Answered step by step

Verified Expert Solution

Question

1 Approved Answer

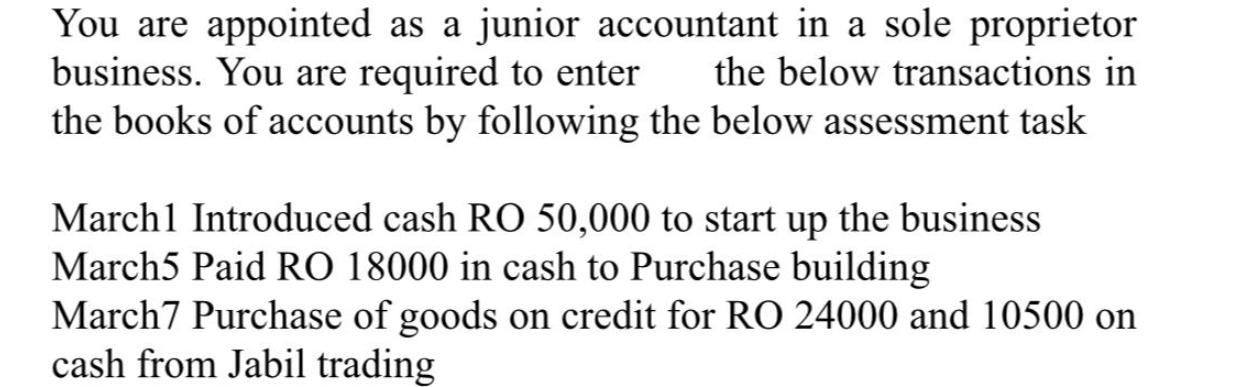

You are appointed as a junior accountant in a sole proprietor business. You are required to enter the below transactions in the books of

