Question

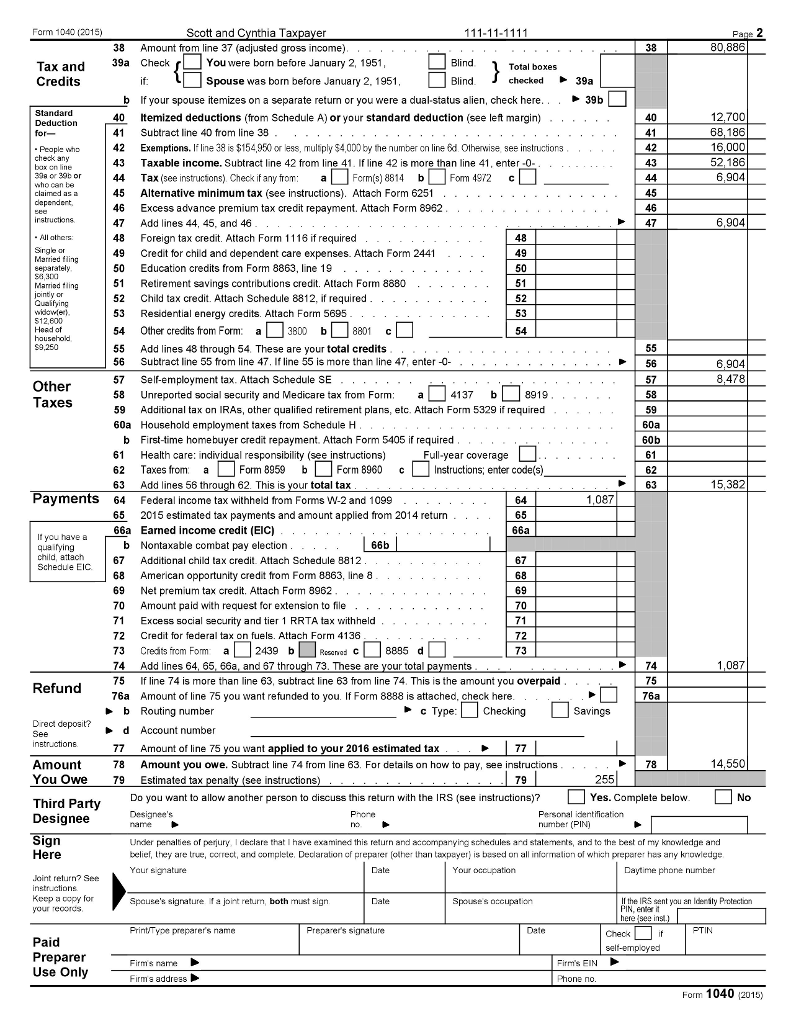

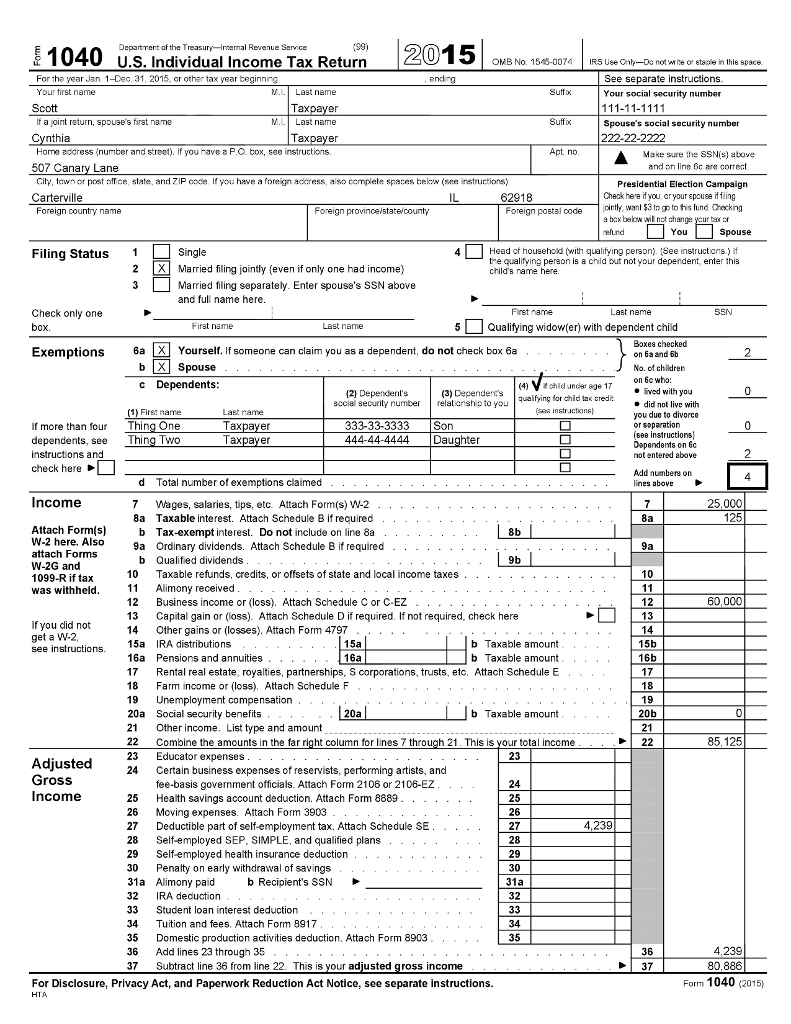

You are an income tax auditor assigned to the Taxpayers 2015 Income Tax Return. The Taxpayers are cash basis taxpayers and filed their Form 1040

You are an income tax auditor assigned to the Taxpayers 2015 Income Tax Return. The Taxpayers are cash basis taxpayers and filed their Form 1040 tax return for 2015 a copy of which is attached and includes the following information:

