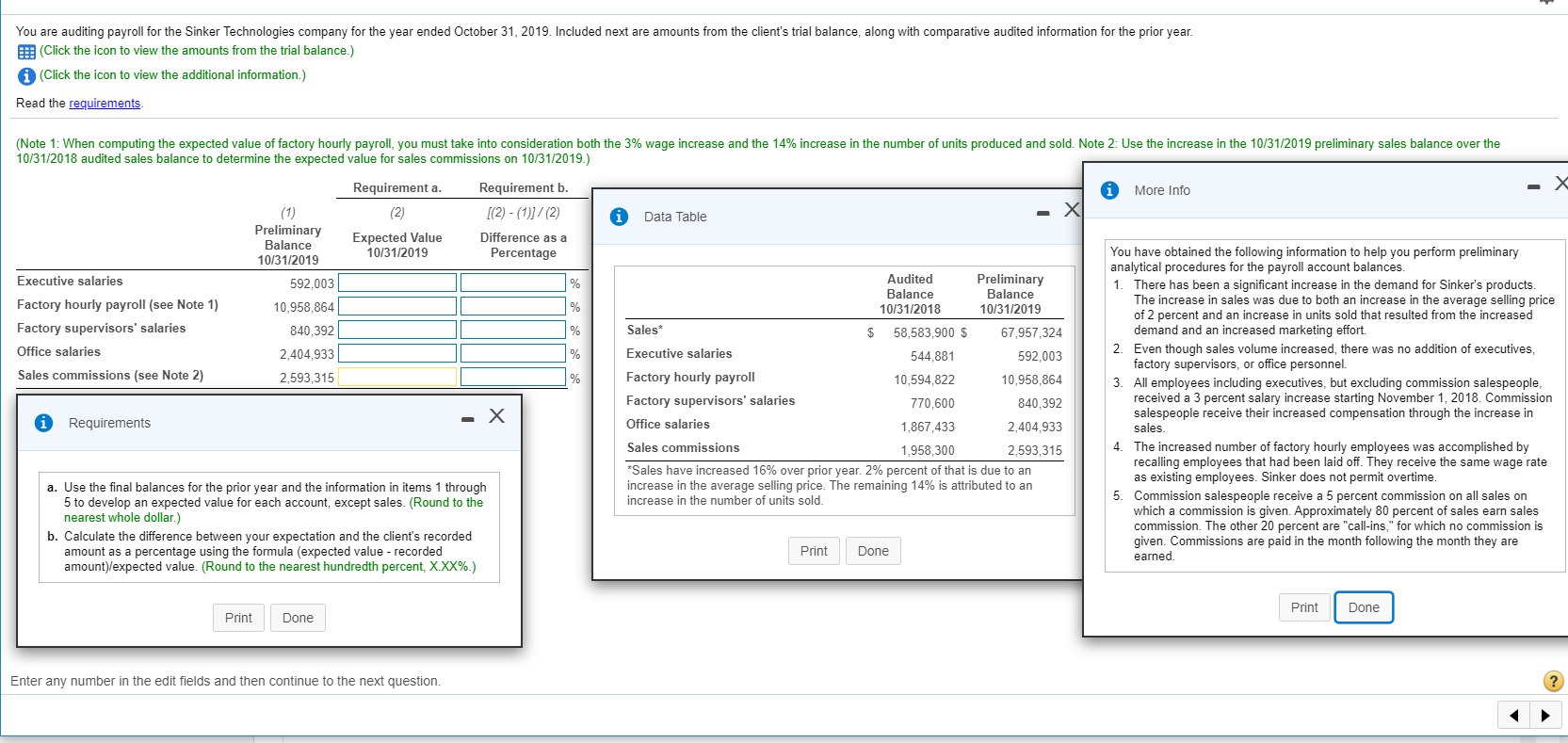

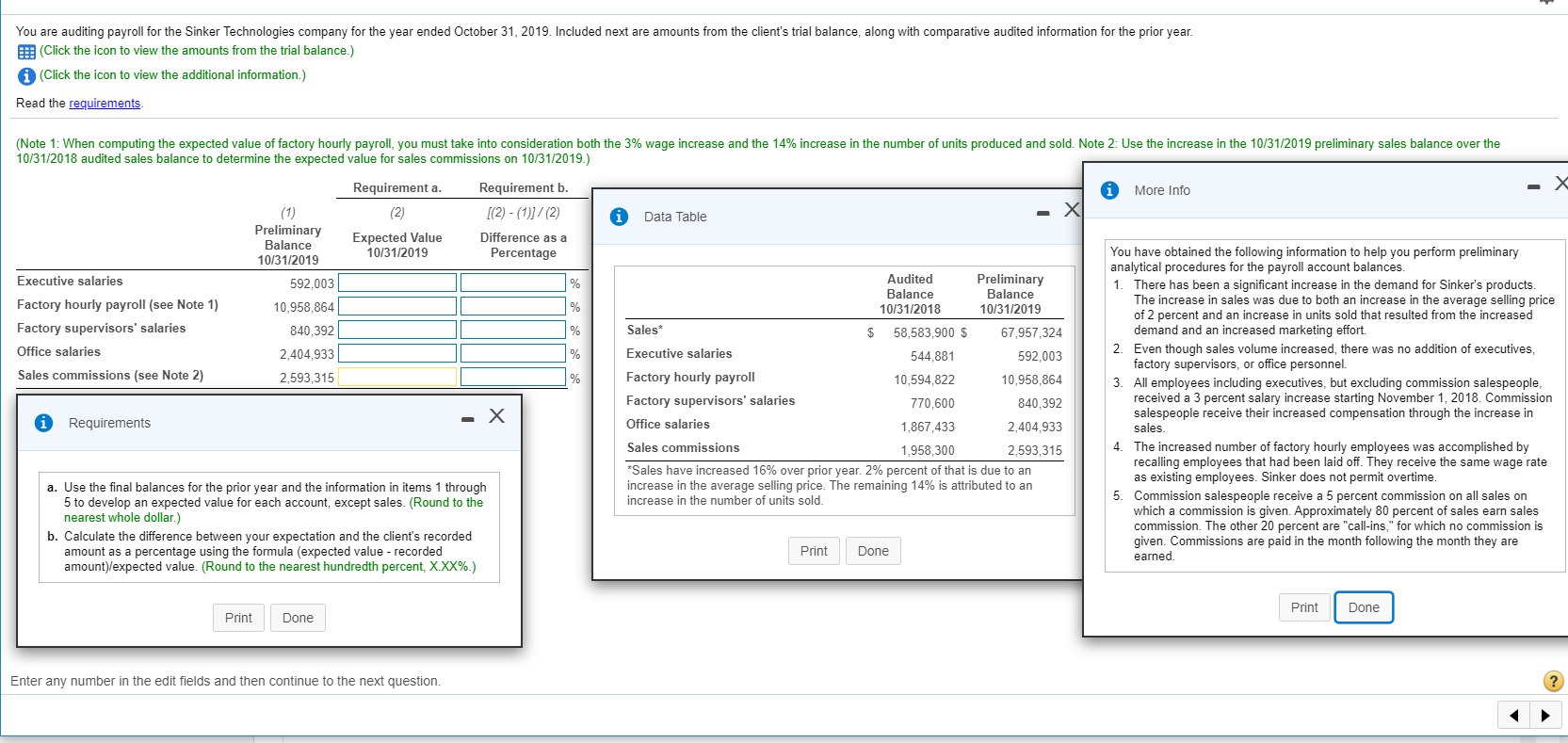

You are auditing payroll for the Sinker Technologies company for the year ended October 31, 2019. Included next are amounts from the client's trial balance, along with comparative audited information for the prior year. (Click the icon to view the amounts from the trial balance.) (Click the icon to view the additional information.) Read the requirements. (Note 1: When computing the expected value of factory hourly payroll, you must take into consideration both the 3% wage increase and the 14% increase in the number of units produced and sold. Note 2: Use the increase in the 10/31/2019 preliminary sales balance over the 10/31/2018 audited sales balance to determine the expected value for sales commissions on 10/31/2019.) A More Info Requirement a. (2) Requirement b. [(2) - (1)]/(2) Difference as a Percentage * Data Table Expected Value 10/31/2019 Executive salaries Factory hourly payroll (see Note 1) Factory supervisors' salaries Office salaries Sales commissions (see Note 2) Preliminary any Balance 10/31/2019 592,003 10,958,864 840,392 2,404,933 2,593,315 Audited Preliminary Balance Balance 10/31/2018 10/31/2019 Sales* $ 58,583,900 $ 67,957,324 Executive salaries 544,881 592,003 Factory hourly payroll 10,594,822 10,958,864 Factory supervisors' salaries 770,600 840,392 Office salaries 1,867,433 2,404,933 Sales commissions 1,958,300 2,593,315 *Sales have increased 16% over prior year. 2% percent of that is due to an increase in the average selling price. The remaining 14% is attributed to an increase in the number of units sold. You have obtained the following information to help you perform preliminary analytical procedures for the payroll account balances. 1. There has been a significant increase in the demand for Sinker's products. The increase in sales was due to both an increase in the average selling price of 2 percent and an increase in units sold that resulted from the increased demand and an increased marketing effort. 2. Even though sales volume increased, there was no addition of executives, factory supervisors, or office personnel. 