Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an employee of a consultant company and have been given the following information to do an investment analysis of a new small incomeproducing

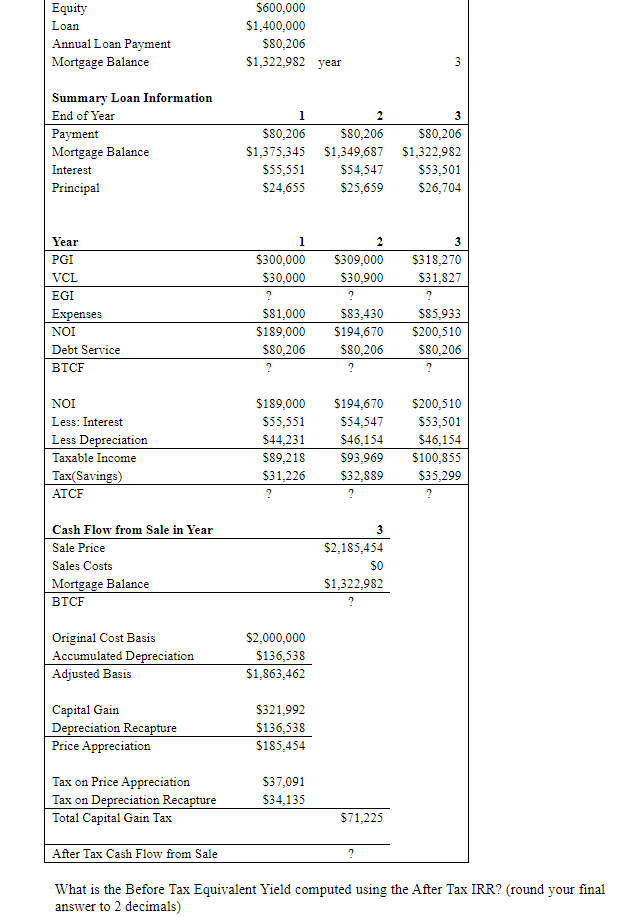

- You are an employee of a consultant company and have been given the following information to do an investment analysis of a new small incomeproducing property for sale to a potential investor. What is the Before Tax Equivalent Yield computed using the After Tax IRR? (round your final answer to 2 decimals)

| Asking Price | $2,000,000 |

|

| Rent Year 1 | $300,000 |

|

| Growth Rent | 3% |

|

| Vacancy and Coll Loss | 10% | of rents |

| Expenses | 30% | of EGI |

| Appreciation Rate | 3% |

|

| Tax Considerations |

|

|

| Building Value | $1,800,000 |

|

| Depreciation | 39 | years |

| Ordinary Income Tax Rate | 35% |

|

| Capital Gains Tax Rate | 20% |

|

| Depreciation Recapture Tax Rate | 25% |

|

| LTV | 70% |

|

| Loan Interest | 4% |

|

| Loan Term | 30 | years |

| Payments Per Year | 12 |

|

| Holding Period | 3 | years |

| Selling Costs | 0% | of sale price |

| Equity Discount Rate | 14% |

|

| After Tax Equity Discount Rate | 10% |

|

The above information results in the following investment analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started