Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are analyzing the Photon project, which has the expected cash flows below. The Photon project has a 4 year life (assume best life) and

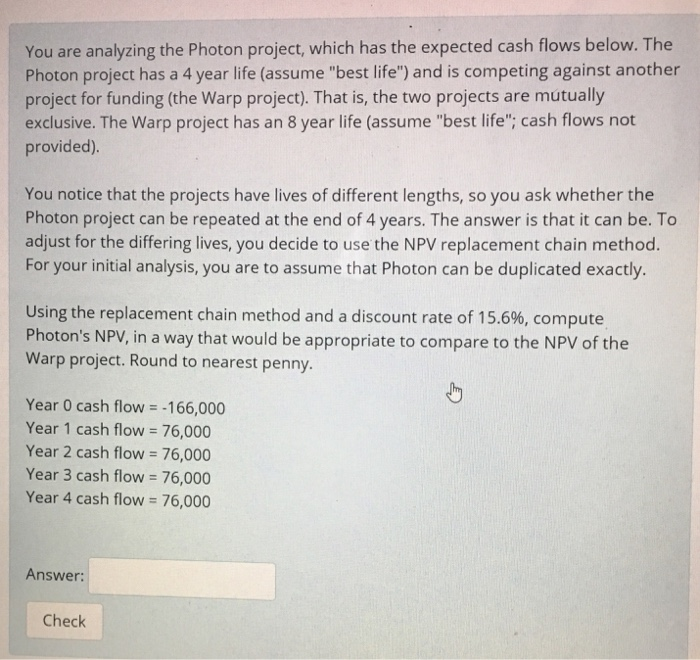

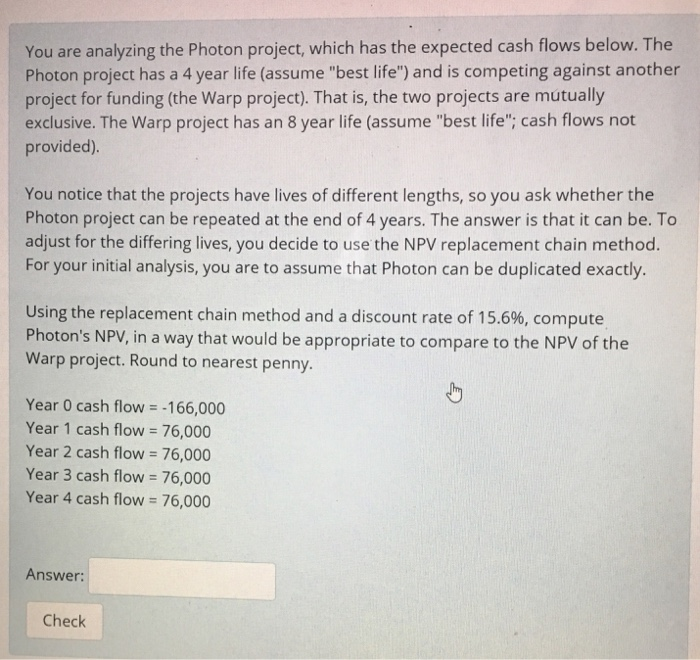

You are analyzing the Photon project, which has the expected cash flows below. The Photon project has a 4 year life (assume "best life") and is competing against another project for funding (the Warp project). That is, the two projects are mutually exclusive. The Warp project has an 8 year life (assume "best life"; cash flows not provided) You notice that the projects have lives of different lengths, so you ask whether the Photon project can be repeated at the end of 4 years. The answer is that it can be. To adjust for the differing lives, you decide to use the NPV replacement chain method. For your initial analysis, you are to assume that Photon can be duplicated exactly. using the replacement chain method and a discount rate of 15.6%, compute Photon's NPV, in a way that would be appropriate to compare to the NPV of the Warp project. Round to nearest penny. Year 0 cash flow =-166,000 Year 1 cash flow 76,000 Year 2 cash flow 76,000 Year 3 cash flow 76,000 Year 4 cash flow 76,000 Answer: Check

You are analyzing the Photon project, which has the expected cash flows below. The Photon project has a 4 year life (assume "best life") and is competing against another project for funding (the Warp project). That is, the two projects are mutually exclusive. The Warp project has an 8 year life (assume "best life"; cash flows not provided) You notice that the projects have lives of different lengths, so you ask whether the Photon project can be repeated at the end of 4 years. The answer is that it can be. To adjust for the differing lives, you decide to use the NPV replacement chain method. For your initial analysis, you are to assume that Photon can be duplicated exactly. using the replacement chain method and a discount rate of 15.6%, compute Photon's NPV, in a way that would be appropriate to compare to the NPV of the Warp project. Round to nearest penny. Year 0 cash flow =-166,000 Year 1 cash flow 76,000 Year 2 cash flow 76,000 Year 3 cash flow 76,000 Year 4 cash flow 76,000 Answer: Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started