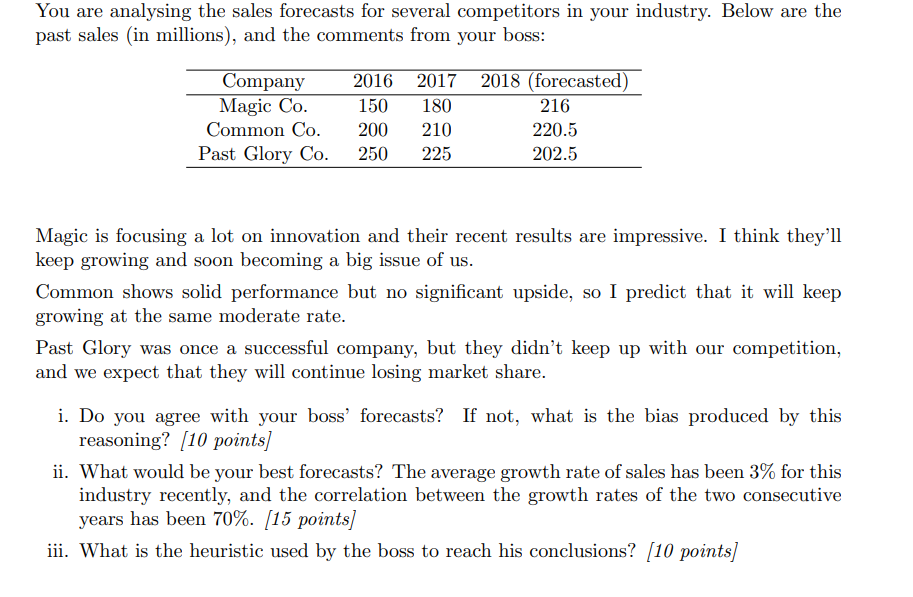

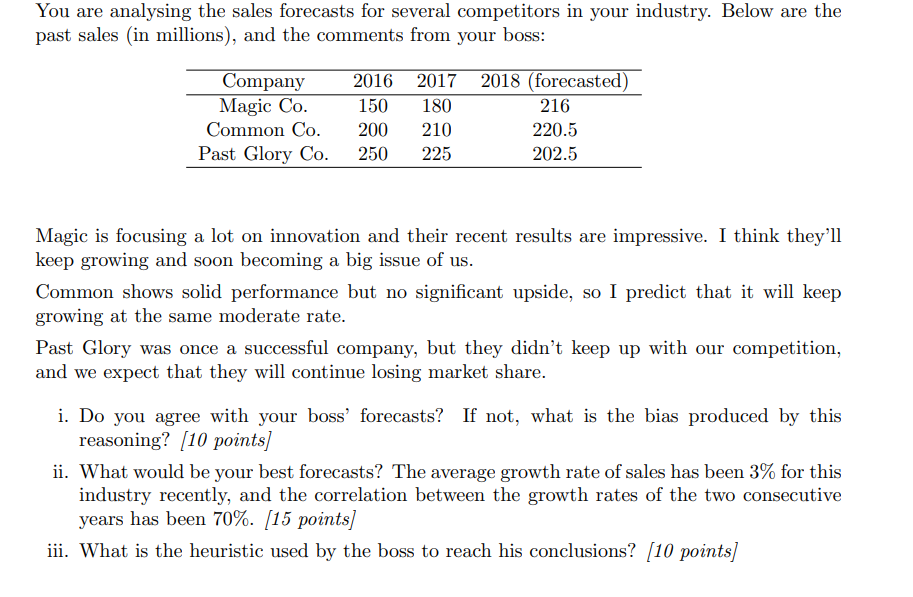

You are analysing the sales forecasts for several competitors in your industry. Below are the past sales in millions), and the comments from your boss: Company Magic Co. Common Co. Past Glory Co. 2016 150 200 250 2017 2018 (forecasted) 180 216 210 220.5 225 202.5 Magic is focusing a lot on innovation and their recent results are impressive. I think they'll keep growing and soon becoming a big issue of us. Common shows solid performance but no significant upside, so I predict that it will keep growing at the same moderate rate. Past Glory was once a successful company, but they didn't keep up with our competition, and we expect that they will continue losing market share. i. Do you agree with your boss' forecasts? If not, what is the bias produced by this reasoning? (10 points) ii. What would be your best forecasts? The average growth rate of sales has been 3% for this industry recently, and the correlation between the growth rates of the two consecutive years has been 70%. (15 points) iii. What is the heuristic used by the boss to reach his conclusions? (10 points) You are analysing the sales forecasts for several competitors in your industry. Below are the past sales in millions), and the comments from your boss: Company Magic Co. Common Co. Past Glory Co. 2016 150 200 250 2017 2018 (forecasted) 180 216 210 220.5 225 202.5 Magic is focusing a lot on innovation and their recent results are impressive. I think they'll keep growing and soon becoming a big issue of us. Common shows solid performance but no significant upside, so I predict that it will keep growing at the same moderate rate. Past Glory was once a successful company, but they didn't keep up with our competition, and we expect that they will continue losing market share. i. Do you agree with your boss' forecasts? If not, what is the bias produced by this reasoning? (10 points) ii. What would be your best forecasts? The average growth rate of sales has been 3% for this industry recently, and the correlation between the growth rates of the two consecutive years has been 70%. (15 points) iii. What is the heuristic used by the boss to reach his conclusions? (10 points)