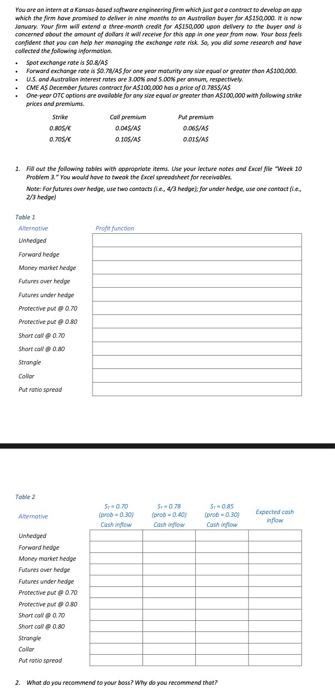

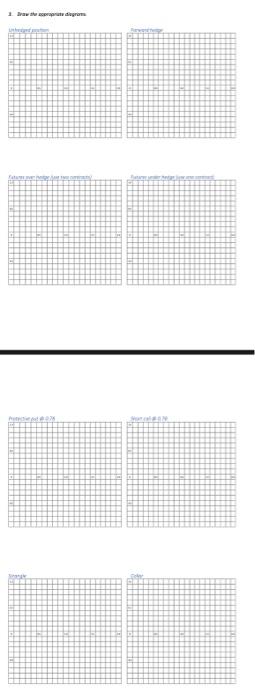

You are an interna a Kansas Gosed software engineering from which just got a career to develop an app which the firm have promised to deliver in nine months to an Austration buyer for A$350.000 Jonwary. Yow firm will extend a three-month credit for AS150.000 upon delivery to the buyer and concerned about the amount of dollars it will receive for this app in one year from now. Your boss feels confident that you can help her managing the exchange rate risk So, you did some research and love collected the following information Spot exchange rates S/AS Forward exchange rote S. 71/A5 for one year maturity any size equal or greater than 100.000 ... and Australien interest rates are 3.00 od 5.00 per ont, respectively . CME AS December vares contract for A5200.000 has a price of 785S/AS One year OTC options are available for any size equal or greater than A$100,000 with following strike prices and premium Strike Colem Put premium 0.205/6 O.DESIAS 0.06S/AS a.705/ 0.105/AS OTSIAS 1. Fill out the following tables with appropriate items. Use your lecture notes and Excel Me Week 10 Problem. You would how to tweak the Excel spreadsheet for receivable Note: For futures over hele, use two contacts ... 4/3 hedel for under hedge, use one contacte. 7/3 hedel Profit function Table Atentive edged Forward hedge Money martede Futures overed Futures under hediye Protective pe 0.70 Protective 0.80 Short 0 0 Shortcall 0.00 Strangle Color Put ratio ad T2 5070 030 fro - 0.0 Srecas 0.30 Cash below Expected.com Unledged Forward hedge Money more Futures overledige Futures under hedge Protective pe 0.70 Protective 0.80 Short 00 Shortco 0.80 Strangle Collor Put to spread 2. What do you recommend to your boss? Why do you recommend that? You are an interna a Kansas Gosed software engineering from which just got a career to develop an app which the firm have promised to deliver in nine months to an Austration buyer for A$350.000 Jonwary. Yow firm will extend a three-month credit for AS150.000 upon delivery to the buyer and concerned about the amount of dollars it will receive for this app in one year from now. Your boss feels confident that you can help her managing the exchange rate risk So, you did some research and love collected the following information Spot exchange rates S/AS Forward exchange rote S. 71/A5 for one year maturity any size equal or greater than 100.000 ... and Australien interest rates are 3.00 od 5.00 per ont, respectively . CME AS December vares contract for A5200.000 has a price of 785S/AS One year OTC options are available for any size equal or greater than A$100,000 with following strike prices and premium Strike Colem Put premium 0.205/6 O.DESIAS 0.06S/AS a.705/ 0.105/AS OTSIAS 1. Fill out the following tables with appropriate items. Use your lecture notes and Excel Me Week 10 Problem. You would how to tweak the Excel spreadsheet for receivable Note: For futures over hele, use two contacts ... 4/3 hedel for under hedge, use one contacte. 7/3 hedel Profit function Table Atentive edged Forward hedge Money martede Futures overed Futures under hediye Protective pe 0.70 Protective 0.80 Short 0 0 Shortcall 0.00 Strangle Color Put ratio ad T2 5070 030 fro - 0.0 Srecas 0.30 Cash below Expected.com Unledged Forward hedge Money more Futures overledige Futures under hedge Protective pe 0.70 Protective 0.80 Short 00 Shortco 0.80 Strangle Collor Put to spread 2. What do you recommend to your boss? Why do you recommend that