Question

You are an investor considering the purchase of an upscale office/warehouse flex building. The terms of the purchase are a price of $6,150,000 with 80%

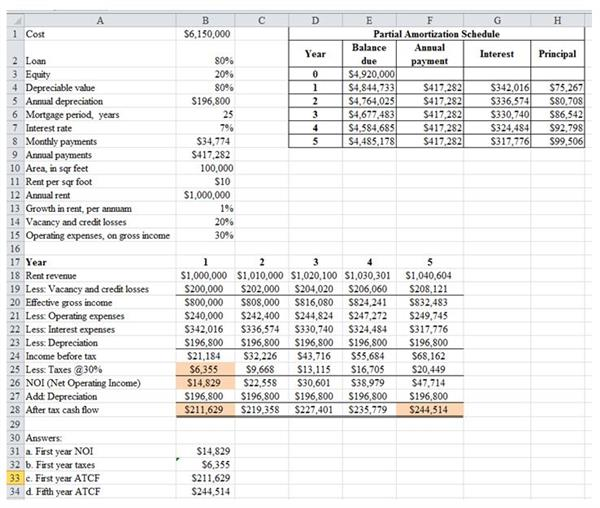

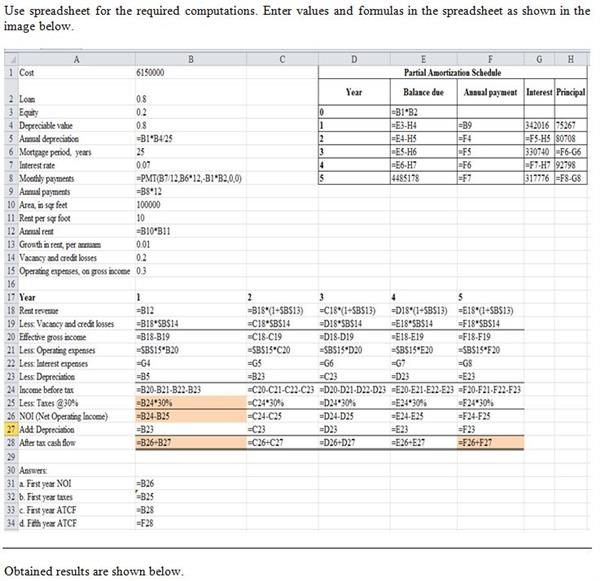

You are an investor considering the purchase of an upscale office/warehouse flex building. The terms of the purchase are a price of $6,150,000 with 80% of the purchase price financed with a 25-year loan at 7% interest with fixed monthly payments and 20% financed with cash (equity). Eighty percent (80%) of the purchase price is attributed to the improvements and can be depreciated. A total of 100,000 square feet can be leased at $10 per square foot per year. Vacancies and credit losses are expected to be 20%. The operating expenses are estimated to be 30% of the effective gross income. Rents are expected to grow at 1% per year.

Assume that you will sell the property in 5 years. At the end of year 5, the property is projected to be valued at the year 6 NOI capitalized at 8% (direct capitalization). Selling expenses are estimated to be 9% of the selling price. You are in the 30% income tax bracket (congratulations!!) and expect to pay a 15% tax on the capital gain and a 25% tax on the recovery of depreciation.

a. What is the sixth year NOI?

b. Calculate the ATER, as if you were selling after 5 years?

c. What is the break-even vacancy rate (year 1)?

d. If the discount rate is 16%, what is the NPV?

e. What is the IRR?

f. If the capitalization rate on comparable properties is 9%, is the offered price of $6,150,000 reasonable? Explain. [review the direct capitalization (appraisal) formula]

g. Do you accept or reject this investment opportunity? Why?

PLEASE SHOW ALL WORK!!!

THANK YOU!!!

1 Cost $6,150,000 Partial Amortization Schedule BalanceAnnual Year InterestPrincipal 2 Loan 3 Equity 4 Depreciable value 8090 20% 80% S196,800 payment $342,016 $75,267 $336,574 $$0,708 330,740 $6,542 4 S4,584,68517,282$324,484 $92,798 5 S4517$417,22317,776 $99,506 $4,920,000 $4,844,733 $4,764.025 $4,677,483 $417,282 $417.282 S417282 Annual depreciation 6 Mortgage period, years 7 Interest rate Moothly payments 9 Annaal payments 10 Area, in sqr feet 11 Rent per sqr foot 2 Annaal rent 13 Growth in rent, per armuam 14 Vacaney and credit losses 15 Operating expenses, on gross income $34,774 $417,282 100,000 S10 $1,000,000 1% 20% 17 Year 18 Rent revenue 1,000,000 $1,010,000 $1,020,100 $1.030,301 $1,040,604 $208.121 S$00,000 $808,000 $$16,080 $824,241 $832,483 $240,000 $242,400 $244,824 $247,272 $249,745 342,016 $336,574 330,740 $324.484 S317,776 $196,800 $196,800 $196,800 196,800 196800 21,184 $32,226 $43.716 55,684 $68,162 S20,449 S14,829 $22,55 $30,601 38,979 $47,714 $196,800 $196,800 $196,800 $196,800 $196,800 19 Less Vacaney aned credi losses $200,000 $202,000 $204,020 $206,060 9 Less Vacancy and credit losses 20 Effective gross income 21 Less Operating expenses 22 Less Interest expenses 23 Less: Depreciation 24 Income before tax 25 Less: Taxes @30% 26 NOI Net Operating Income) 27 Add Depreciation 28 After tax cash flow 56,355 $9,668 $13,115 S16,705 S00 S196,00 196,800 S196800 $211,629 $219,358 S227,401 $235,779 $244,514 30 Answers: 31 a First year NOI 32 b. First year taxes 33 c. First year ATCF 34 d Fith year ATCF $14,829 $211,629 $244,514Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started