Question

You are an investor who just bought three newly issued bonds. These bonds have the same credit quality and 10 years to maturity. The following

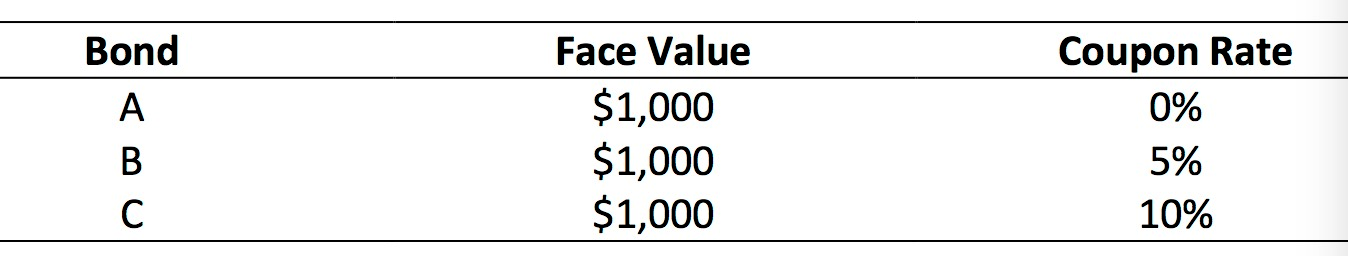

You are an investor who just bought three newly issued bonds. These bonds have the same credit quality and 10 years to maturity. The following table summarizes the characteristics of your portfolio.

All three bonds pay coupons annually and are currently priced to yield 5% per annum. Your tax bracket is 30% on ordinary income and 20% on capital gains.

-

a) What are the bond princes? [3 marks]

-

b) If next year the yield to maturity for these bonds is 5%, what will their prices be? If at that time

you liquidate your portfolio, what is your rate of return on each bond before taxes? What is your after-tax rate of return on each bond? Repeat these calculations for yields to maturity of 4.5% and 5.5%. [9 marks]

-

c) Based on your answers for part (b), does the price of the bonds change if the yield to maturity next year remains at the current level of 5%? Why does this happen? [3 marks]

-

d) Based on your answers for parts (b), are different bonds more attractive at different yields on an after-tax basis? Why? [2 marks]

-

e) Assume that the issuer of Bond A is the government of Canada. Will the stated yield to maturity and the realized holding period rate at maturity (expressed as an EAR) be equal for this bond? Why? [2 marks]

-

f) After 7 years, Bond B sells for $950 and it has 3 years left to maturity. Immediately after the coupon is paid, an investor purchases the bond and holds it to maturity. The investor reinvests the two remaining coupons at the following rates (1,2) = 2% and (2,3) = 3%, where (, + 1) is the effective annual rate from year to year + 1. Calculate the YTM and the realized compound yield (expressed as an EAR) for this investor. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started