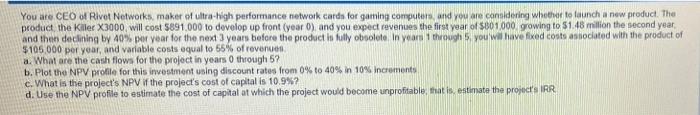

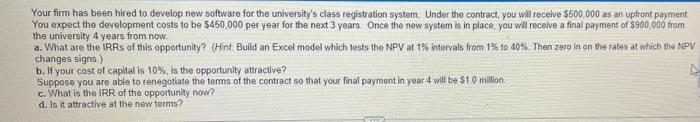

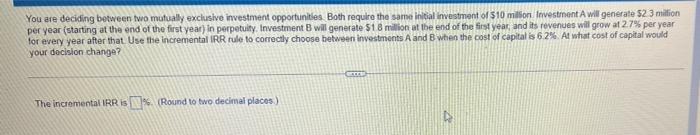

You are CEO of Rivot Networks, maker of ultra-high performance network cards for gaming computer and you are considering whether to launch a new product. The product the killer X3000 will cost $891,000 to develop up front (year 0), and you expect revenues the first year of $801.000 growing to $1.48 million the second year and then declining by 40% per year for the nexd 3 years before the product is fully obsolete in year through you will have fixed costs associated with the product of $105.000 per year, and variable costs equal to 55% of revenues a. What are the cash flows for the project in years through 5? b. Plot the NPV profile for this investment using discount rates from 0% to 40% in 10% Increments c. What is the project's NPV If the project's cost of capital is 10.9%? d. Use the NPV profile to estimate the cost of capital at which the project would become unprofitable that is estimate the project's RR Your firm has been hired to develop new software for the university's class registration system Under the contract, you will receive 5500 000 as an upfront payment You expect the development costs to be $450,000 per year for the next 3 years. Once the new system is in place, you wil receive a final payment of S900,000 from the university 4 years from now. a. What are the IRRs of this opportunity? (Hint Build an Excel model which bosts the NPV at 1% intervals from 1% to 40% Then zero in on the rates at which the NPV changes signs b. If your cost of capital is 10%, is the opportunity attractive? Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $10 million c. What is the IRR of the opportunity now? d. Is it attractive at the new terms? You are deciding between two mutually exclusive investment opportunities Both require the same initial investment of $10 million Investment will generate 52 3 milion per year (starting at the end of the first year) in perpetuity Investment B will generate $18 million at the end of the first year, and its revenues will grow at 27% per year for every year after that. Use the incremental IRR rule to correctly choose between investments A and B when the cost of capital is 62%. At what cost of capital would your decision change? The incremental IRR IS N% (Round to two decimal places)