Answered step by step

Verified Expert Solution

Question

1 Approved Answer

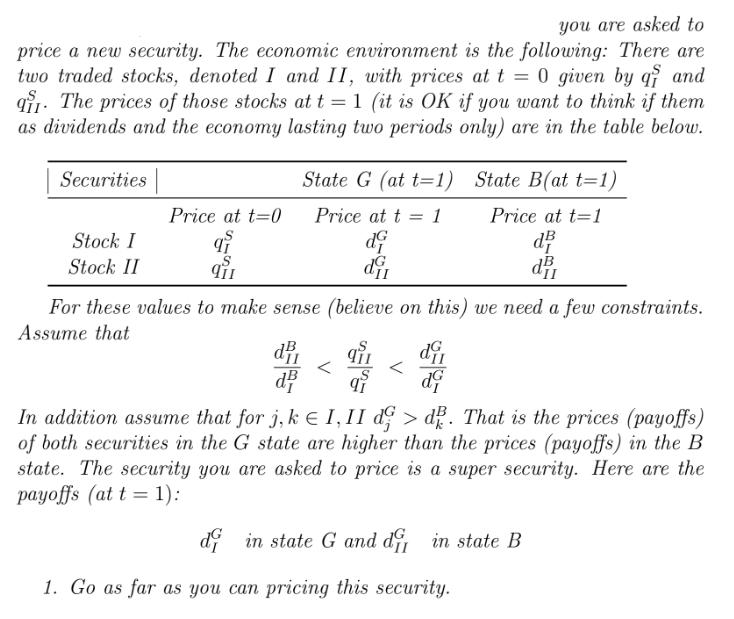

you are asked to price a new security. The economic environment is the following: There are two traded stocks, denoted I and II, with

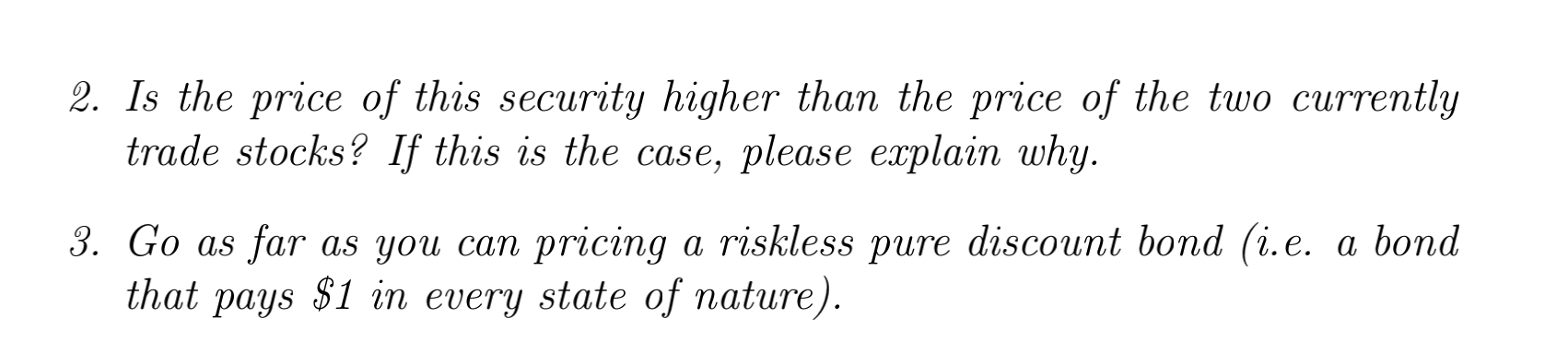

you are asked to price a new security. The economic environment is the following: There are two traded stocks, denoted I and II, with prices at t = 0 given by q and 9. The prices of those stocks at t = 1 (it is OK if you want to think if them as dividends and the economy lasting two periods only) are in the table below. Securities | Stock I Stock II Price at t=0 State G (at t=1) Price at t = 1 de State B(at t=1) Price at t=1 dB d d For these values to make sense (believe on this) we need a few constraints. Assume that dB dB In addition assume that for j, k = I, II d > d. That is the prices (payoffs) of both securities in the G state are higher than the prices (payoffs) in the B state. The security you are asked to price is a super security. Here are the payoffs (att = 1): d in state G and do in state B 1. Go as far as you can pricing this security. 2. Is the price of this security higher than the price of the two currently trade stocks? If this is the case, please explain why. 3. Go as far as you can pricing a riskless pure discount bond (i.e. a bond that pays $1 in every state of nature).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started