Question

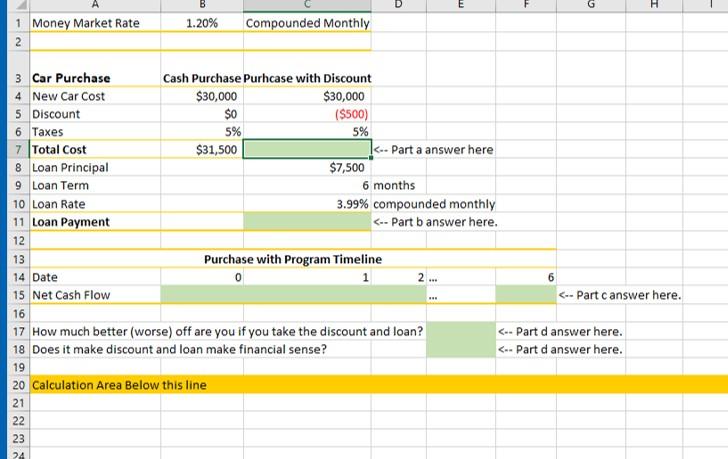

You are buying a new car for $30,000 plus 5% taxes for a total cost of $31,500. You can pay cash for the entire amount

You are buying a new car for $30,000 plus 5% taxes for a total cost of $31,500. You can pay cash for the entire amount by writing a check from your money market deposit account at the bank that currently pays 1.2%, compounded monthly.

Use the Excel File above to answer the following three questions showing your work and then upload your file to answer this question.

Part a: The finance manager says, I can discount the price an additional $500 if you participate in a special program we have. What is the total cost if you participate in the program (including the price, discount, and taxes on the discounted price)?

Part b: The finance manager says, All you have to do to qualify for the $500 discount is to finance a minimum of $7,500 at 3.99% compounded monthly. You also cannot pay off the loan for at least 6 months. How much would your loan payments be if you borrowed the minimum $7,500 and paid it off in equal installments over the next 6 months?

Part c: Make a timeline for buying the car for the discounted price and taking out the loan.

Part d: How much better or worse off are you today if you take the discount and the loan, making loan payments from your money market deposit account? Does the loan/discount deal make financial sense?

20 Calculation Area Below this line 20 Calculation Area Below this lineStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started