Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are called by Tim Duncan of Pearl Co. on July 16 and asked to prepare a claim for insurance as a result of a

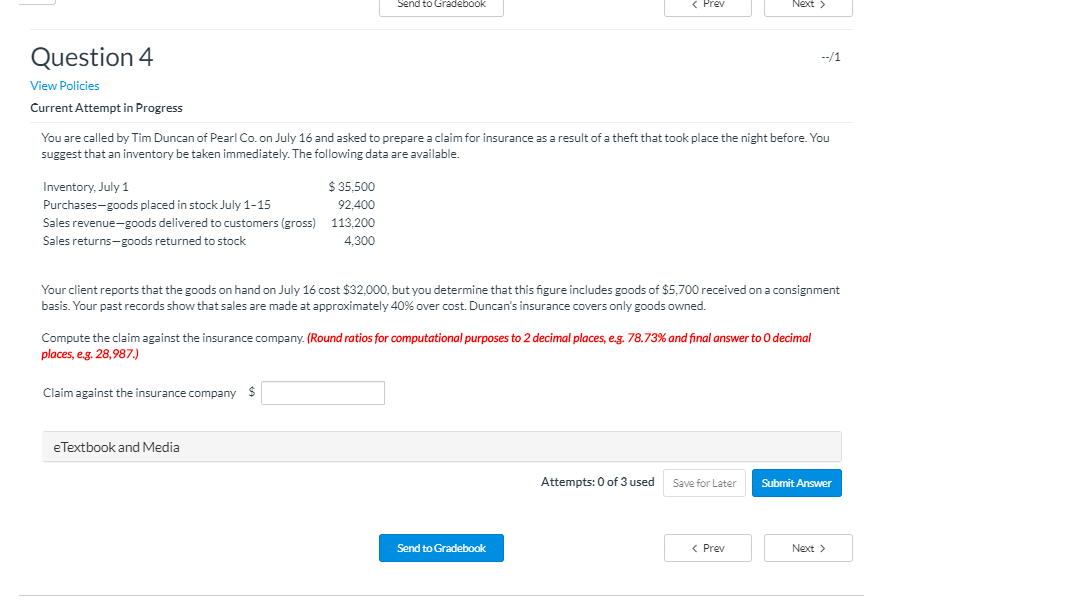

You are called by Tim Duncan of Pearl Co. on July 16 and asked to prepare a claim for insurance as a result of a theft that took place the night before. You suggest that an inventory be taken immediately. The following data are available.

| Inventory, July 1 | $ 35,500 | |

| Purchasesgoods placed in stock July 115 | 92,400 | |

| Sales revenuegoods delivered to customers (gross) | 113,200 | |

| Sales returnsgoods returned to stock | 4,300 |

Your client reports that the goods on hand on July 16 cost $32,000, but you determine that this figure includes goods of $5,700 received on a consignment basis. Your past records show that sales are made at approximately 40% over cost. Duncans insurance covers only goods owned.

Send to Gradebook --/1 Question 4 View Policies Current Attempt in Progress You are called by Tim Duncan of Pearl Co. on July 16 and asked to prepare a claim for insurance as a result of a theft that took place the night before. You suggest that an inventory be taken immediately. The following data are available. Inventory, July 1 Purchases-goods placed in stock July 1-15 Sales revenue-goods delivered to customers (gross) Sales returns-goods returned to stock $ 35.500 92,400 113,200 4,300 Your client reports that the goods on hand on July 16 cost $32,000, but you determine that this figure includes goods of $5,700 received on a consignment basis. Your past records show that sales are made at approximately 40% over cost. Duncan's insurance covers only goods owned. Compute the claim against the insurance company. (Round ratios for computational purposes to 2 decimal places, e.g. 78.73% and final answer to O decimal places, eg. 28,987.) Claim against the insurance company $ e Textbook and Media Attempts: 0 of 3 used Save for Later Submit Answer Send to GradebookStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started