Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are asked to find the value of a share of the company XYZ. You are presented with the following information: the company has

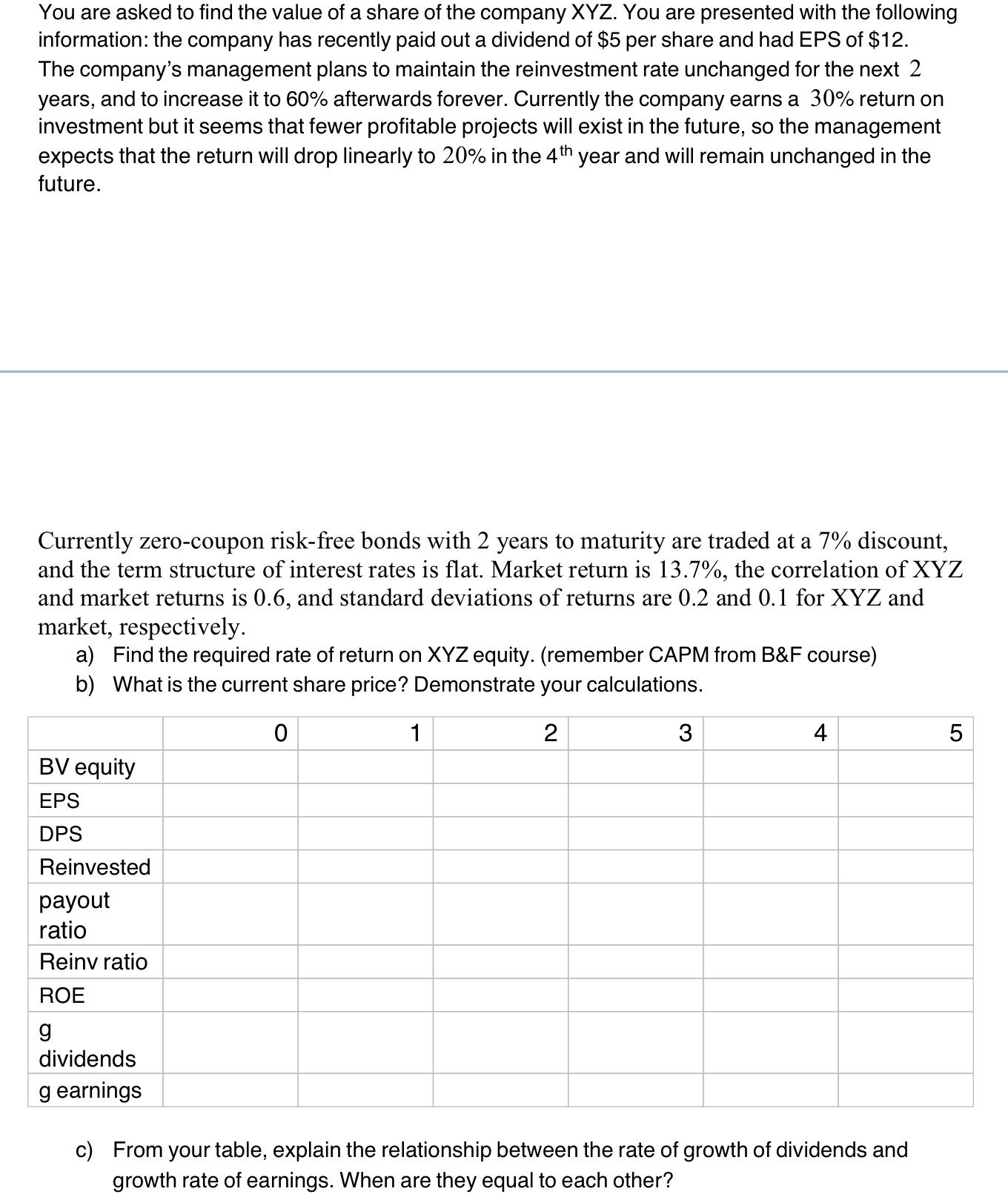

You are asked to find the value of a share of the company XYZ. You are presented with the following information: the company has recently paid out a dividend of $5 per share and had EPS of $12. The company's management plans to maintain the reinvestment rate unchanged for the next 2 years, and to increase it to 60% afterwards forever. Currently the company earns a 30% return on investment but it seems that fewer profitable projects will exist in the future, so the management expects that the return will drop linearly to 20% in the 4th year and will remain unchanged in the future. Currently zero-coupon risk-free bonds with 2 years to maturity are traded at a 7% discount, and the term structure of interest rates is flat. Market return is 13.7%, the correlation of XYZ and market returns is 0.6, and standard deviations of returns are 0.2 and 0.1 for XYZ and market, respectively. a) Find the required rate of return on XYZ equity. (remember CAPM from B&F course) b) What is the current share price? Demonstrate your calculations. 2 BV equity EPS DPS Reinvested payout ratio Reinv ratio ROE g dividends g earnings 0 1 3 4 c) From your table, explain the relationship between the rate of growth of dividends and growth rate of earnings. When are they equal to each other? LO 5

Step by Step Solution

★★★★★

3.46 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

a To find the required rate of return on XYZ equity using the CAPM we need to use the following form...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started