Answered step by step

Verified Expert Solution

Question

1 Approved Answer

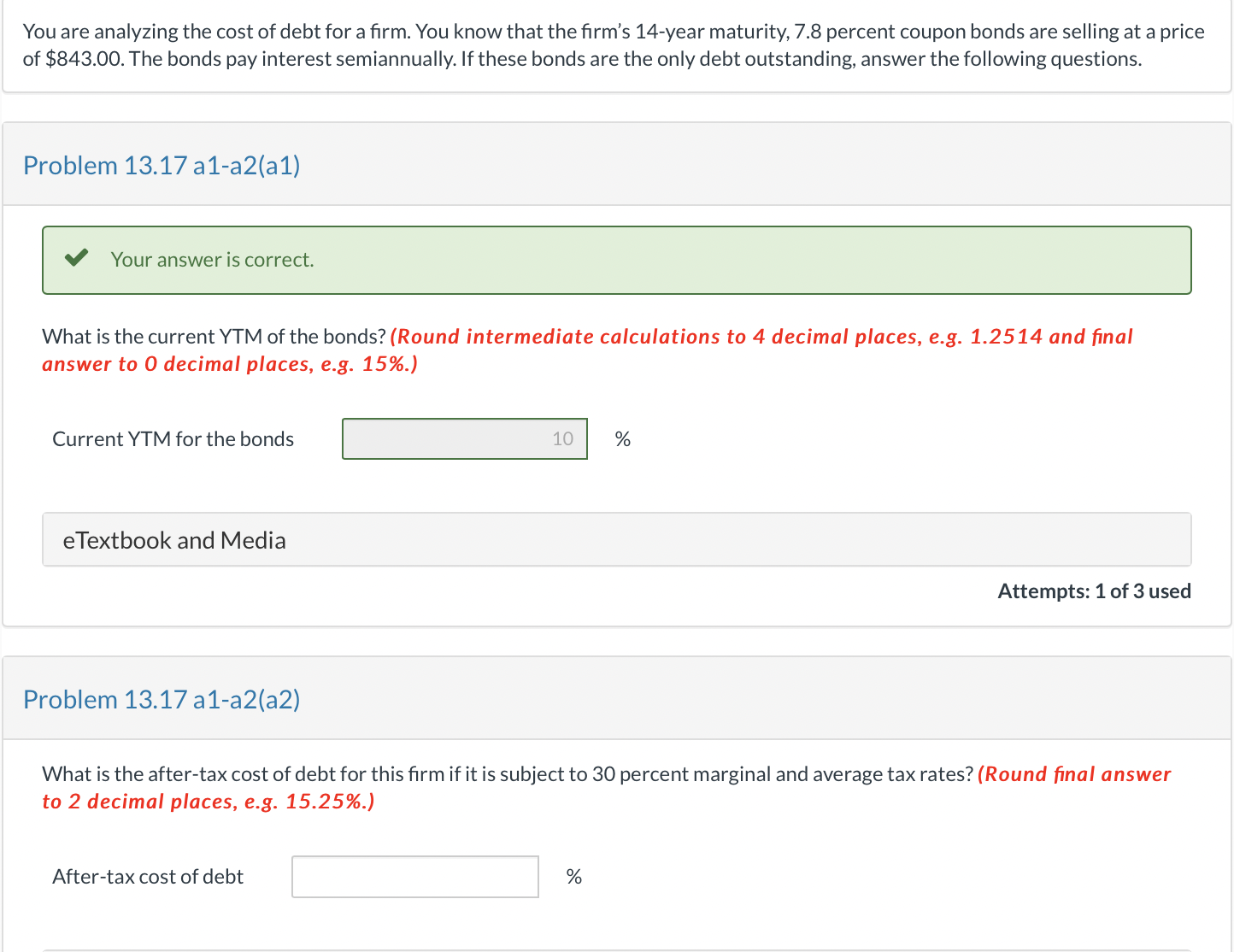

You are analyzing the cost of debt for a firm. You know that the firm's 1 4 - year maturity, 7 . 8 percent coupon

You are analyzing the cost of debt for a firm. You know that the firm's year maturity, percent coupon bonds are selling at a price

of $ The bonds pay interest semiannually. If these bonds are the only debt outstanding, answer the following questions.

Problem aaa

Your answer is correct.

What is the current YTM of the bonds? Round intermediate calculations to decimal places, eg and final

answer to decimal places, eg

Current YTM for the bonds

eTextbook and Media

Problem aaa

What is the aftertax cost of debt for this firm if it is subject to percent marginal and average tax rates? Round final answer

to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started