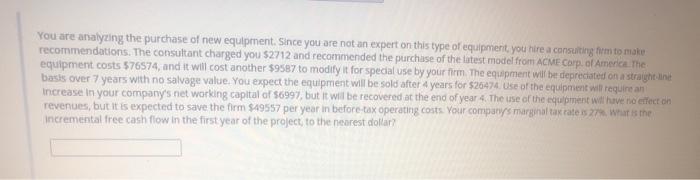

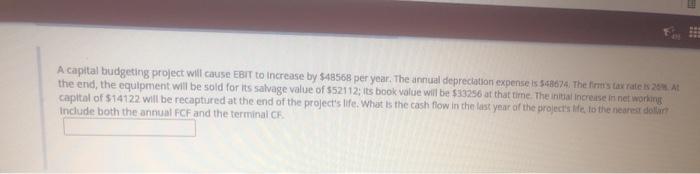

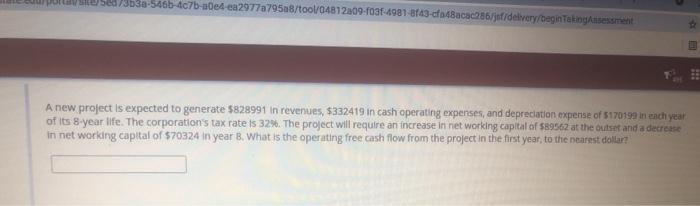

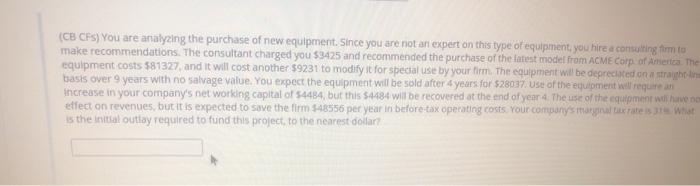

You are analyzing the purchase of new equipment. Since you are not an expert on this type of equipment, you hire a consulting firm to make recommendations. The consultant charged you 52712 and recommended the purchase of the latest model from ACME Corp. of America. The equipment costs 576574, and it will cost another $9587 to modify it for special use by your firm The equipment will be depreciated on a straight lint basis over 7 years with no salvage value. You expect the equipment will be sold after 4 years for $26474. Use of the equipment will require an Increase in your company's net working capital of 56997, but it will be recovered at the end of year 4. The use of the equipment will have no effect on revenues, but it is expected to save the firm $49557 per year in before tax operating costs your company's marginal tax rate is 27 What is the incremental free cash flow in the first year of the project to the nearest dollar HIE A capital budgeting project will cause EBIT to increase by $48568 per year. The annual depreciation expense is $48074. The firm's tax rates 2012 the end, the equipment will be sold for its salvage value of $52112: Its book value will be 533256 at that time. The na Increase in networking capital of 514122 will be recaptured at the end of the project's life. What is the cash flow in the last year of the project's life, to the nearest dollar Include both the annual FCF and the terminal C. DILLUSIUSE/3630-5466-4c7b-a0e4ca2977a795a8/tool 04872209-f031-1981-843-c48ac286/jsf/delivery/beginTeknisessment A new project is expected to generate $828991 in revenues, $332419 in cash operating expenses, and depreciation expense of 5170199 in each year of its 8-year life. The corporation's tax rate is 32%. The project will require an increase in networking capital of 589562 at the outset and a decrease in net working capital of $70324 in year B. What is the operating free cash flow from the project in the first year, to the nearest dollar (CB CES) You are analyzing the purchase of new equipment. Since you are not an expert on this type of equipment, you hire a consulting firm to make recommendations. The consultant charged you $3425 and recommended the purchase of the latest model from ACME Corp of America. The equipment costs 581327, and it will cost another $9231 to modify it for special use by your tim. The equipment will be deprecated on a straight to basis over 9 years with no salvage value. You expect the equipment will be sold after 4 years for $28037. Use of the equipment will require an increase in your company's networking capital of 54484, but this $4484 will be recovered at the end of year. The use of the equipment will have no effect on revenues, but it is expected to save the firm $48556 per year in before-tax operating costs your company's margral trate is wat is the initial outlay required to find this project to the nearest dollar