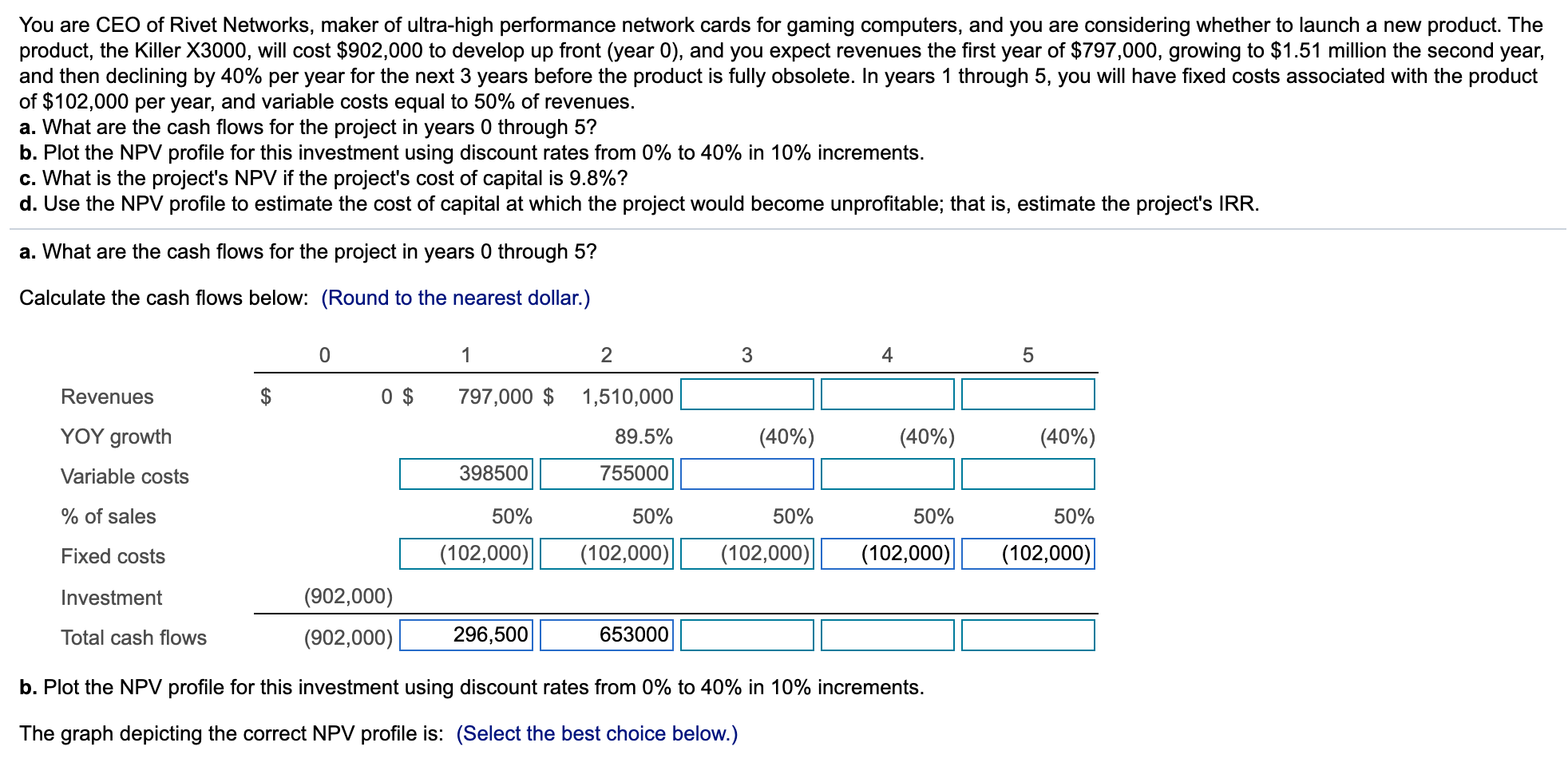

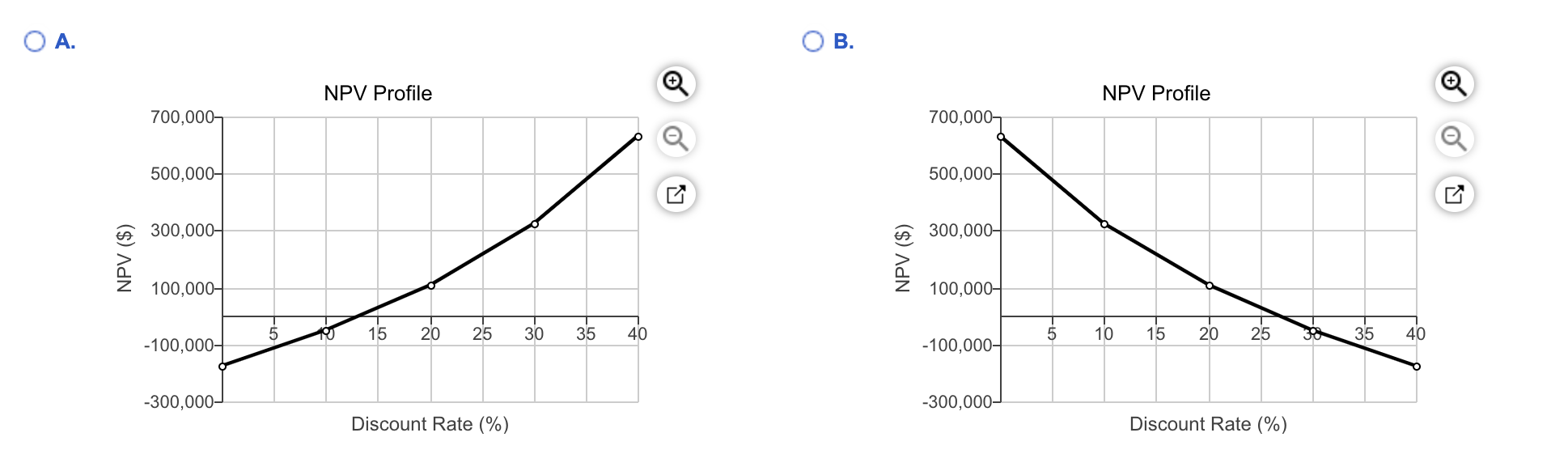

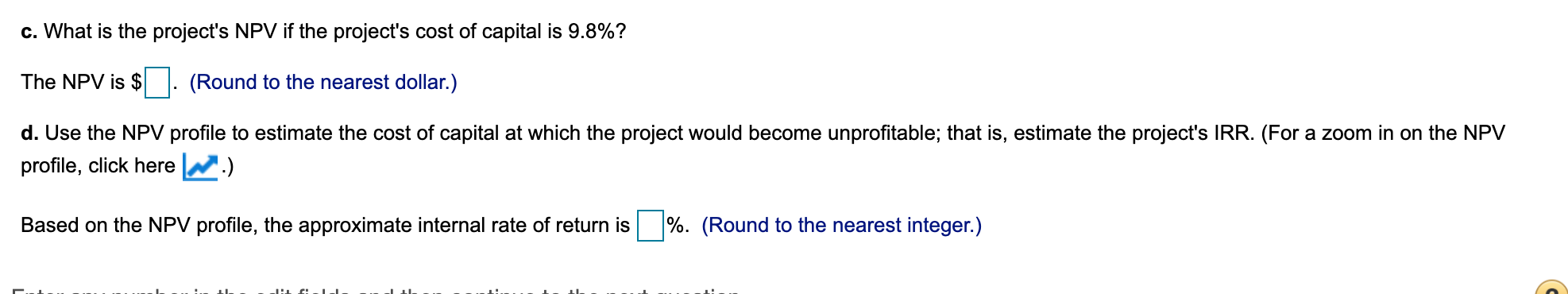

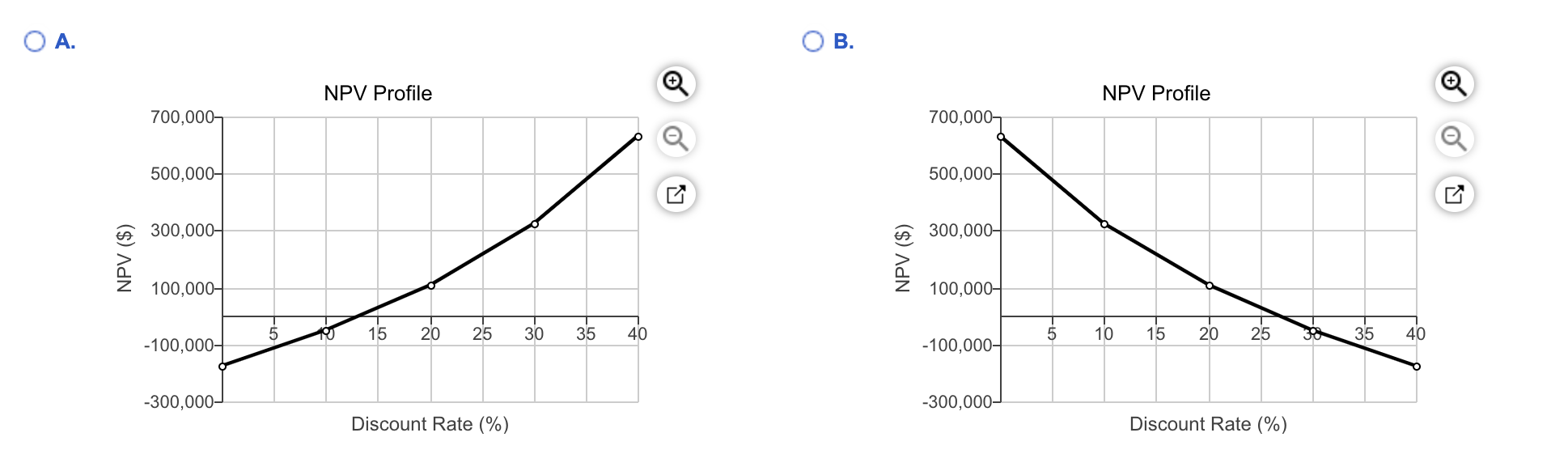

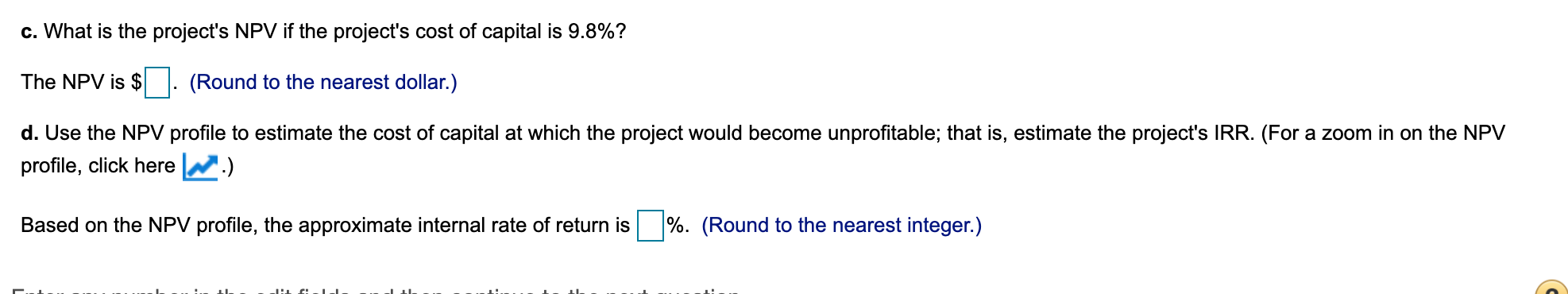

You are CEO of Rivet Networks, maker of ultra-high performance network cards for gaming computers, and you are considering whether to launch a new product. The product, the Killer X3000, will cost $902,000 to develop up front (year 0), and you expect revenues the first year of $797,000, growing to $1.51 million the second year, and then declining by 40% per year for the next 3 years before the product is fully obsolete. In years 1 through 5, you will have fixed costs associated with the product of $102,000 per year, and variable costs equal to 50% of revenues. a. What are