You are an income tax auditor assigned to the Taxpayers 2015 Income Tax Return. The Taxpayers are cash basis taxpayers and filed their Form 1040 tax return for 2015 a copy of which is attached and includes the following information:

1. The taxpayer is married and claims two children as dependents.

2. The Form W-2 attached to the tax return indicates that her employer is a third party and $3,000 was withheld for payroll taxes.

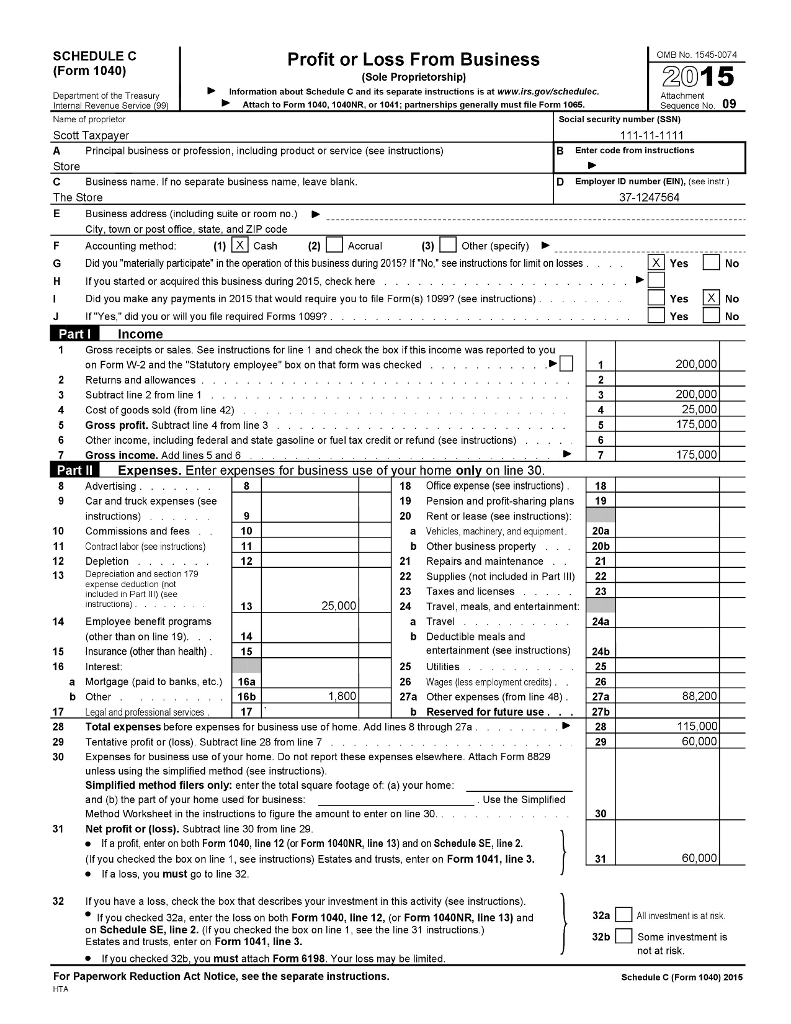

3. The inventory purchases on schedule C were paid in cash.

Initial estimated Personal Living Expenses from BLS are $55,000.00.

