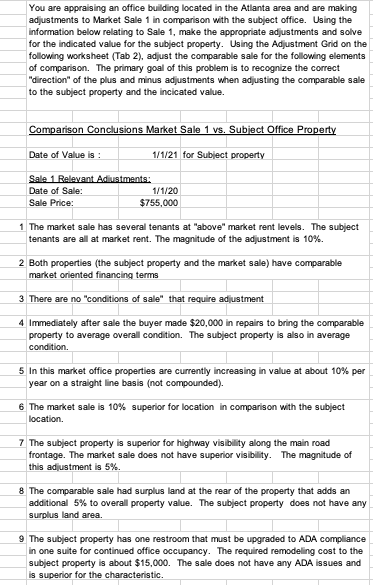

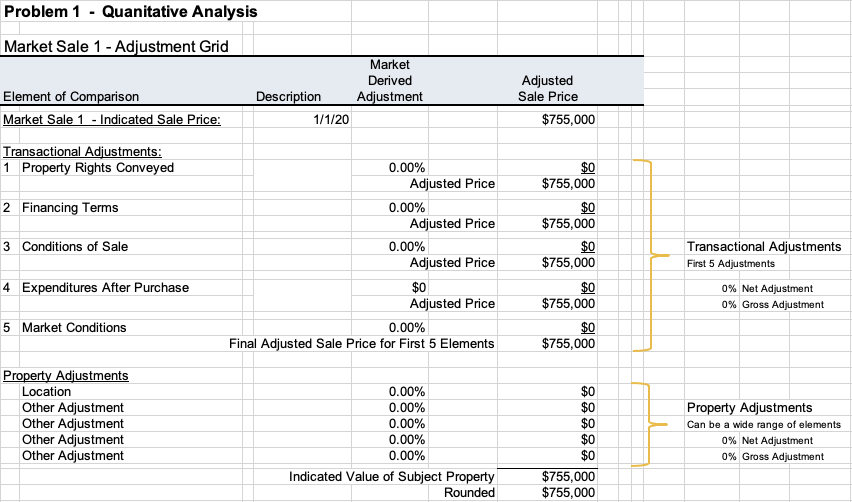

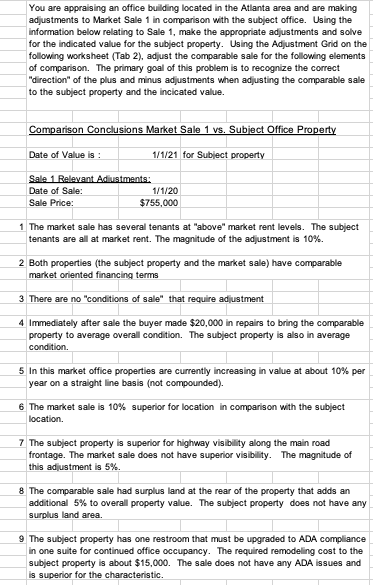

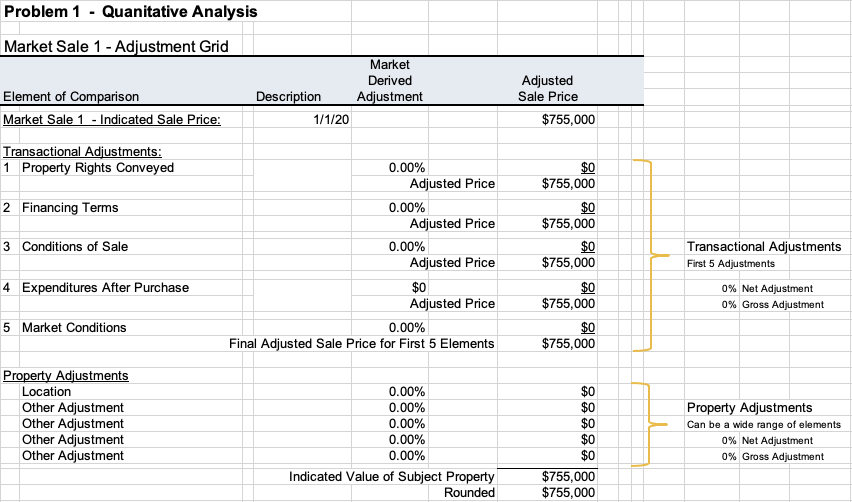

You are appraising an office building located in the Atlanta area and are making adjustments to Market Sale 1 in comparison with the subject office. Using the information below relating to Sale 1, make the appropriate adjustments and solve for the indicated value for the subject property. Using the Adjustment Grid on the following worksheet (Tab 2), adjust the comparable sale for the following elements of comparison. The primary goal of this problem is to recognize the correct "direction" of the plus and minus adjustments when adjusting the comparable sale to the subject property and the incicated value. Comparison Conclusions Market Sale 1 vs. Subject Office Property Date of Value is: 1/1/21 for Subject property Sale 1 Relevant Adjustments: Date of Sale: 1/1/20 Sale Price: $755,000 1 The market sale has several tenants at "above" market rent levels. The subject tenants are all at market rent. The magnitude of the adjustment is 10%. 2 Both properties (the subject property and the market sale) have comparable market oriented financing terms 3. There are no "conditions of sale" that require adjustment 4 Immediately after sale the buyer made $20,000 in repairs to bring the comparable property to average overall condition. The subject property is also in average condition. 5 In this market office properties are currently increasing in value at about 10% per year on a straight line basis (not compounded). 6 The market sale is 10% superior for location in comparison with the subject location. 7 The subject property is superior for highway visibility along the main road frontage. The market sale does not have superior visibility. The magnitude of this adjustment is 5%. 8 The comparable sale had surplus land at the rear of the property that adds an additional 5% to overall property value. The subject property does not have any surplus land area. 9 The subject property has one restroom that must be upgraded to ADA compliance in one suite for continued office occupancy. The required remodeling cost to the subject property is about $15,000. The salle does not have any ADA issues and is superior for the characteristic. Adjusted Sale Price $755,000 Problem 1 - Quanitative Analysis Market Sale 1 - Adjustment Grid Market Derived Element of Comparison Description Adjustment Market Sale 1 - Indicated Sale Price: 21 1/1/20 Transactional Adjustments: 1 Property Rights Conveyed 0.00% Adjusted Price 2 Financing Terms 0.00% Adjusted Price 3 Conditions of Sale 0.00% Adjusted Price 4 Expenditures After Purchase $0 Adjusted Price 5 Market Conditions 0.00% Final Adjusted Sale Price for First 5 Elements $0 $755,000 $0 $755,000 $0 $755,000 $0 $755,000 $0 $755,000 Transactional Adjustments First 5 Adjustments 0% Net Adjustment 0% Gross Adjustment Property Adjustments Location Other Adjustment Other Adjustment Other Adjustment Other Adjustment 0.00% 0.00% 0.00% 0.00% 0.00% Indicated Value of Subject Property Rounded $0 $0 $0 $0 $0 $755,000 $755,000 Property