the cash flows for the project in years 0 through 5? b. Plot the NPV profile for this investment using discount rates from 0% to 40% in 10% increments. c. What is the project's NPV if the project's cost of capital is 9.8%? d. Use the NPV profile to estimate the cost of capital at which the project would become unprofitable; that is, estimate the project's IRR. a. What are the cash flows for the project in years 0 through 5? Calculate the cash flows below: (Round to the nearest dollar.) 0 1 2 3 4 5 Revenues 0 $ 797,000 $ 1,510,000 89.5% (40%) (40%) (40%) YOY growth Variable costs % of sales 398500 755000 50% 50% 50% 50% 50% Fixed costs (102,000)| (102,000) (102,000) (102,000) (102,000) Investment (902,000) (902,000) Total cash flows 296,500 653000 b. Plot the NPV profile for this investment using discount rates from 0% to 40% in 10% increments. The graph depicting the correct NPV profile is: (Select the best choice below.) O A. B. NPV Profile NPV Profile 700,000 700,0007 500,000- 500,000 300,000 300,000 NPV ($) NPV ($) 100,000 100,000 5 10 15 20 25 30 35 40 5 10 15 20 25 38 35 40 -100,000 -100,000 -300,000- -300,000- Discount Rate (%) Discount Rate (%) c. What is the project's NPV if the project's cost of capital is 9.8%? The NPV is $ (Round to the nearest dollar.) d. Use the NPV profile to estimate the cost of capital at which the project would become unprofitable; that is, estimate the project's IRR. (For a zoom in on the NPV profile, click here ..) Based on the NPV profile, the approximate internal rate of return is %. (Round to the nearest integer.)