Answered step by step

Verified Expert Solution

Question

1 Approved Answer

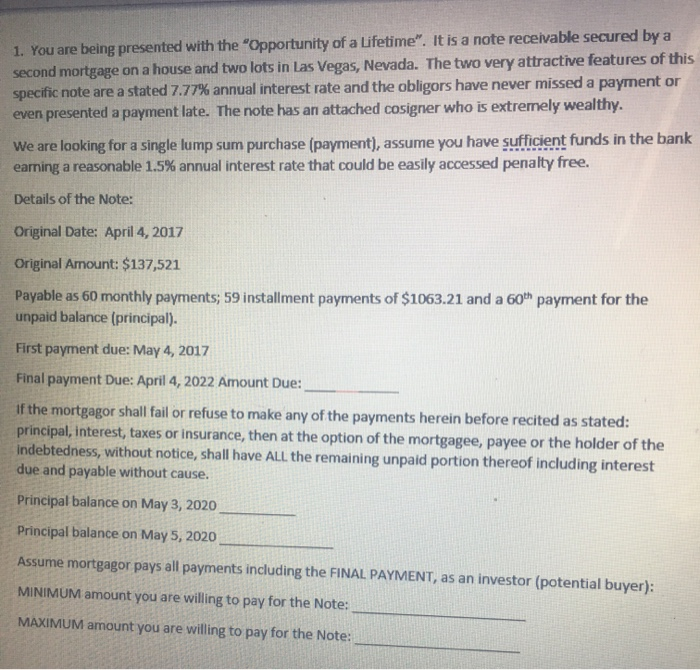

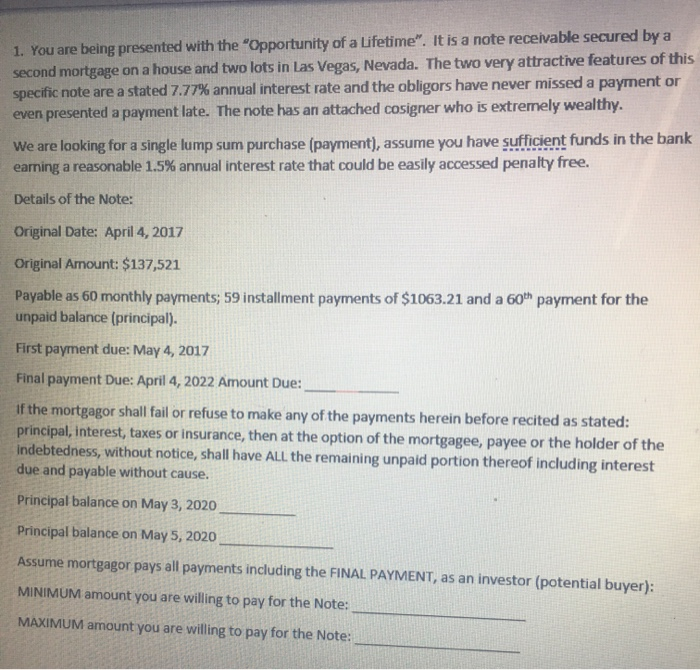

You are being presented with the opportunity of a lifetime. it is a note recievable secured by a second mortgage on a house and its

You are being presented with the opportunity of a lifetime. it is a note recievable secured by a second mortgage on a house and its two lots in Las Vegas, Nevada. the two very attractive features of this specific note are stated 7.77% annual interest rate and obligers have missed a payment or even presented a payment late. The note has an attached cosigner who is extremely wealthy.

1. You are being presented with the "Opportunity of a Lifetime". It is a note receivable secured by a second mortgage on a house and two lots in Las Vegas, Nevada. The two very attractive features of this specific note are a stated 7.77% annual interest rate and the obligors have never missed a payment or even presented a payment late. The note has an attached cosigner who is extremely wealthy. We are looking for a single lump sum purchase (payment), assume you have sufficient funds in the bank eaming a reasonable 1.5% annual interest rate that could be easily accessed penalty free. Details of the Note: Original Date: April 4, 2017 Original Amount: $137,521 Payable as 60 monthly payments; 59 installment payments of $1063.21 and a 60th payment for the unpaid balance (principal). First payment due: May 4, 2017 Final payment Due: April 4, 2022 Amount Due: If the mortgagor shall fail or refuse to make any of the payments herein before recited as stated: principal, interest, taxes or insurance, then at the option of the mortgagee, payee or the holder of the indebtedness, without notice, shall have ALL the remaining unpaid portion thereof including interest due and payable without cause. Principal balance on May 3, 2020 Principal balance on May 5, 2020 Assume mortgagor pays all payments including the FINAL PAYMENT, as an investor (potential buyer): MINIMUM amount you are willing to pay for the Note: MAXIMUM amount you are willing to pay for the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started