Using the information disclosed on the tax return and estimated Bureau of Labor expenses statistics for a family of four, prepare a preliminary Cash T worksheet.

After preparing the preliminary Cash T worksheet you then interview the taxpayer and determined the following:

1. The taxpayer received a business loan of $50,000 in March of 2015. The interest was claimed as an expense on Schedule C. The taxpayer made payments of $1,500 each month beginning in April of 2015. The taxpayer made payments of $13,500 (9 x $1,500) that included $1,800 of interest (per tax return). The taxpayer repaid $11,700 in principal.

2. The taxpayer kept $1,000 as cash-on-hand for business purposes; it was the same at the beginning and the end of the year.

3. The taxpayer keeps cash at home for emergencies. At the beginning of the year it was $1,500; at the end of the year it was $200 (used the funds to pay holiday expenses).

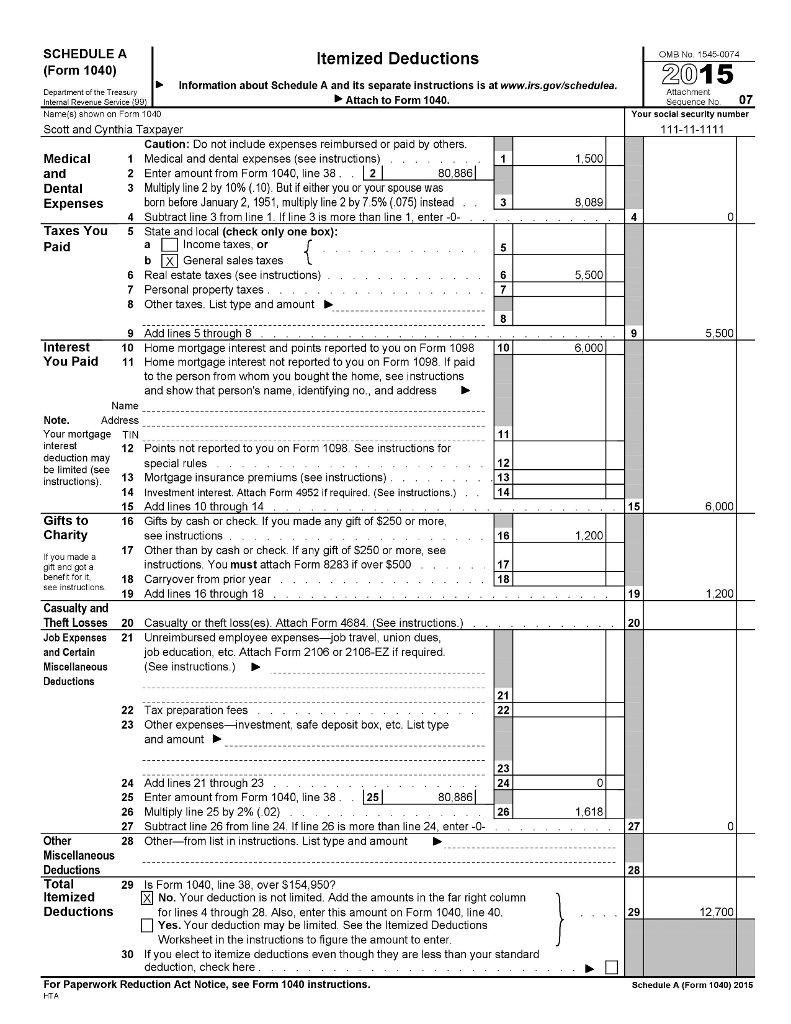

4. The taxpayer makes monthly mortgage payments of $1,200 dollars, for a total of $14,400. Subtracting out the interest claimed on Schedule A, the taxpayer paid principal of $8,400. The estimated Personal Living Expenses (BLS) included an estimated mortgage principal payment of $12,000, and therefore must be reduced because the actual costs are known. ($55,000 - $12,000 = $43,000)

You then toured the Taxpayers business site and observed the business in operation and noted the following:

1. The taxpayer sold merchandise on the Internet,

2. There didnt seem to be enough space to store the ending inventory reflected on the tax return.

3. There were more assets on site (and producing income) than disclosed on the depreciation schedules attached to the tax return.

