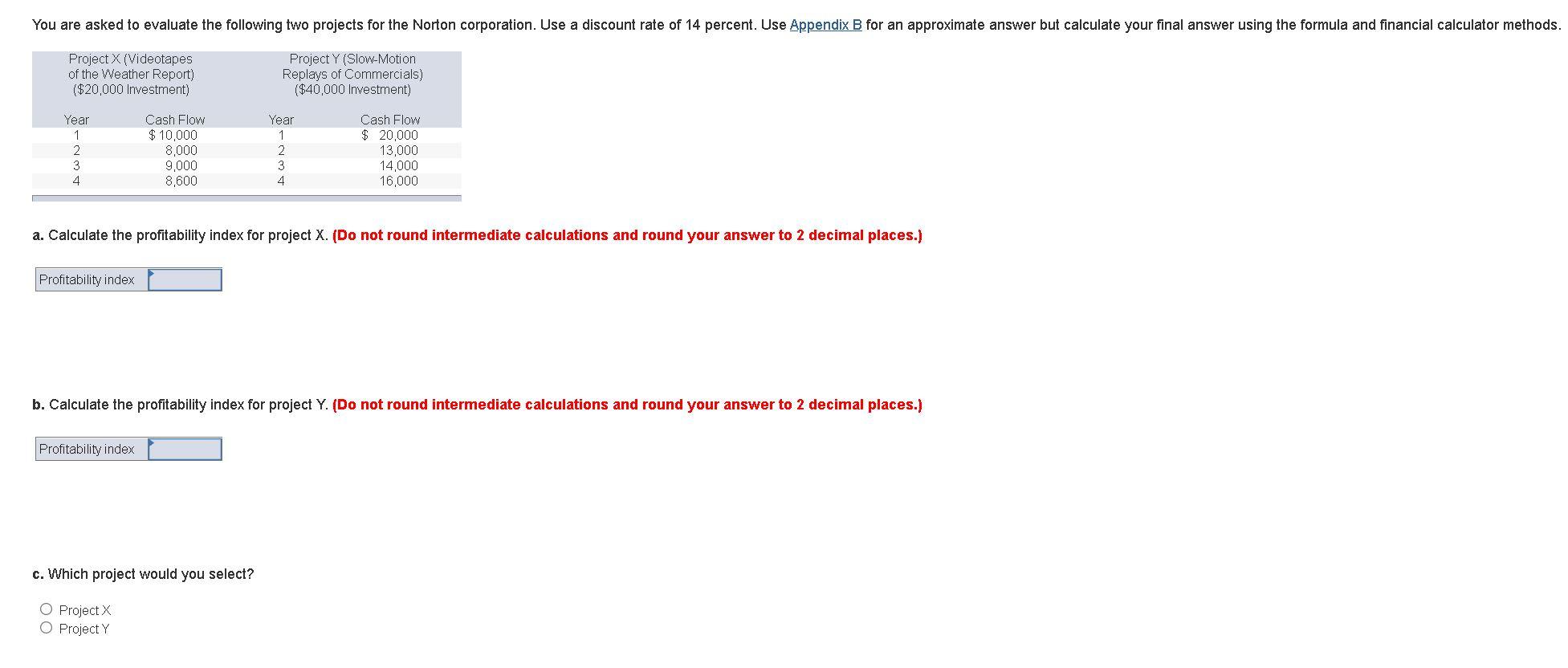

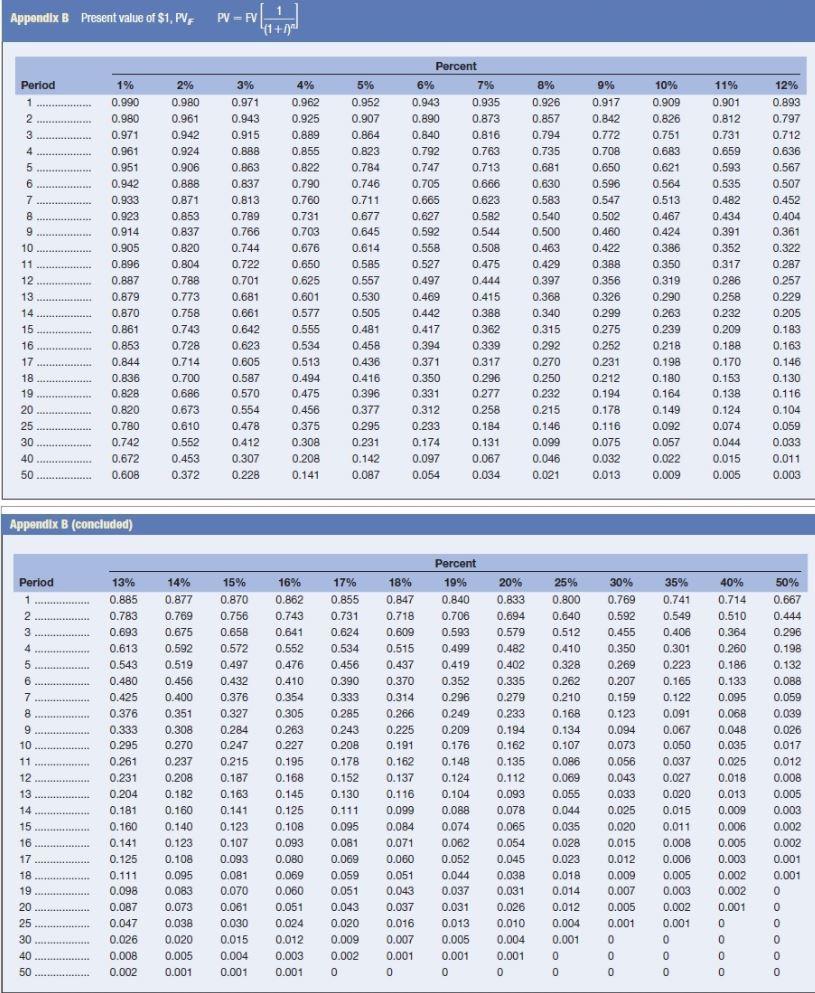

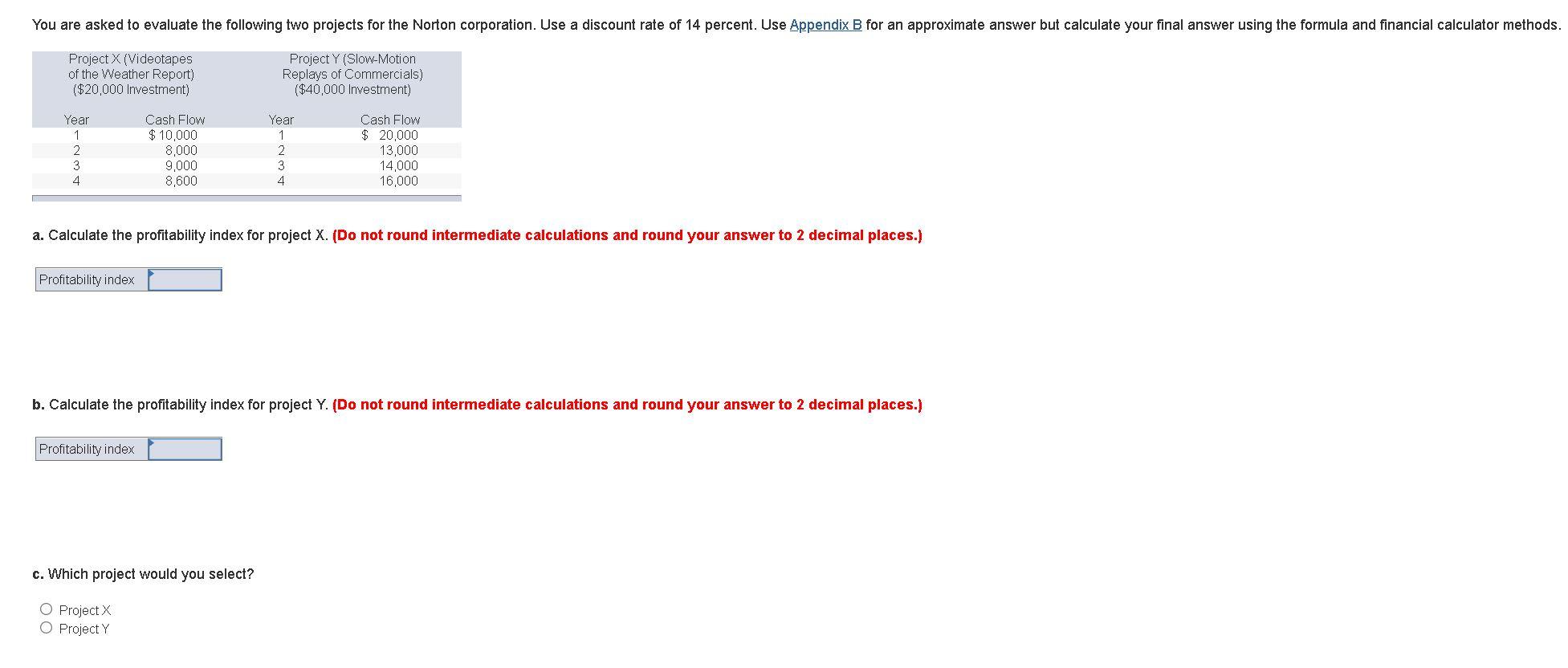

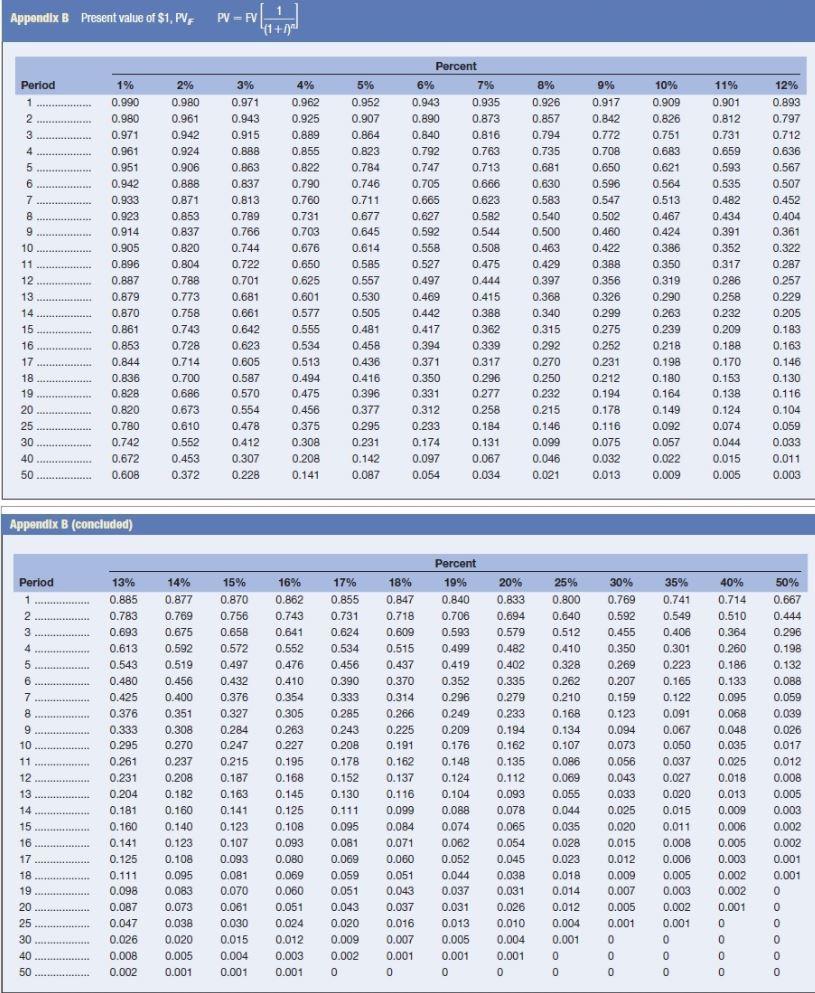

You are asked to evaluate the following two projects for the Norton corporation. Use a discount rate of 14 percent. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Project X (Videotapes of the Weather Report) ($20,000 Investment) Project Y (Slow-Motion Replays of Commercials) ($40,000 Investment) Year 1 2 3 4 Cash Flow $ 10,000 8,000 9,000 8,600 Year 1 2 3 4 Cash Flow $ 20,000 13,000 14,000 16,000 a. Calculate the profitability index for project X. (Do not round intermediate calculations and round your answer to 2 decimal places.) Profitability index b. Calculate the profitability index for project Y. (Do not round intermediate calculations and round your answer to 2 decimal places.) Profitability index c. Which project would you select? O Project X O Project Y Appendix B Present value of $1, PV, 1 PVFV 111+1) 3% Period 1 2 3 4 5 6 7 8 9 10 11 12 1 13 1 14 15 16 17 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.885 0.933 0.923 W.820 0.914 0.905 wowe w.ovo 0.896 0.887 0.879 0.870 0.861 ORA 0.853 25 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 2% 0.980 0.961 0.942 0.924 *** 0.906 weco 0.888 0.871 0.87 0.853 0.837 0.820 w 0.804 W.00 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 0.971 0.943 0.915 0.888 2.00 0.863 0.837 0.65 0.813 0.813 0.789 0.766 0.744 . 