3. All employees including executives, but excluding commission salespeople, received a 3 percent salary increase starting November 1, 2018. Commission salespeople receive their increased compensation through the increase in sales. 4. The increased number of factory hourly employees was accomplished by recalling employees that had been laid off. They receive the same wage rate as existing employees. Sinker does not permit overtime. 5. Commission salespeople receive a 5 percent commission on all sales on which a commission is given. Approximately 80 percent of sales earn sales commission. The other 20 percent are "call-ins," for which no commission is given. Commissions are paid in the month following the month they are earned 0 Requirements a. Use the final balances for the prior year and the information in items 1 through 5 to develop an expected value for each account, except sales. (Round to the nearest whole dollar.) b. Calculate the difference between your expectation and the client's recorded amount as a percentage using the formula (expected value - recorded amount)/expected value. (Round to the nearest hundredth percent, X.XX%.) Print Done Print Done Print Done Enter any number in the edit fields and then continue to the next question. You are auditing payroll for the Sinker Technologies company for the year ended October 31, 2019. Included next are amounts from the client's trial balance, along with comparative audited information for the prior year. (Click the icon to view the amounts from the trial balance.) (Click the icon to view the additional information.) Read the requirements. (Note 1: When computing the expected value of factory hourly payroll, you must take into consideration both the 3% wage increase and the 14% increase in the number of units produced and sold. Note 2: Use the increase in the 10/31/2019 preliminary sales balance over the 10/31/2018 audited sales balance to determine the expected value for sales commissions on 10/31/2019.) A More Info Requirement a. (2) Requirement b. [(2) - (1)]/(2) Difference as a Percentage * Data Table Expected Value 10/31/2019 Executive salaries Factory hourly payroll (see Note 1) Factory supervisors' salaries Office salaries Sales commissions (see Note 2) Preliminary any Balance 10/31/2019 592,003 10,958,864 840,392 2,404,933 2,593,315 Audited