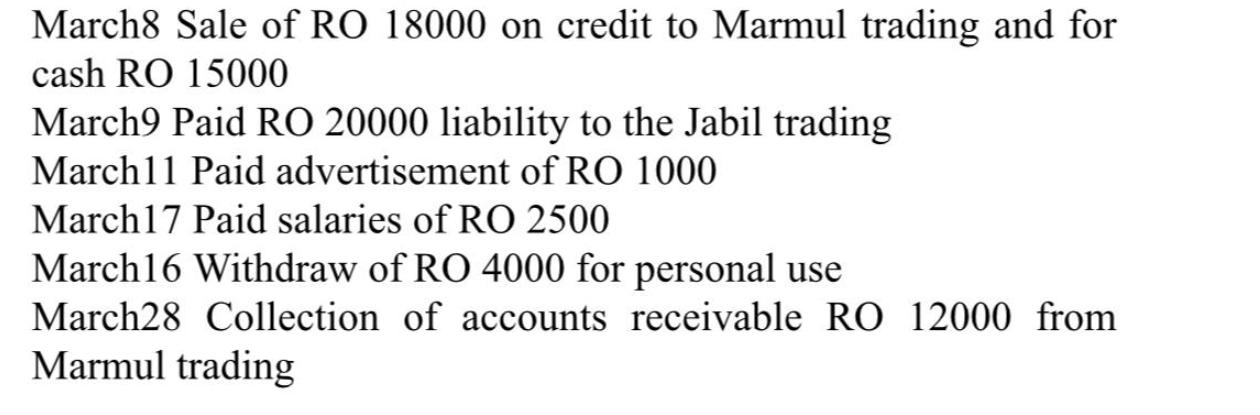

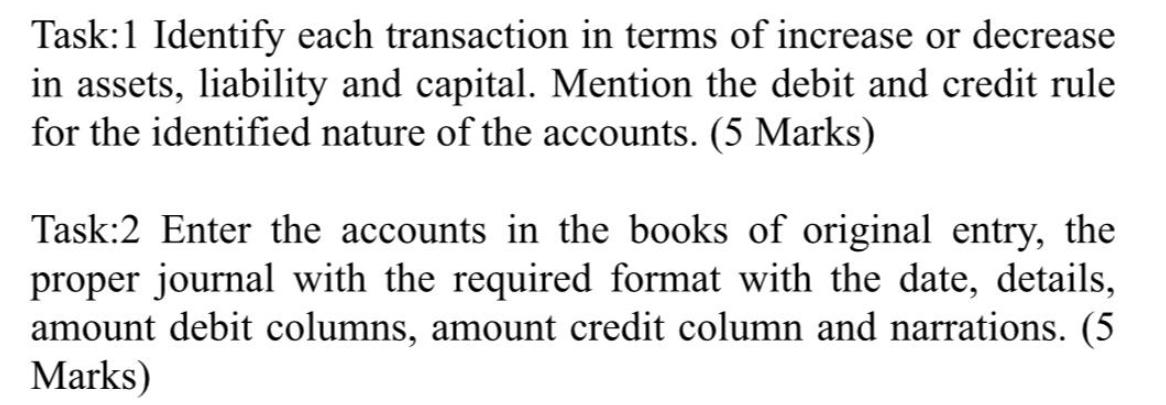

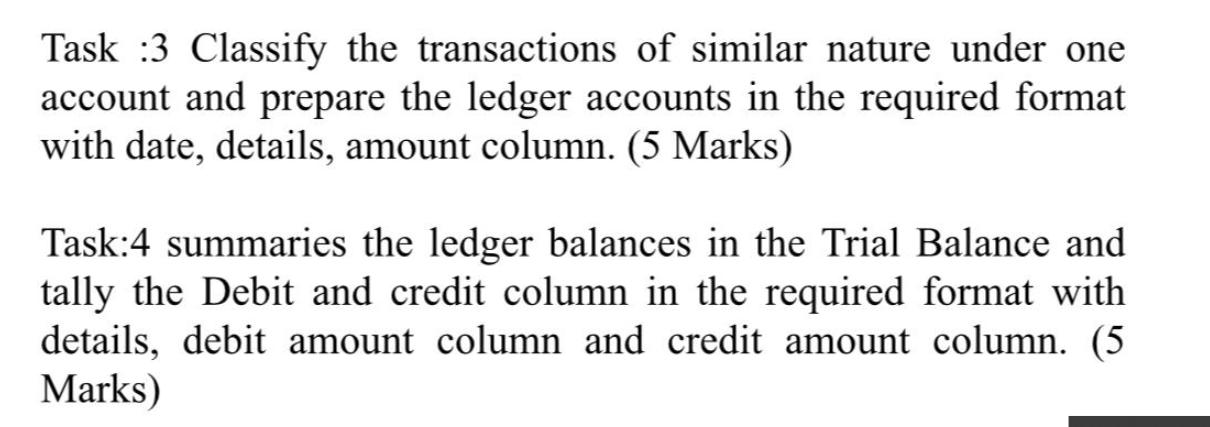

You are appointed as a junior accountant in a sole proprietor business. You are required to enter the below transactions in the books of accounts by following the below assessment task March1 Introduced cash RO 50,000 to start up the business March5 Paid RO 18000 in cash to Purchase building March7 Purchase of goods on credit for RO 24000 and 10500 on cash from Jabil trading March8 Sale of RO 18000 on credit to Marmul trading and for cash RO 15000 March9 Paid RO 20000 liability to the Jabil trading March11 Paid advertisement of RO 1000 March 17 Paid salaries of RO 2500 March 16 Withdraw of RO 4000 for personal use March28 Collection of accounts receivable RO 12000 from Marmul trading Task:1 Identify each transaction in terms of increase or decrease in assets, liability and capital. Mention the debit and credit rule for the identified nature of the accounts. (5 Marks) Task:2 Enter the accounts in the books of original entry, the proper journal with the required format with the date, details, amount debit columns, amount credit column and narrations. (5 Marks) Task 3 Classify the transactions of similar nature under one account and prepare the ledger accounts in the required format with date, details, amount column. (5 Marks) Task:4 summaries the ledger balances in the Trial Balance and tally the Debit and credit column in the required format with details, debit amount column and credit amount column. (5 Marks)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Task 1 March 1 Cash Ac A Capital Ac C Cash and Capital increase as per debit and credit rul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started