Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are being placed in the position of an analyst inside a small publicly traded business. Your job is to evaluate: The capital structure of

You are being placed in the position of an analyst inside a small publicly traded business. Your job is to evaluate:

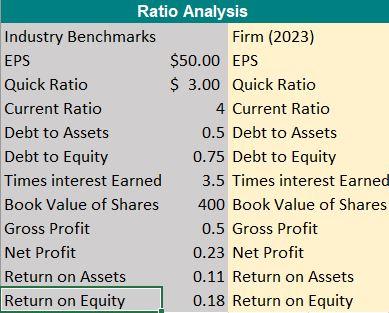

- The capital structure of the business using the financial statements provided and benchmark them against industry ratios provided. In benchmarking you will compare the ratios of your firm to that of the industry. Ratios include but not limited to:

- Debt/Equity

- Current Ratio

- Debt/asset

- Return on Assets Ratio

- Earnings per share.

- Once you have completed ratio you will evaluate the next years, purposed capital expenditures, there are several. Rank them based on:

- NPV

- Cost of capital (Evaluate is it risk or return that is the cost driver)

- Cash Flows

- Evaluate the sources of capital available, given the stipulations of for example:

- Minimum cash reserves.

- Equity dilution.

- Cost of debt.

- Aligning with industry or segment benchmarks.

- Budgeting Guide lines

- Reevaluate the capital expenditures based on the nature of capital available for capital expenditures.

