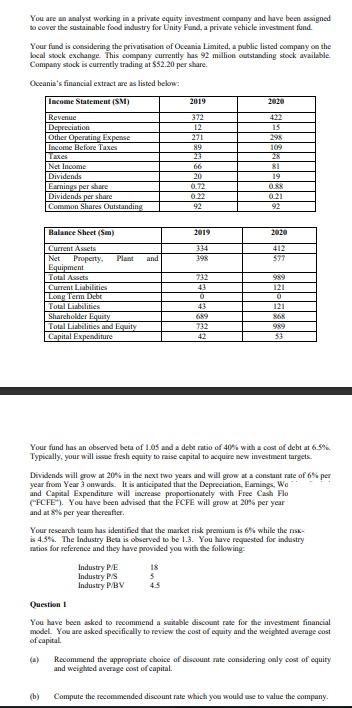

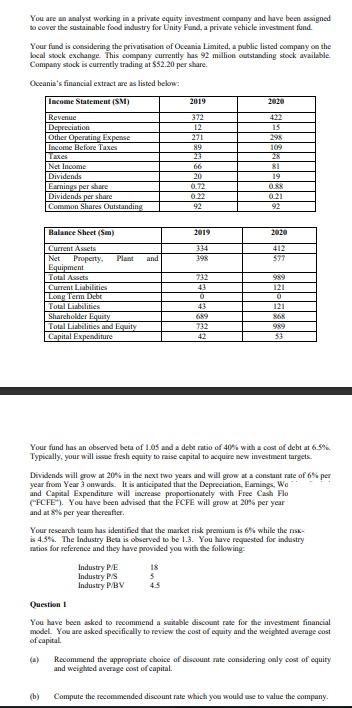

You are an analyst working in a private equity investment company and have been assigned to cover the sustainable food industry for Unity Fund, a private vehicle investment fund. Your fund is considering the privatisation of Oceania Limited, a public listed company on the local stock exchange. This company currently has 92 million outstanding stock available Company stock is currently trading at $2.20 per share. Oceania's financial extract me as listed below: Income Statement (SM) 2019 2010 Revenue Depreciation Other Operating Expense Bascom Before Taxes 15 195 109 Taxes 372 12 271 89 23 06 20 6.72 0.22 92 Net Income Dividends Earnings per share Dividends per share Common Shares Outstanding 81 19 OAX 0.21 92 Balance Sheet (Sun) 2019 2020 334 398 412 577 Net and Current Assets Property Plant Equipment Total Assets Current Liabilities Long Term Debt Total Liabilities Shareholder Equity Total Liabilities and Equity Capital Expenditure 732 43 0 43 689 732 42 989 121 0 121 989 53 Your fund has an observed beta of 1.05 and a debt ratio of 40% with a cost of debt at 6.3% Typically, your will issue fresh equity to raise capital to acquire new investment targets. Dividends will grow at 20% in the next two years and will grow at a constant rate of 6% per year from Year onwards. It is anticipated that the Depreciation. Emmings. We and Capital Expenditure will increase proportionately with Free Cash Flo (FCFE). You have been advised that the FCFE will grow at 20% per year and at 8% per year thereafter. Your research team has identified that the market risk premium is while the risk is 4.5%. The Industry Beta is observed to be 1.3. You have requested for industry ratios for reference and they have provided you with the following Industry PE 18 Industry P/S 5 Industry PBV 45 Question You have been asked to recommend a suitable discount rate for the investment financial model You are asked specifically to review the cost of equity and the weighted average cost of capital (a) Recommend the appropriate choice of discount mate considering only cost of equity and weighted average cost of capital. (b) Compute the recommended discount rate which you would use to value the company