Question

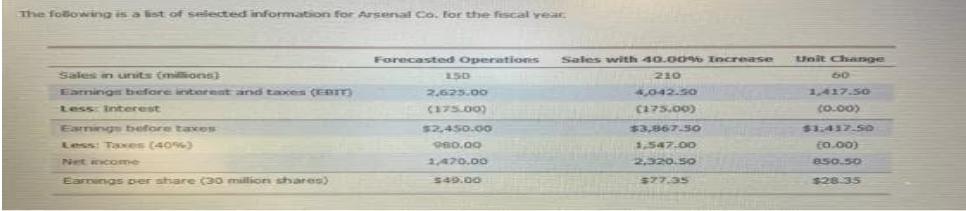

You are an employee for Arsenal Co., and your boss needs help assessing the level of risk associated with the firm's current financial position. Begin

You are an employee for Arsenal Co., and your boss needs help assessing the level of risk associated with the firm's current financial position. Begin by calculating the degree of financial leverage for the change between forecasted operations and the operational increase of 50.00%

O 0.38

O 0.60

O 1.07%

O 1.05X

Your boss says, "Looking good so far. However, I would like to know how we stack up against our strongest competitor, Hotspurs Co." Compare the degree of operating leverage of Hotspurs Co. with that of Arsenal Co. and then answer the following question All else being equal, is Arsenal Co. more risky than, less risky than, or as equally risky as Hotspurs Co., considering that the degree of financial leverage for Hotspurs Co. is 1.07?

O Less risky

O Not enough information give

O More risky

O Equally risky

The foBowing is a ist of selected informatiion for Arsersal Co. for the fescal vear Forecasted Operations Sales with 40.0096 Increase Unit Charage Sales in ursits (mions 150 210 60 Earnings before intereat and taoces (E 2,623.00 4,042.50 1,417.50 Less Interest C375.00) C75.00) co.00) Earnings before taxes $2,450.00 $3,867.3O $3.437.50 Less: Taxes (40%) On0.00 1,547.00 Co.00) Net wcome 2,470.00 2,320.50 as0.50 Earmings oer share (30 million shares) $49.00 $77.35 $28.35

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Degree of financial leverage change in EPS change in EBIT Percent in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started