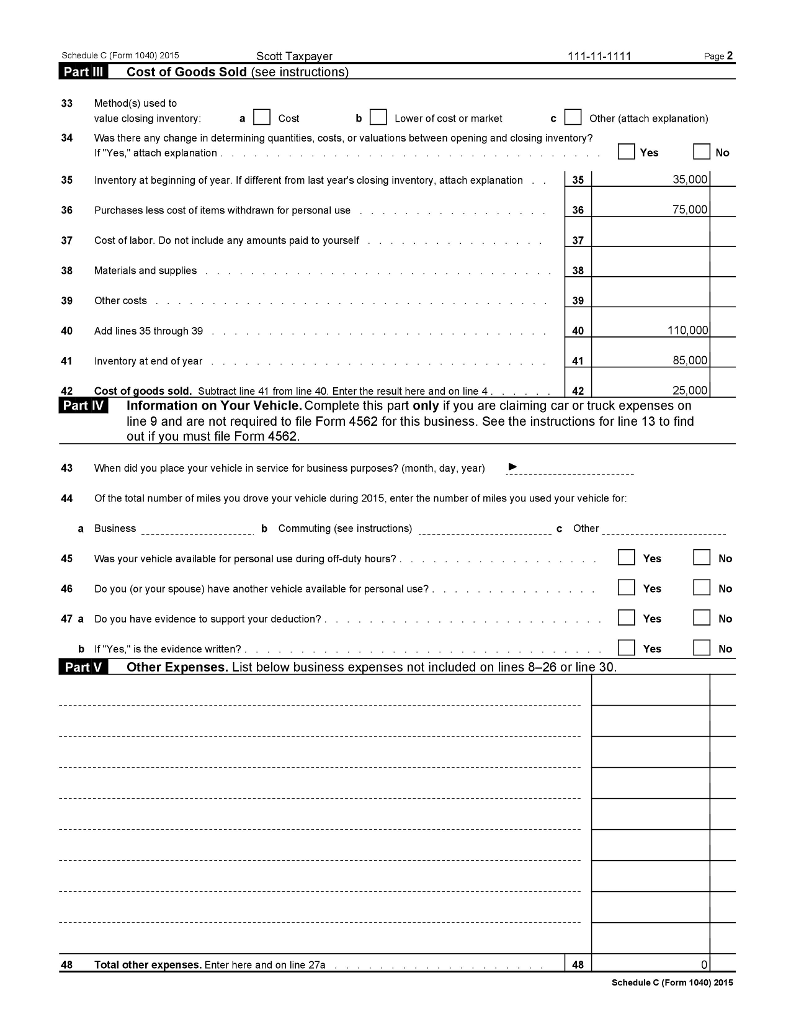

Because it appeared that the taxpayer had purchased more goods for resale than could be stored, the examiner analyzed the inventory records in depth and determined that the taxpayer had overstated ending inventory and therefore understated cost of goods sold, as shown below:

| Description | Per Return | Per Audit | |

|---|---|---|---|

| Beginning Inventory | $35,000 | $35,000 | |

| Purchases | +$75,000 | +$75,000 | |

| Ending Inventory | -$85,000 | -$45,000 | |

| Cost of Goods Sold | +$25,000 | $65,000 |

The taxpayer not only understated the cost of goods sold, but failed to record the sale of the additional inventory in the books or report the income from the sale as gross receipts. Scott Taxpayers mark up on the $40,000 of inventory was 20%.

You then reconciled the taxpayers bank accounts, with the following results:

1. The gross receipts deposited in the business account reconciled to the gross receipts reported on the tax return. The bookkeeper had properly accounted for cash deposits, credit card sales, and Internet sales.

2. The taxpayer did not commingle business and personal accounts. The taxpayer transferred money to two personal accounts via check or ATM transactions.

3. The personal accounts reflected typical personal expenses, including automatic withdrawals for mortgage and utility payments and ATM withdrawals for cash. Overall, there were few personal checks. However, one check to a hardware store for $1,000 was noted. The taxpayer said that he had purchased materials to remodel his home. After discussions with the taxpayer, you contacted the store and determined that the taxpayer made purchases totaling $60,000, including the $1,000 purchased by check. He also paid a carpenter and electrician $40,000 in cash. In total, the taxpayer spent $100,000.

