Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an IIMK Kochi campus graduate along with two of your friends whom you approached at various stage of your idea generation decided

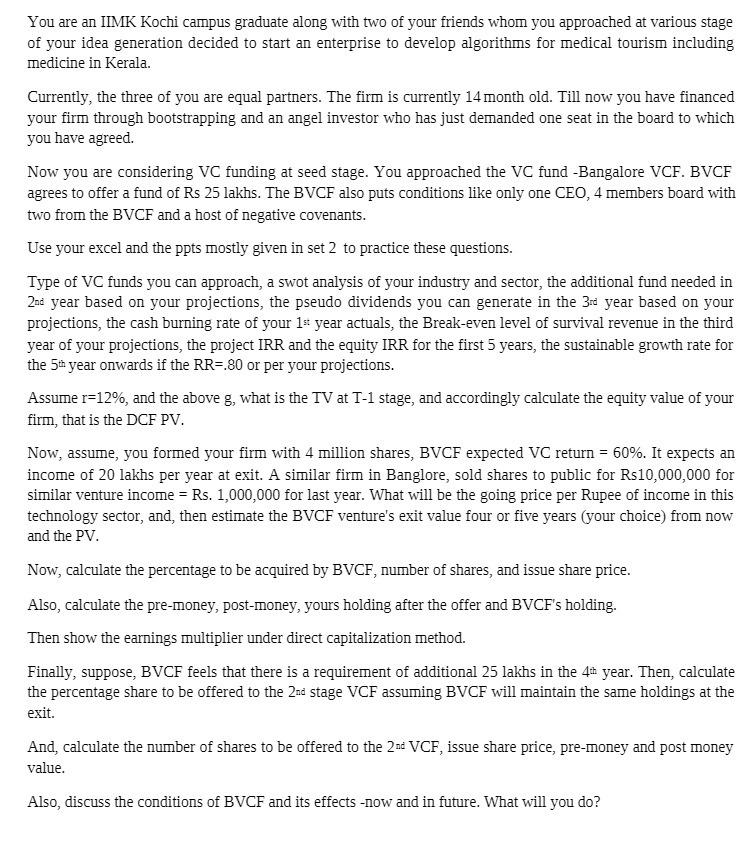

You are an IIMK Kochi campus graduate along with two of your friends whom you approached at various stage of your idea generation decided to start an enterprise to develop algorithms for medical tourism including medicine in Kerala. Currently, the three of you are equal partners. The firm is currently 14 month old. Till now you have financed your firm through bootstrapping and an angel investor who has just demanded one seat in the board to which you have agreed. Now you are considering VC funding at seed stage. You approached the VC fund -Bangalore VCF. BVCF agrees to offer a fund of Rs 25 lakhs. The BVCF also puts conditions like only one CEO, 4 members board with two from the BVCF and a host of negative covenants. Use your excel and the ppts mostly given in set 2 to practice these questions. Type of VC funds you can approach, a swot analysis of your industry and sector, the additional fund needed in 2nd year based on your projections, the pseudo dividends you can generate in the 3rd year based on your projections, the cash burning rate of your 1st year actuals, the Break-even level of survival revenue in the third year of your projections, the project IRR and the equity IRR for the first 5 years, the sustainable growth rate for the 5th year onwards if the RR=.80 or per your projections. Assume r=12%, and the above g, what is the TV at T-1 stage, and accordingly calculate the equity value of your firm, that is the DCF PV. Now, assume, you formed your firm with 4 million shares, BVCF expected VC return = 60%. It expects an income of 20 lakhs per year at exit. A similar firm in Banglore, sold shares to public for Rs10,000,000 for similar venture income = Rs. 1,000,000 for last year. What will be the going price per Rupee of income in this technology sector, and, then estimate the BVCF venture's exit value four or five years (your choice) from now and the PV. Now, calculate the percentage to be acquired by BVCF, number of shares, and issue share price. Also, calculate the pre-money, post-money, yours holding after the offer and BVCF's holding. Then show the earnings multiplier under direct capitalization method. Finally, suppose, BVCF feels that there is a requirement of additional 25 lakhs in the 4th year. Then, calculate the percentage share to be offered to the 2nd stage VCF assuming BVCF will maintain the same holdings at the exit. And, calculate the number of shares to be offered to the 2nd VCF, issue share price, pre-money and post money value. Also, discuss the conditions of BVCF and its effects -now and in future. What will you do?

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Let me try to answer all the questions stepbystep 1 Type of VC funds you can approach SeedEarly stag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started