0.722 0.701 84 0.681 64 0.661 en 0.642 0.623 0.605 0.587 620 0.570 0.554 0.478 0.412 0.307 0.228 4% 0.962 0.925 0.889 0.855 w.oc 0.822 0.rs 0.790 0.760 0.731 0.703 0.676 wer 0.650 0.625 0.601 0.577 EEE 0.555 0.534 0.513 0.494 0.475 475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 W.10 0.711 0.677 0.01 0.645 0.614 0 0.585 U.DOC 0.557 0.530 0.505 0.481 0.456 19 0.436 0.416 20 0.396 0.377 0.295 0.231 0.142 0.087 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.705 0.666 5.000 0.665 0.623 0.627 0.027 0.582 0.592 0.544 0.558 0.508 wowo 0.527 0.02 0.475 0.497 0.444 0.469 0415 0.469 0.415 0.442 0.388 0417 0.417 0.362 an 20 0.339 0.394 0.371 0.317 0.350 0.296 0.331 201 0.277 0.312 0.258 0.233 0.184 0.174 0.131 0.097 0.067 0.054 0.034 8% 0.926 0.857 0.794 0.735 0.681 0.00! 0.630 9.00 0.583 0.583 0.540 0.500 ce 0.463 0.700 0.429 0.397 0.368 0.340 0.315 24 200 0.292 0.270 0.250 0.232 290 25 0.215 0.146 0.099 0.046 0.021 9% 0.917 0.842 0.772 0.708 0.00 0.650 0.596 0.547 0.502 0.460 0.422 0.44 0.388 0.356 0.326 0.299 075 0.275 0.252 0.231 0.212 0.194 101 0.178 170 0.116 140 0.075 0.032 0.013 10% 0.909 0.826 0.751 0.683 woen 0.621 0.564 0.004 0.513 0.467 0.424 0.386 9.00 0.350 0.319 0.290 0.263 220 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 11% 0.901 0.812 0.731 0.659 0.593 0.535 9.00 0.482 0.434 0.434 0.391 . 