Answered step by step

Verified Expert Solution

Question

1 Approved Answer

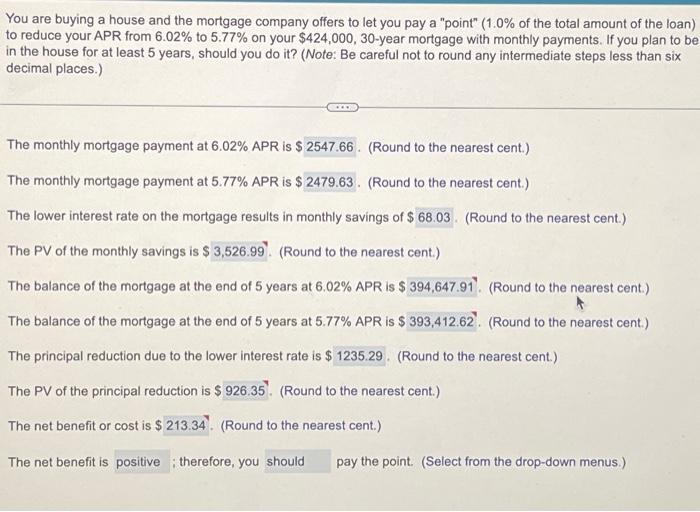

You are buying a house and the mortgage company offers to let you pay a point (1.0% of the total amount of the loan) to

You are buying a house and the mortgage company offers to let you pay a "point" (1.0% of the total amount of the loan) to reduce your APR from 6.02% to 5.77% on your $424,000, 30-year mortgage with monthly payments. If you plan to be in the house for at least 5 years, should you do it? (Note: Be careful not to round any intermediate steps less than six decimal places.) The monthly mortgage payment at 6.02% APR is $ 2547.66. (Round to the nearest cent.) The monthly mortgage payment at 5.77% APR is $ 2479.63. (Round to the nearest cent.) The lower interest rate on the mortgage results in monthly savings of $ 68.03. (Round to the nearest cent.) The PV of the monthly savings is $ 3,526.99. (Round to the nearest cent.) The balance of the mortgage at the end of 5 years at 6.02% APR is $394,647.91. (Round to the nearest cent.) The balance of the mortgage at the end of 5 years at 5.77% APR is $393,412.62. (Round to the nearest cent.) The principal reduction due to the lower interest rate is $1235.29. (Round to the nearest cent.) The PV of the principal reduction is $ 926.35. (Round to the nearest cent.) The net benefit or cost is $213.34. (Round to the nearest cent.) The net benefit is positive therefore, you should pay the point. (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started