Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an investment advisor at Honest Stock Brokers. You have been approached by a new client, Hugo Elliot, who has accumulated total savings of

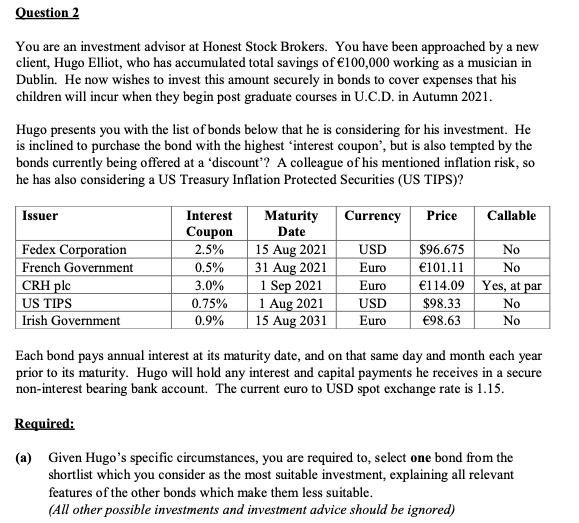

You are an investment advisor at Honest Stock Brokers. You have been approached by a new client, Hugo Elliot, who has accumulated total savings of 100,000 working as a musician in Dublin. He now wishes to invest this amount securely in bonds to cover expenses that his children will incur when they begin post graduate courses in U.C.D. in Autumn 2021. Hugo presents you with the list of bonds below that he is considering for his investment. He is inclined to purchase the bond with the highest 'interest coupon', but is also tempted by the bonds currently being offered at a 'discount'? A colleague of his mentioned inflation risk, so he has also considering a US Treasury Inflation Protected Securities (US TIPS)? Each bond pays annual interest at its maturity date, and on that same day and month each year prior to its maturity. Hugo will hold any interest and capital payments he receives in a secure non-interest bearing bank account. The current euro to USD spot exchange rate is 1.15. Required: (a) Given Hugo's specific circumstances, you are required to, select one bond from the shortlist which you consider as the most suitable investment, explaining all relevant features of the other bonds which make them less suitable. (All other possible investments and investment advice should be ignored)

You are an investment advisor at Honest Stock Brokers. You have been approached by a new client, Hugo Elliot, who has accumulated total savings of 100,000 working as a musician in Dublin. He now wishes to invest this amount securely in bonds to cover expenses that his children will incur when they begin post graduate courses in U.C.D. in Autumn 2021. Hugo presents you with the list of bonds below that he is considering for his investment. He is inclined to purchase the bond with the highest 'interest coupon', but is also tempted by the bonds currently being offered at a 'discount'? A colleague of his mentioned inflation risk, so he has also considering a US Treasury Inflation Protected Securities (US TIPS)? Each bond pays annual interest at its maturity date, and on that same day and month each year prior to its maturity. Hugo will hold any interest and capital payments he receives in a secure non-interest bearing bank account. The current euro to USD spot exchange rate is 1.15. Required: (a) Given Hugo's specific circumstances, you are required to, select one bond from the shortlist which you consider as the most suitable investment, explaining all relevant features of the other bonds which make them less suitable. (All other possible investments and investment advice should be ignored) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started