Preliminary Balance Balance 10/31/2018 10/31/2019 Sales* $ 58,583,900 $ 67,957,324 Executive salaries 544,881 592,003 Factory hourly payroll 10,594,822 10,958,864 Factory supervisors' salaries 770,600 840,392 Office salaries 1,867,433 2,404,933 Sales commissions 1,958,300 2,593,315 *Sales have increased 16% over prior year. 2% percent of that is due to an increase in the average selling price. The remaining 14% is attributed to an increase in the number of units sold. You have obtained the following information to help you perform preliminary analytical procedures for the payroll account balances. 1. There has been a significant increase in the demand for Sinker's products. The increase in sales was due to both an increase in the average selling price of 2 percent and an increase in units sold that resulted from the increased demand and an increased marketing effort. 2. Even though sales volume increased, there was no addition of executives, factory supervisors, or office personnel. 3. All employees including executives, but excluding commission salespeople, received a 3 percent salary increase starting November 1, 2018. Commission salespeople receive their increased compensation through the increase in sales. 4. The increased number of factory hourly employees was accomplished by recalling employees that had been laid off. They receive the same wage rate as existing employees. Sinker does not permit overtime. 5. Commission salespeople receive a 5 percent commission on all sales on which a commission is given. Approximately 80 percent of sales earn sales commission. The other 20 percent are "call-ins," for which no commission is given. Commissions are paid in the month following the month they are earned 0 Requirements a. Use the final balances for the prior year and the information in items 1 through 5 to develop an expected value for each account, except sales. (Round to the nearest whole dollar.) b. Calculate the difference between your expectation and the client's recorded amount as a percentage using the formula (expected value - recorded amount)/expected value. (Round to the nearest hundredth percent, X.XX%.) Print Done Print Done Print Done Enter any number in the edit fields and then continue to the next