Question

You are analyzing the performance of two stocks as shown in the following graphs: The first, shown in Panel A, is Cyclical Industries Incorporated. Cyclical

You are analyzing the performance of two stocks as shown in the following graphs:

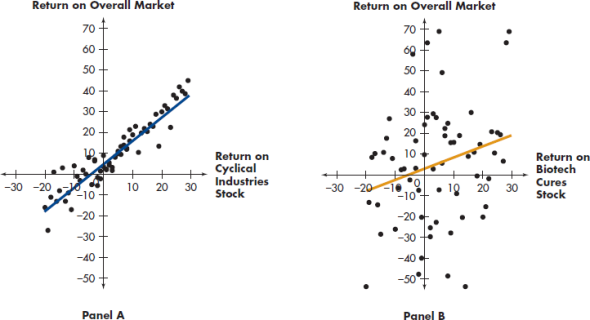

The first, shown in Panel A, is Cyclical Industries Incorporated. Cyclical Industries makes machine tools and other heavy equipment, the demand for which rises and falls closely with the overall state of the economy. The second stock, shown in Panel B, is Biotech Cures Corporation. Biotech Cures uses biotechnology to develop new pharmaceutical compounds to treat incurable diseases. Biotech's fortunes are driven largely by the success or failure of its scientists to discover new and effective drugs. Each data point on the graph shows the monthly return on the stock of interest and the monthly return on the overall stock market. The lines drawn through the data points represent the characteristic lines for each security.

a.Which stock do you think has a higher standard deviation? Why?

b.Which stock do you think has a higher beta? Why?

c. If an investor was seeking to diversify the risk of their current portfolio, which stock would be preferred?

Return on Overall Market 70 50 20 Return on Cyclical ndustries 10 20 30 Stock 20 -30 Panel A Return on Overall Market 10 19 20 10 -30-t. Panel B Return on Biotech Cures StockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started