Answered step by step

Verified Expert Solution

Question

1 Approved Answer

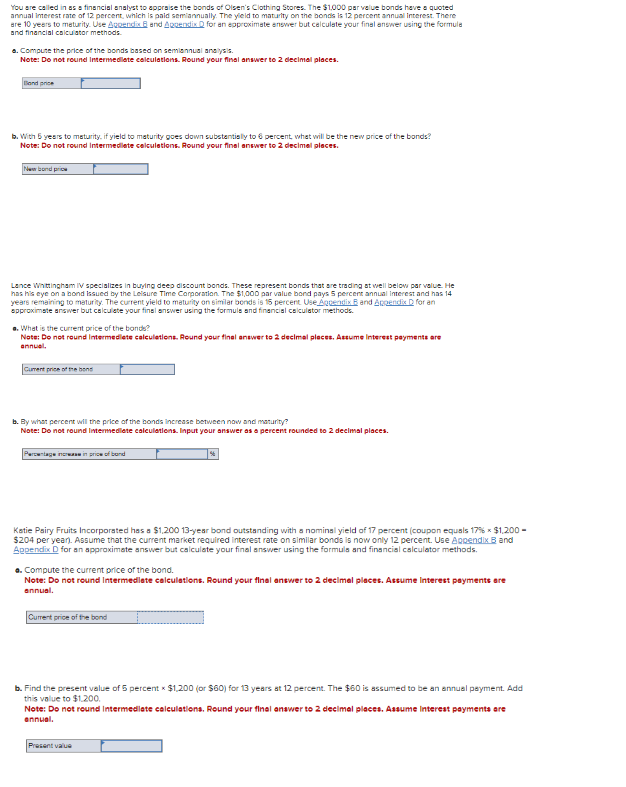

You are caled in as a finsucisl snalyst to appraise the bonds of Olsen's Clothng Stores. The $ 1 , 0 0 0 par value

You are caled in as a finsucisl snalyst to appraise the bonds of Olsen's Clothng Stores. The $ par value bonds have a quoted

annual imerest rate of percent, which is paid sem'annually. The yeld to matuity on the bonds is percent annusil interest. There

are yesrs to maturity. Use Bopendix B and Acoendix D for an eppoximate answer but calculste your final answer using the formula

and financial calcuator methods.

Compure the price of the bonds based on semiannul andizls.

Note: Do not reund Intermedlate calculations. Round your final answer to decimal places.

Band price

b With yeses to maturity, if yield to maturity goes dawn substentisly to percent, what will be the new price of the bonds?

Note: Do not rownd Intermedilete celculations. Round your finsl answer to decimel pleces.

Thew bend price

Lance Whttingham IV specializes in buying deep discount bonds. These represent bonds that are trading ot well below par velue. He

has his eye on a bond issued by the Leisure Time Corporation. The $ par value bond pays percent annual interest and has

spproximste answer but calculate your final snswer using the formuls snd financial calculator methods.

a What is the current price of the bonds?

Nate; Do not round Intermed ete caleuletions. Round your final anawer to decimal pleces, Astume Intersst payments are

annuel,

Cument price of the bons

b By what percent will the price of the bonds incresse between now and maturity?

Note: Do net round lintermed ete caleulations. Input your answef as a percent rounded to deelmal places.

Pertetage inerease in price of bund

Katie Psiry Fruits Incorporated has a $year bond outstanding with nominal yield of percent coupon equsls times $

$ per yean Assume that the current market required interest rate on similar bonds is now only percent. Use Apoendix and

Appendix for an appraximate answer but calculate your final answer using the formula and finsmcial calculator methods.

a Compute the current price of the bond.

Note: Do not reund Intermedlate caleulatlons. Round your flnal answer to decimal places. Astume Interest payments are

annual.

Currert price of the bond

b Find the present value of percent $or $ for years at percent. The $ is sssumed to be an annual payment. Add

this value to $

Note: Do not round Intermedlate caleulations. Round your flnol onswer to declmal places. Assume interest payments are

ennual.

Present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started