Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are buying a property and are considering taking out a 5% loan amortizing at a 30 -year rate with monthly payments. Your first evaluation

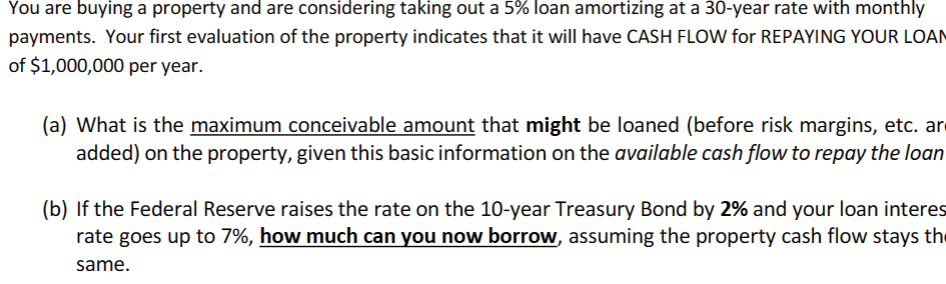

You are buying a property and are considering taking out a 5% loan amortizing at a 30 -year rate with monthly payments. Your first evaluation of the property indicates that it will have CASH FLOW for REPAYING YOUR LOAI of $1,000,000 per year. (a) What is the maximum conceivable amount that might be loaned (before risk margins, etc. ar added) on the property, given this basic information on the available cash flow to repay the loan (b) If the Federal Reserve raises the rate on the 10 -year Treasury Bond by 2% and your loan intere rate goes up to 7%, how much can you now borrow, assuming the property cash flow stays th same

You are buying a property and are considering taking out a 5% loan amortizing at a 30 -year rate with monthly payments. Your first evaluation of the property indicates that it will have CASH FLOW for REPAYING YOUR LOAI of $1,000,000 per year. (a) What is the maximum conceivable amount that might be loaned (before risk margins, etc. ar added) on the property, given this basic information on the available cash flow to repay the loan (b) If the Federal Reserve raises the rate on the 10 -year Treasury Bond by 2% and your loan intere rate goes up to 7%, how much can you now borrow, assuming the property cash flow stays th same Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started