5. Summarize, prioritize, and communicate your analysis in a format that allow executives to make decisions.

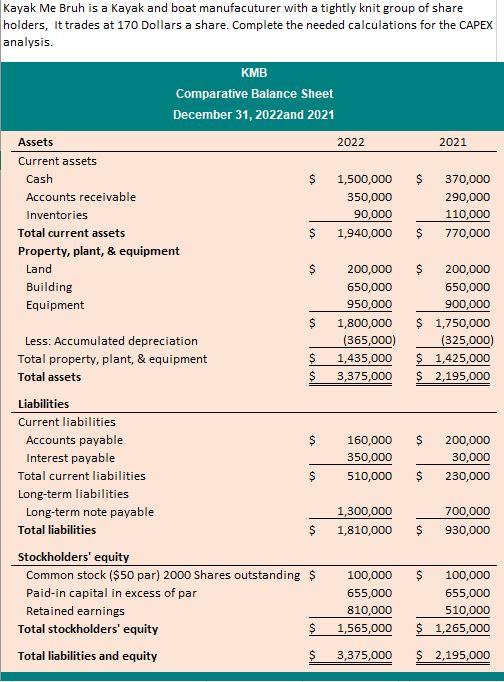

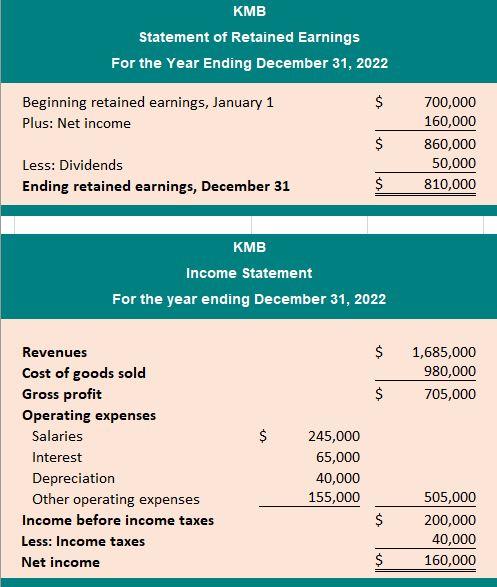

Kayak Me Bruh is a Kayak and boat manufacuturer with a tightly knit group of share holders, it trades at 170 Dollars a share. Complete the needed calculations for the CAPEX analysis. 2021 $ 370,000 290,000 110,000 770,000 $ KMB Comparative Balance Sheet December 31, 2022 and 2021 Assets 2022 Current assets Cash S 1,500,000 Accounts receivable 350,000 Inventories 90,000 Total current assets S 1,940,000 Property, plant, & equipment Land S 200,000 Building 650,000 Equipment 950,000 $ 1,800,000 Less: Accumulated depreciation (365,000) Total property, plant, & equipment $ 1,435,000 Total assets S 3,375,000 Liabilities Current liabilities Accounts payable $ 160,000 Interest payable 350,000 Total current liabilities $ 510,000 Long-term liabilities Long-term note payable 1,300,000 Total liabilities $ 1,810,000 Stockholders' equity Common stock ($50 par) 2000 Shares outstanding $ 100,000 Paid-in capital in excess of par 655,000 Retained earnings 810,000 Total stockholders' equity $ 1,565,000 Total liabilities and equity S 3,375,000 $ 200,000 650,000 900,000 $ 1,750,000 (325,000) $ 1,425,000 $ 2,195,000 $ 200,000 30,000 230,000 $ 700,000 930,000 $ $ 100,000 655,000 510,000 $ 1,265,000 $ 2,195,000 KMB Statement of Retained Earnings For the Year Ending December 31, 2022 $ Beginning retained earnings, January 1 Plus: Net income $ 700,000 160,000 860,000 50,000 810,000 Less: Dividends Ending retained earnings, December 31 $ KMB Income Statement For the year ending December 31, 2022 $ 1,685,000 980,000 705,000 $ $ Revenues Cost of goods sold Gross profit Operating expenses Salaries Interest Depreciation Other operating expenses Income before income taxes Less: Income taxes Net income 245,000 65,000 40,000 155,000 $ 505,000 200,000 40,000 160,000 $ Ratio Analysis Industry Benchmarks Firm (2023) EPS $50.00 EPS Quick Ratio $ 3.00 Quick Ratio Current Ratio 4 Current Ratio Debt to Assets 0.5 Debt to Assets Debt to Equity 0.75 Debt to Equity Times interest Earned 3.5 Times interest Earned Book Value of Shares 400 Book Value of Shares Gross Profit 0.5 Gross Profit Net Profit 0.23 Net Profit Return on Assets 0.11 Return on Assets Return on Equity 0.18 Return on Equity Kayak Me Bruh is a Kayak and boat manufacuturer with a tightly knit group of share holders, it trades at 170 Dollars a share. Complete the needed calculations for the CAPEX analysis. 2021 $ 370,000 290,000 110,000 770,000 $ KMB Comparative Balance Sheet December 31, 2022 and 2021 Assets 2022 Current assets Cash S 1,500,000 Accounts receivable 350,000 Inventories 90,000 Total current assets S 1,940,000 Property, plant, & equipment Land S 200,000 Building 650,000 Equipment 950,000 $ 1,800,000 Less: Accumulated depreciation (365,000) Total property, plant, & equipment $ 1,435,000 Total assets S 3,375,000 Liabilities Current liabilities Accounts payable $ 160,000 Interest payable 350,000 Total current liabilities $ 510,000 Long-term liabilities Long-term note payable 1,300,000 Total liabilities $ 1,810,000 Stockholders' equity Common stock ($50 par) 2000 Shares outstanding $ 100,000 Paid-in capital in excess of par 655,000 Retained earnings 810,000 Total stockholders' equity $ 1,565,000 Total liabilities and equity S 3,375,000 $ 200,000 650,000 900,000 $ 1,750,000 (325,000) $ 1,425,000 $ 2,195,000 $ 200,000 30,000 230,000 $ 700,000 930,000 $ $ 100,000 655,000 510,000 $ 1,265,000 $ 2,195,000 KMB Statement of Retained Earnings For the Year Ending December 31, 2022 $ Beginning retained earnings, January 1 Plus: Net income $ 700,000 160,000 860,000 50,000 810,000 Less: Dividends Ending retained earnings, December 31 $ KMB Income Statement For the year ending December 31, 2022 $ 1,685,000 980,000 705,000 $ $ Revenues Cost of goods sold Gross profit Operating expenses Salaries Interest Depreciation Other operating expenses Income before income taxes Less: Income taxes Net income 245,000 65,000 40,000 155,000 $ 505,000 200,000 40,000 160,000 $ Ratio Analysis Industry Benchmarks Firm (2023) EPS $50.00 EPS Quick Ratio $ 3.00 Quick Ratio Current Ratio 4 Current Ratio Debt to Assets 0.5 Debt to Assets Debt to Equity 0.75 Debt to Equity Times interest Earned 3.5 Times interest Earned Book Value of Shares 400 Book Value of Shares Gross Profit 0.5 Gross Profit Net Profit 0.23 Net Profit Return on Assets 0.11 Return on Assets Return on Equity 0.18 Return on EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started