4. You also noted that only a few payments from the bank accounts were to major credit card companies, yet the monthly statements for the credit cards indicated that the taxpayer made payments every month. Scott Taxpayer then disclosed that he had a third personal non-interest bearing account. The account was setup to receive PayPal payments when the he sold damaged merchandise on an Internet auction site. The taxpayer received $15,000 as electronic payments. The damaged merchandise had been written-off as cost of goods sold. In addition, the taxpayer used the account to transfer funds to, and receive winnings from an Internet gambling website. The net winnings deposited for 2015 were $25,000.

5. The table below shows the beginning and ending balances of the taxpayers bank accounts.

| Account Number | Beginning Balance | Ending Balance |

|---|---|---|

| Business Account | $15,000 | $12,000 |

| Personal #1 | $2,000 | $2,000 |

| Personal #2 | $1,000 | $1,000 |

| Personal #3 | 0 | $40,000 |

| Totals | $18,000 | $55,000 |

6. You then tested a sample of deposits by comparing the office managers reconciliation of gross receipts and deposits to the deposits as recorded on the bank statements. For about half the sampled deposits, you found that the actual amount deposited was significantly less than the amount recorded in the office managers reconciliation. The taxpayer diverted the deposits by preparing a new deposit slip and keeping a portion of the cash receipts for personal use. You conclude that the bank records were not a reliable record for determining gross receipts. Using the office managers records, you determined that the taxpayer had diverted $35,000 of the funds.

7. You then analyzed personal credit card use and summarized the transactions as follows.

| Beginning Balance | $22,000 |

| Charges | +$32,000 |

| Payments | -$50,000 |

| Ending Balance | $4,000 |

Based on the personal bank account information and credit card transactions, you determined that the best estimate of personal living expenses were the known expenses; i.e., the sum of the credit card charges (determined from the monthly statements), plus the cash withdrawn and checks written from the personal bank accounts. After including the expenses previously identified (e.g., Schedule A expenses), you determined the personal living expenses for the Taxpayers to be $57,000.

Prepare a final Cash T and identify any amount of under reported income by the Taxpayers.

