Question

You are an investor who is looking for a place to invest your money. Previous investments have led you to feel that you are only

You are an investor who is looking for a place to invest your money. Previous investments have led you to feel that you are only interested in public, unregulated companies. You must choose a company that has not been used in previous course work, where you will now invest your money. Based on publicly available information you are to do a complete strategic analysis of the company.

Tips: Clothing companies do not make good choices because their reporting dates do not match standard reporting of economic data.

The result of your research will be your opinion, backed by your analysis, and use of evidence (use 6th edition APA) and reasons why you would personally invest in this company as well as why people wish to be employed at this company. What makes it attractive to employees?

You may think of this as an evaluation of the firm for investment purposes. Ensure that you select a company that has data available for conducting the needed analyses. Do due diligence right at the beginning of the course, so you do not run into issues right before the assignment is due.

You should, at a minimum, prepare: (1) a financial analysis comparing the firm to comparable peer firms; (2) a revenues forecast for the company using statistical and economic tools; (3) an industry analysis; (4) an evaluation of the companys financial status and prospects; (5) a competitive analysis in which the company operates, and (3) leadership analysis (confidence in leadership). Make sure you identify, describe, and evaluate the overall strategy of the company and important to your assessment of the firms prospects, the functional strategies, i.e. marketing, technology, financial, human resources, manufacturing, etc. being employed.

You may choose to utilize these analyses and others as relevant in a traditional: Strengths, Weaknesses, Opportunities and Threats (SWOT) format, or choose another option.

References: Provide hyperlinks or appropriate 6th edition, APA format in your references (not in the citations) so that readers can locate your sources.

Choose a company that has been publicly traded long enough (6 years) so that you have the quarterly data you need for the project analyses. Use the attached checklist to help you in your company selection. Taking the time to ensure that your company satisfies ALL of these checkpoints will go a long way to a successful study. Submit this checklist to your professor by the end of Module 2 via email to ensure the company you selected is acceptable. Minimum 3000 words

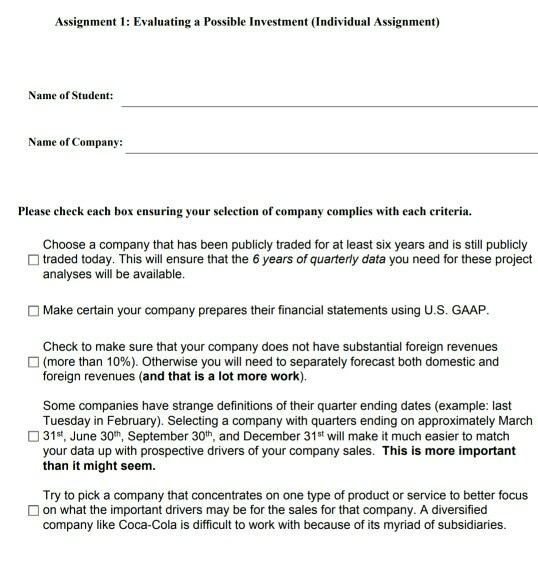

Assignment 1: Evaluating a Possible Investment (Individual Assignment) Name of Student: Name of Company: Please check each box ensuring your selection of company complies with each criteria. Choose a company that has been publicly traded for at least six years and is still publicly traded today. This will ensure that the 6 years of quarterly data you need for these project analyses will be available. Make certain your company prepares their financial statements using U.S. GAAP. Check to make sure that your company does not have substantial foreign revenues (more than 10%). Otherwise you will need to separately forecast both domestic and foreign revenues (and that is a lot more work). Some companies have strange definitions of their quarter ending dates (example: last Tuesday in February). Selecting a company with quarters ending on approximately March 31June 30, September 30th, and December 31st will make it much easier to match your data up with prospective drivers of your company sales. This is more important than it might seem. Try to pick a company that concentrates on one type of product or service to better focus on what the important drivers may be for the sales for that company. A diversified company like Coca-Cola is difficult to work with because of its myriad of subsidiaries. Assignment 1: Evaluating a Possible Investment (Individual Assignment) Name of Student: Name of Company: Please check each box ensuring your selection of company complies with each criteria. Choose a company that has been publicly traded for at least six years and is still publicly traded today. This will ensure that the 6 years of quarterly data you need for these project analyses will be available. Make certain your company prepares their financial statements using U.S. GAAP. Check to make sure that your company does not have substantial foreign revenues (more than 10%). Otherwise you will need to separately forecast both domestic and foreign revenues (and that is a lot more work). Some companies have strange definitions of their quarter ending dates (example: last Tuesday in February). Selecting a company with quarters ending on approximately March 31June 30, September 30th, and December 31st will make it much easier to match your data up with prospective drivers of your company sales. This is more important than it might seem. Try to pick a company that concentrates on one type of product or service to better focus on what the important drivers may be for the sales for that company. A diversified company like Coca-Cola is difficult to work with because of its myriad of subsidiaries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started