Adjustments Can be a wide range of elements 0% Net Adjustment 0% Gross Adjustment You are appraising an office building located in the Atlanta area and are making adjustments to Market Sale 1 in comparison with the subject office. Using the information below relating to Sale 1, make the appropriate adjustments and solve for the indicated value for the subject property. Using the Adjustment Grid on the following worksheet (Tab 2), adjust the comparable sale for the following elements of comparison. The primary goal of this problem is to recognize the correct "direction" of the plus and minus adjustments when adjusting the comparable sale to the subject property and the incicated value. Comparison Conclusions Market Sale 1 vs. Subject Office Property Date of Value is: 1/1/21 for Subject property Sale 1 Relevant Adjustments: Date of Sale: 1/1/20 Sale Price: $755,000 1 The market sale has several tenants at "above" market rent levels. The subject tenants are all at market rent. The magnitude of the adjustment is 10%. 2 Both properties (the subject property and the market sale) have comparable market oriented financing terms 3. There are no "conditions of sale" that require adjustment 4 Immediately after sale the buyer made $20,000 in repairs to bring the comparable property to average overall condition. The subject property is also in average condition. 5 In this market office properties are currently increasing in value at about 10% per year on a straight line basis (not compounded). 6 The market sale is 10% superior for location in comparison with the subject location. 7 The subject property is superior for highway visibility along the main road frontage. The market sale does not have superior visibility. The magnitude of this adjustment is 5%. 8 The comparable sale had surplus land at the rear of the property that adds an additional 5% to overall property value. The subject property does not have any surplus land area. 9 The subject property has one restroom that must be upgraded to ADA compliance in one suite for continued office occupancy. The required remodeling cost to the subject property is about $15,000. The salle does not have any ADA issues and is superior for the characteristic. Adjusted Sale Price $755,000 Problem 1 - Quanitative Analysis Market Sale 1 - Adjustment Grid Market Derived Element of Comparison Description Adjustment Market Sale 1 - Indicated Sale Price: 21 1/1/20 Transactional Adjustments: 1 Property Rights Conveyed 0.00% Adjusted Price 2 Financing Terms 0.00% Adjusted Price 3 Conditions of Sale 0.00% Adjusted Price 4 Expenditures After Purchase $0 Adjusted Price 5 Market Conditions 0.00% Final Adjusted Sale Price for First 5 Elements $0 $755,000 $0 $755,000 $0 $755,000 $0 $755,000 $0 $755,000 Transactional Adjustments First 5 Adjustments 0% Net Adjustment 0% Gross Adjustment Property Adjustments Location Other Adjustment Other Adjustment Other Adjustment Other Adjustment 0.00% 0.00% 0.00% 0.00% 0.00% Indicated Value of Subject Property Rounded $0 $0 $0 $0 $0 $755,000 $755,000 Property Adjustments Can be a wide range of elements 0% Net Adjustment 0% Gross Adjustment