Departrertof the Treasury-imemal Revenue Servic U.S. Individual Income Tax Return OMB No. 15 3-007 IRS Use Onty-Do notine or staple in thie space For th year Jan 1-Dec. 31, 2015, or other tax year beginning Your first name See separate instructions MLast name er Last name er Your social security number Ta If a joint return, spouse's first name Spouse's social security number 222-22-2222 ia Home accress (number and street). If you rave PO. box, see instructions. Make sure the SSNs) above and on line 6c are correct Presidential Election Campaign y, went $3 to go to this fund Chocking 507 Canary Lane City, tawn or post ofT ce state. and 7 IP cocie If you have a free n accress also ccmplete spares hkw (seinstructions) Check here if you ar your spcuse iffing Foreign eign province/state Foreign postal code Filing Status 1 2 Head cf household (wit qualifying person). See instructons.) I the qualifying person is a child but not your dependent, enter this Married filing jointly (even if only one had income) Married fling separately. Enter spouse's SSN above and full name here Check only one First name 5Qualifying widow(er) with dependent child Boxes checked on 6a and 6b No. of children Exemptions 6a X Yourself. If someone can claim you as a dependent, do not check box 6a 2 b Spouse pendent (3) Dependenchid unr se 17 6ewho: ing for chid tax credit sccial security number elaticnsho to you did not live with you due to divorce if more than four Thing One dependents, see Thing Two 333-33-3333 Son 444-44-4444Daughter not entered above Add numbere on lines above 4 d Total number of exemptions claimed Income 7 Wages, salaries, tips, etc Attach Form(s) W-2 . 25,000 8a Taxable interest. Attach Schedule B if required Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld b Tax-exempt interest. Do not include on line 8a 9a Ordinary dividends. Attach Schedule B if required b Qualified dividends 10 Taxable refunds, credits, or offsets of state and local income taxes . 11 Alimony received 12 Business income or (loss). Attach Schedule C or C-EZ 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here 14 Other gains or (losses). Attach Form 4797 b Taxable amount b Taxable amount 15b 16b see instructions 15a IRA distributio 16a Pensions and annuities 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 18 Farm income or (loss). Attach Schedule F 19 Unemployment compensation 20a Social security benefits 21 Other income, List type and amount 22 Combine the amounts in the far right column for lines 7 through 21. This is your total income 23Educator expenses 24 Certain business expenses of reservists, performing artists, and b Taxable amount 20b Gross Income fee-basis government officials. Attach Form 2106 or 2106-E2Z 25Health savings account deduction. Attach Form 8889.... . . . 26 Moving expenses. Attach Form 3903 27Deductible part of self-employment tax. Attach Schedule SE. 28 Self-employed SEP, SIMPLE, and qualified plans 29 Self employed health insurance deduction 30 Penalty on early withdrawal of sa 31a Alimony paid 32 IRA deduction 33 Student loan interest deduction 34 Tuition and fees. Attach Form 8917 35 Domestic production activities deduction. Attach Form 8903 36 Add lines 23 through 35 37 Subtract line 36 from line 22. This is your adjusted gross income b Recipient's SSN 31a For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 1040 (2015) Departrertof the Treasury-imemal Revenue Servic U.S. Individual Income Tax Return OMB No. 15 3-007 IRS Use Onty-Do notine or staple in thie space For th year Jan 1-Dec. 31, 2015, or other tax year beginning Your first name See separate instructions MLast name er Last name er Your social security number Ta If a joint return, spouse's first name Spouse's social security number 222-22-2222 ia Home accress (number and street). If you rave PO. box, see instructions. Make sure the SSNs) above and on line 6c are correct Presidential Election Campaign y, went $3 to go to this fund Chocking 507 Canary Lane City, tawn or post ofT ce state. and 7 IP cocie If you have a free n accress also ccmplete spares hkw (seinstructions) Check here if you ar your spcuse iffing Foreign eign province/state Foreign postal code Filing Status 1 2 Head cf household (wit qualifying person). See instructons.) I the qualifying person is a child but not your dependent, enter this Married filing jointly (even if only one had income) Married fling separately. Enter spouse's SSN above and full name here Check only one First name 5Qualifying widow(er) with dependent child Boxes checked on 6a and 6b No. of children Exemptions 6a X Yourself. If someone can claim you as a dependent, do not check box 6a 2 b Spouse pendent (3) Dependenchid unr se 17 6ewho: ing for chid tax credit sccial security number elaticnsho to you did not live with you due to divorce if more than four Thing One dependents, see Thing Two 333-33-3333 Son 444-44-4444Daughter not entered above Add numbere on lines above 4 d Total number of exemptions claimed Income 7 Wages, salaries, tips, etc Attach Form(s) W-2 . 25,000 8a Taxable interest. Attach Schedule B if required Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld b Tax-exempt interest. Do not include on line 8a 9a Ordinary dividends. Attach Schedule B if required b Qualified dividends 10 Taxable refunds, credits, or offsets of state and local income taxes . 11 Alimony received 12 Business income or (loss). Attach Schedule C or C-EZ 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here 14 Other gains or (losses). Attach Form 4797 b Taxable amount b Taxable amount 15b 16b see instructions 15a IRA distributio 16a Pensions and annuities 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 18 Farm income or (loss). Attach Schedule F 19 Unemployment compensation 20a Social security benefits 21 Other income, List type and amount 22 Combine the amounts in the far right column for lines 7 through 21. This is your total income 23Educator expenses 24 Certain business expenses of reservists, performing artists, and b Taxable amount 20b Gross Income fee-basis government officials. Attach Form 2106 or 2106-E2Z 25Health savings account deduction. Attach Form 8889.... . . . 26 Moving expenses. Attach Form 3903 27Deductible part of self-employment tax. Attach Schedule SE. 28 Self-employed SEP, SIMPLE, and qualified plans 29 Self employed health insurance deduction 30 Penalty on early withdrawal of sa 31a Alimony paid 32 IRA deduction 33 Student loan interest deduction 34 Tuition and fees. Attach Form 8917 35 Domestic production activities deduction. Attach Form 8903 36 Add lines 23 through 35 37 Subtract line 36 from line 22. This is your adjusted gross income b Recipient's SSN 31a For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 1040 (2015)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started