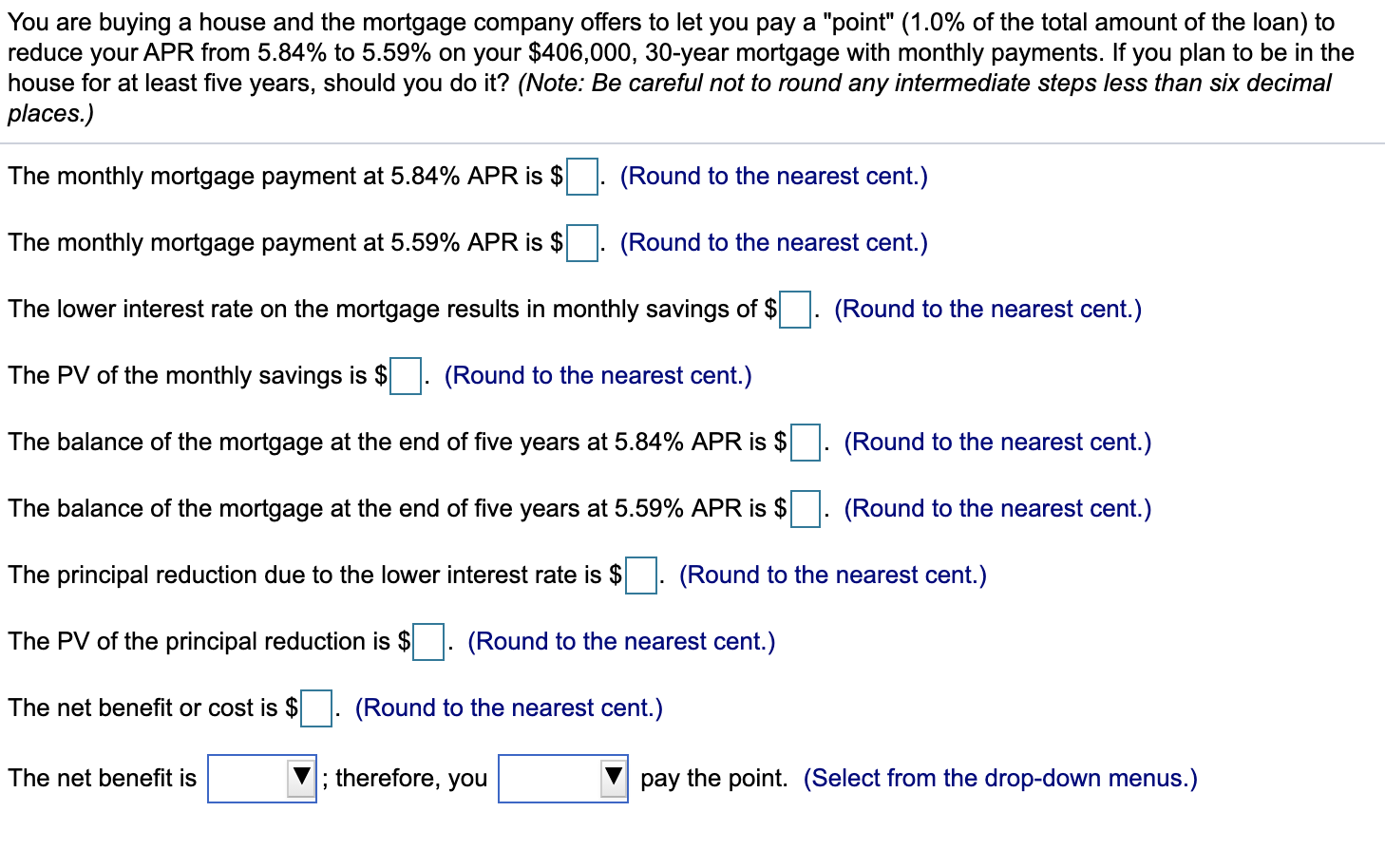

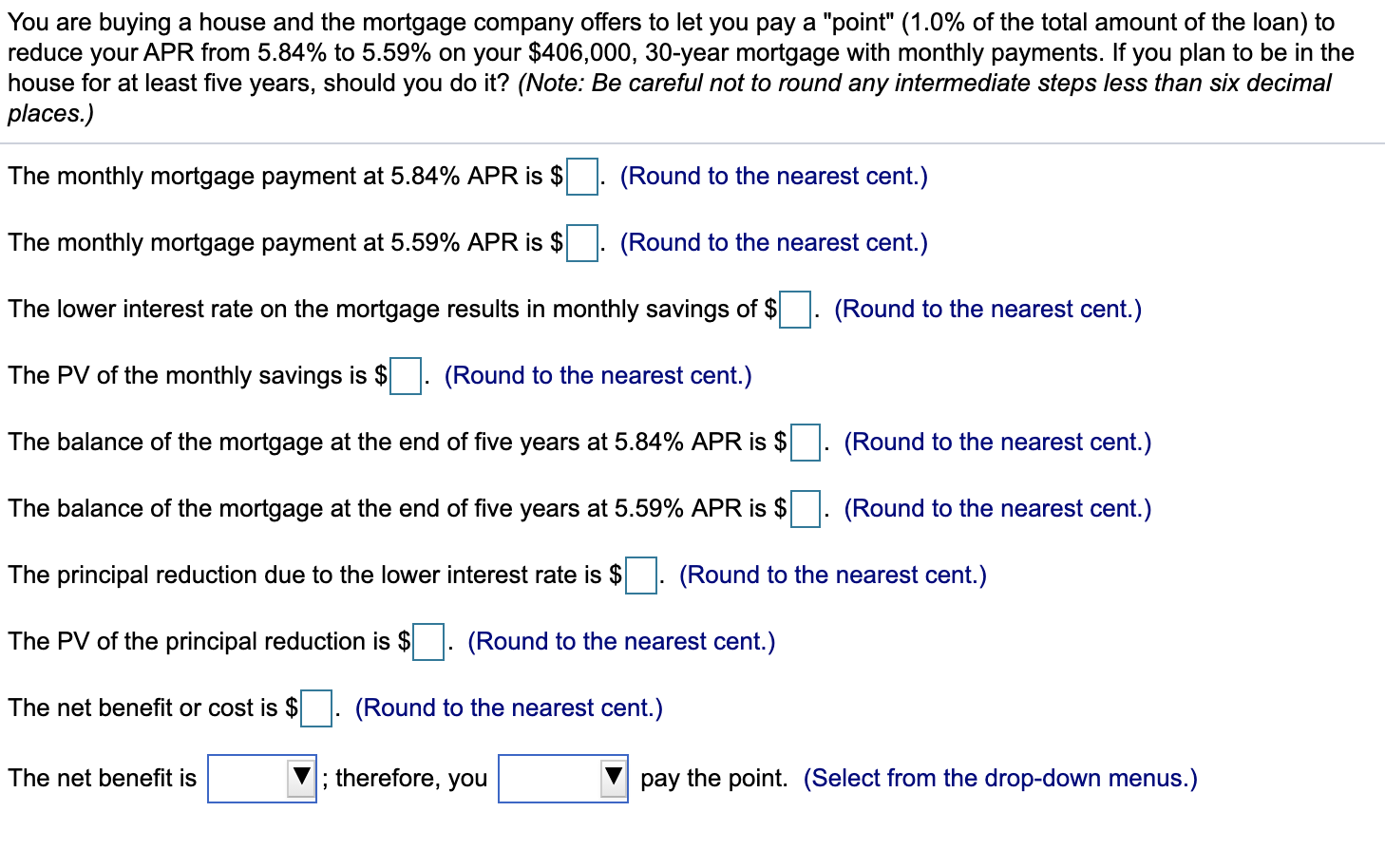

You are buying a house and the mortgage company offers to let you pay a "point" (1.0% of the total amount of the loan) to reduce your APR from 5.84% to 5.59% on your $406,000, 30-year mortgage with monthly payments. If you plan to be in the house for at least five years, should you do it? (Note: Be careful not to round any intermediate steps less than six decimal places.) The monthly mortgage payment at 5.84% APR is $ (Round to the nearest cent.) The monthly mortgage payment at 5.59% APR is $ (Round to the nearest cent.) The lower interest rate on the mortgage results in monthly savings of $| (Round to the nearest cent.) The PV of the monthly savings is $. (Round to the nearest cent.) The balance of the mortgage at the end of five years at 5.84% APR is $ (Round to the nearest cent.) The balance of the mortgage at the end of five years at 5.59% APR is $. (Round to the nearest cent.) The principal reduction due to the lower interest rate is $ (Round to the nearest cent.) The PV of the principal reduction is $ (Round to the nearest cent.) The net benefit or cost is $ (Round to the nearest cent.) The net benefit is ; therefore, you pay the point. (Select from the drop-down menus.) You are buying a house and the mortgage company offers to let you pay a "point" (1.0% of the total amount of the loan) to reduce your APR from 5.84% to 5.59% on your $406,000, 30-year mortgage with monthly payments. If you plan to be in the house for at least five years, should you do it? (Note: Be careful not to round any intermediate steps less than six decimal places.) The monthly mortgage payment at 5.84% APR is $ (Round to the nearest cent.) The monthly mortgage payment at 5.59% APR is $ (Round to the nearest cent.) The lower interest rate on the mortgage results in monthly savings of $| (Round to the nearest cent.) The PV of the monthly savings is $. (Round to the nearest cent.) The balance of the mortgage at the end of five years at 5.84% APR is $ (Round to the nearest cent.) The balance of the mortgage at the end of five years at 5.59% APR is $. (Round to the nearest cent.) The principal reduction due to the lower interest rate is $ (Round to the nearest cent.) The PV of the principal reduction is $ (Round to the nearest cent.) The net benefit or cost is $ (Round to the nearest cent.) The net benefit is ; therefore, you pay the point. (Select from the drop-down menus.)