0.352 0.317 W. 0.286 0.258 0.232 20 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 12% 0.893 0.797 0.712 0.636 wo 0.567 0.507 0.452 0.452 0.404 0.361 Visor 0.322 va 0.287 J.com 0.257 0.229 205 0.205 0.183 se 0.163 0.146 0.130 446 0.116 0.104 0.059 0.033 0.011 0.003 18 19 40 20 25 25 30 40 50 Appendix B (concluded) Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 25 13% 0.885 0.783 0.693 0.613 0.543 0.480 w 0.425 0.376 Ver 0.333 0.295 0.261 0.231 0.204 w 0.181 wo 0.160 wou 0.141 0.141 0.125 0.111 0.098 0.087 0.047 0.026 0.008 0.002 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.85 0.351 0.308 J. 0.270 0.237 0.208 0.182 ro 0.160 0.140 2.1 0.123 0.120 0.108 0.095 0.083 0.073 0.038 0.020 0.005 0.001 15% 0.870 0.756 0.658 0.572 0.497 0.432 www 0.376 0.327 We 0.284 V.com 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.030 0.015 0.004 0.001 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.805 0.263 0.227 0.195 0.168 ware 0.145 0.125 co 0.108 w.ro 0.093 wy 0.080 w.vou 0.069 0.060 0.051 0.024 0.012 0.003 0.001 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 V.CO 0.285 0.243 27 0.208 0.178 0.152 0.130 0.111 0.095 