Question

You are an oil trader working for an investment bank. An independent US producer wants to hedge its production. He needs to sell 50

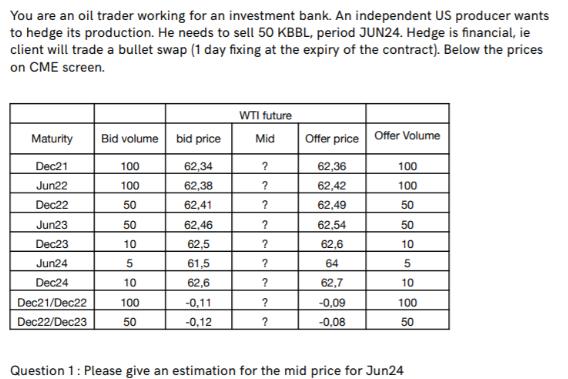

You are an oil trader working for an investment bank. An independent US producer wants to hedge its production. He needs to sell 50 KBBL, period JUN24. Hedge is financial, ie client will trade a bullet swap (1 day fixing at the expiry of the contract). Below the prices on CME screen. Maturity Dec21 Jun22 Dec22 Jun23 Dec23 Jun24 Dec24 Dec21/Dec22 Dec22/Dec23 Bid volume 100 100 50 50 10 5 10 100 50 bid price 62,34 62,38 62,41 62,46 62,5 61,5 62,6 -0,11 -0,12 WTI future Mid ? ? ? ? ? ? ? ? ? Offer price Offer Volume 62,36 62,42 62,49 62,54 62,6 64 62,7 -0,09 -0,08 100 100 50 50 10 5 10 100 50 Question 1: Please give an estimation for the mid price for Jun24

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the midprice for the WTI Future with maturity in June 2024 JUN 24 we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Kin Lo, George Fisher

3rd Edition Vol. 1

133865940, 133865943, 978-7300071374

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App