Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are conducting an analysis of a technology company called PlioTech. You have reviewed the last 5 years of financial reports for PlioTech, and

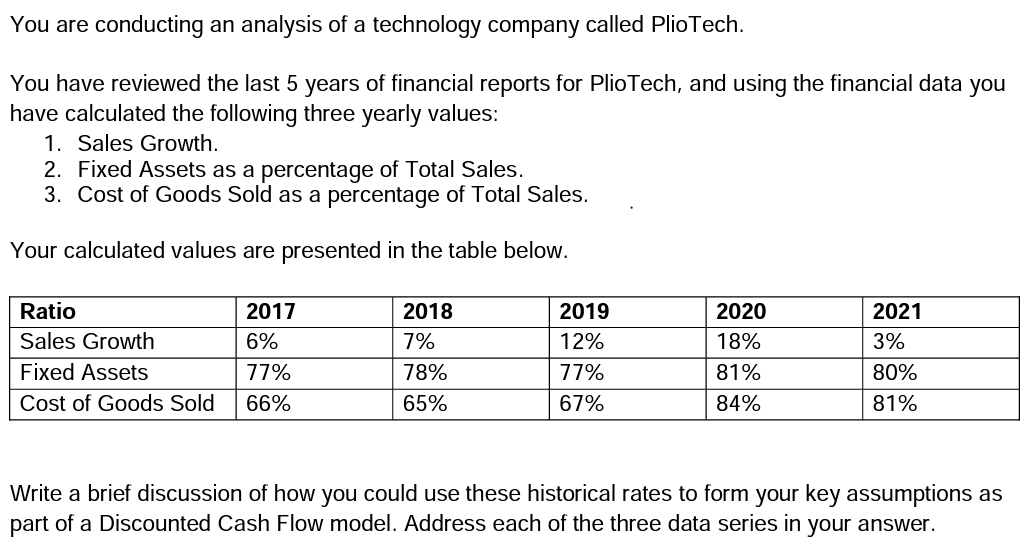

You are conducting an analysis of a technology company called PlioTech. You have reviewed the last 5 years of financial reports for PlioTech, and using the financial data you have calculated the following three yearly values: 1. Sales Growth. 2. Fixed Assets as a percentage of Total Sales. 3. Cost of Goods Sold as a percentage of Total Sales. Your calculated values are presented in the table below. Ratio 2017 2018 2019 2020 2021 Sales Growth 6% 7% 12% 18% 3% Fixed Assets 77% 78% 77% 81% 80% Cost of Goods Sold 66% 65% 67% 84% 81% Write a brief discussion of how you could use these historical rates to form your key assumptions as part of a Discounted Cash Flow model. Address each of the three data series in your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To form key assumptions for a Discounted Cash Flow DCF model using the historical rates provided for PlioTech we can analyze each of the three data series Sales Growth Fixed Assets as a percentage of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664313f88da17_952510.pdf

180 KBs PDF File

664313f88da17_952510.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started