0.081 W.Do 0.069 0.059 0.051 040 0.043 0.020 0.009 0.002 0 18% 0.847 0.718 0.609 0.515 0.437 0.370 www 0.314 0.00 0.266 0.220 0.225 0.191 0.162 0.137 0.116 0.099 wee 0.084 W.00 0.071 0.060 0.000 0.051 0.043 0.037 0.016 0.007 0.001 0 Percent 19% 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 V.CO 0.176 0.148 0.124 0.104 0.088 Wort 0.074 0.062 w.coe 0.052 0.044 0.037 097 0.031 0.013 0.005 0.001 0 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.280 0.194 .18 0.162 0.135 0.112 0.093 0.078 0.065 wee 0.054 W.107 0.045 0.038 0.031 0.026 0.010 0.004 0.001 0 25% 0.800 0.640 0.512 0.410 0.328 0.262 0.210 w 0.168 wo 0.134 0.10 0.107 0.086 0.069 0.055 www 0.044 0.035 Vse 0.028 0.023 0.018 0.014 0.012 0.004 0.001 0 0 30% 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 . 0.073 0.056 0.043 0.033 www 0.025 0.020 we 0.015 w 0.012 0.009 0.007 0.005 0.001 0 0 0 35% 0.741 0.549 0.406 0.301 Weer 0.223 0.165 0.122 0.091 we 0.067 . 0.050 0.037 0.027 0.020 0.015 0.011 0.008 w.wo 0.006 0.005 0.003 000 0.002 0.001 40% 0.714 0.510 0.364 0.260 0.186 0.133 we 0.095 0.068 0.048 0.035 0.025 0.018 0.013 w 0.009 www 0.006 Vovo 0.005 W.000 0.003 0.002 0.002 0.001 0 0 0 0 50% 0.667 0.444 0.296 0.198 0.132 0.088 0.059 0.039 W. 0.026 Voce 0.017 0.012 0.008 0.005 0.003 0.002 www 0.002 0.001 0.001 0 0 0 0 0 0 30 0 40 0 0 50