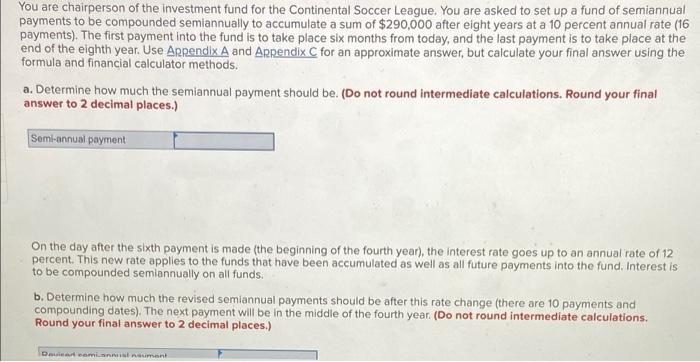

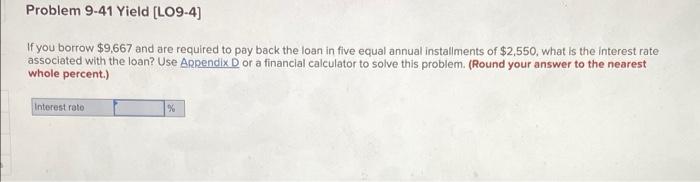

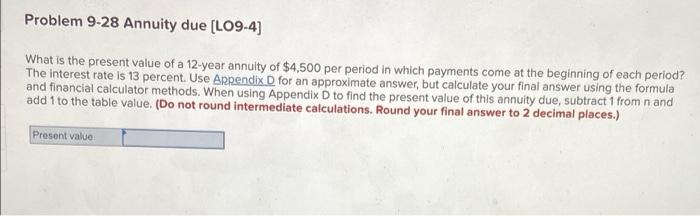

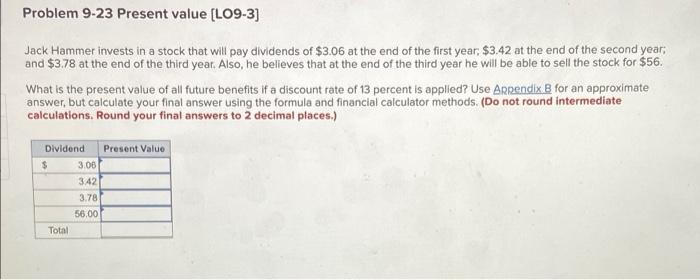

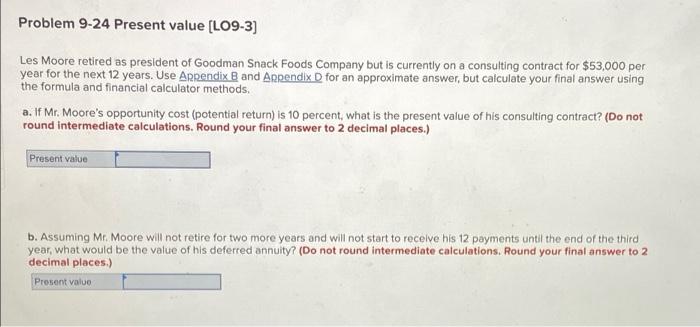

You are chairperson of the investment fund for the Continental Soccer League. You are asked to set up a fund of semiannual payments to be compounded semiannually to accumulate a sum of $290,000 after eight years at a 10 percent annual rate (16 payments). The first payment into the fund is to take place six months from today, and the last payment is to take place at the end of the eighth year. Use Appendix A and Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. Determine how much the semiannual payment should be. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Semi-annual payment On the day after the sixth payment is made (the beginning of the fourth year), the interest rate goes up to an annual rate of 12 percent. This new rate applies to the funds that have been accumulated as well as all future payments into the fund. Interest is to be compounded semiannually on all funds. b. Determine how much the revised semiannual payments should be after this rate change (there are 10 payments and compounding dates). The next payment will be in the middle of the fourth year. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Davisar comi.annisl naumant Problem 9-41 Yield [LO9-4] If you borrow $9,667 and are required to pay back the loan in five equal annual installments of $2,550, what is the interest rate associated with the loan? Use Appendix D or a financial calculator to solve this problem. (Round your answer to the nearest whole percent.) Interest rate Problem 9-28 Annuity due [LO9-4] What is the present value of a 12-year annuity of $4,500 per period in which payments come at the beginning of each period? The interest rate is 13 percent. Use Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. When using Appendix D to find the present value of this annuity due, subtract 1 from n and add 1 to the table value. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value Problem 9-23 Present value [LO9-3] Jack Hammer invests in a stock that will pay dividends of $3.06 at the end of the first year, $3.42 at the end of the second year; and $3.78 at the end of the third year. Also, he believes that at the end of the third year he will be able to sell the stock for $56. What is the present value of all future benefits if a discount rate of 13 percent is applied? Use Appendix B for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Dividend Present Value $ 3.06 3.42 3.78 56.00 Total Problem 9-24 Present value [LO9-3] Les Moore retired as president of Goodman Snack Foods Company but is currently on a consulting contract for $53,000 per year for the next 12 years. Use Appendix B and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. If Mr. Moore's opportunity cost (potential return) is 10 percent, what is the present value of his consulting contract? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value b. Assuming Mr. Moore will not retire for two more years and will not start to receive his 12 payments until the end of the third year, what would be the value of his deferred annuity? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value