Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering an investment in a Third World bank account that pays a monthly rate of 1.5%, compounded monthly. If you invest $5,000 at

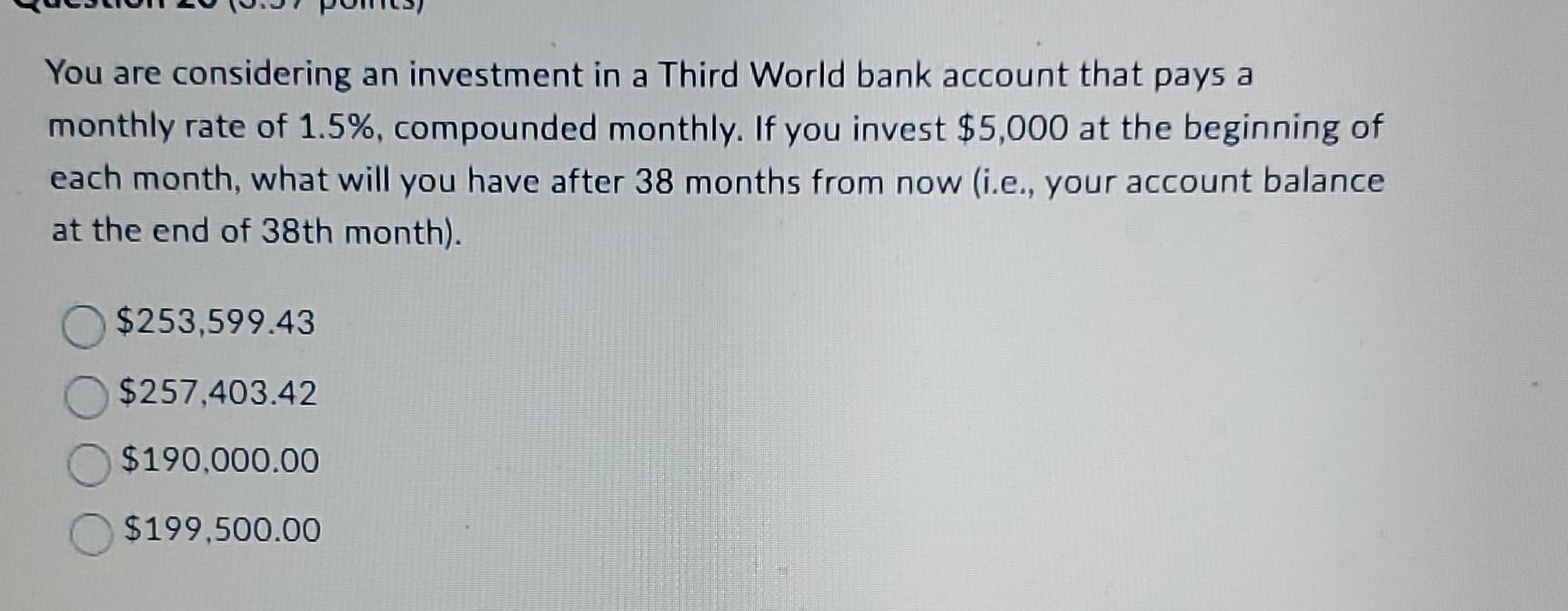

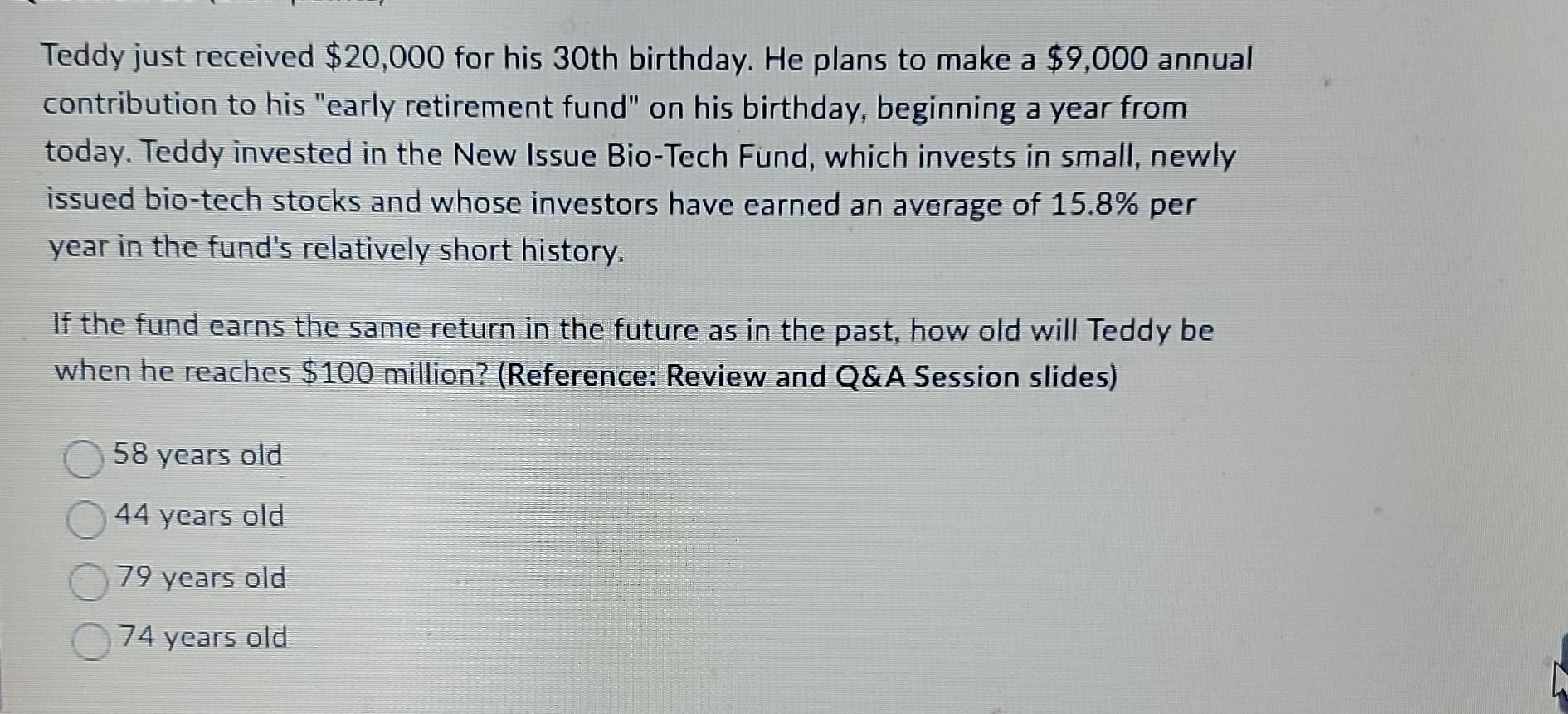

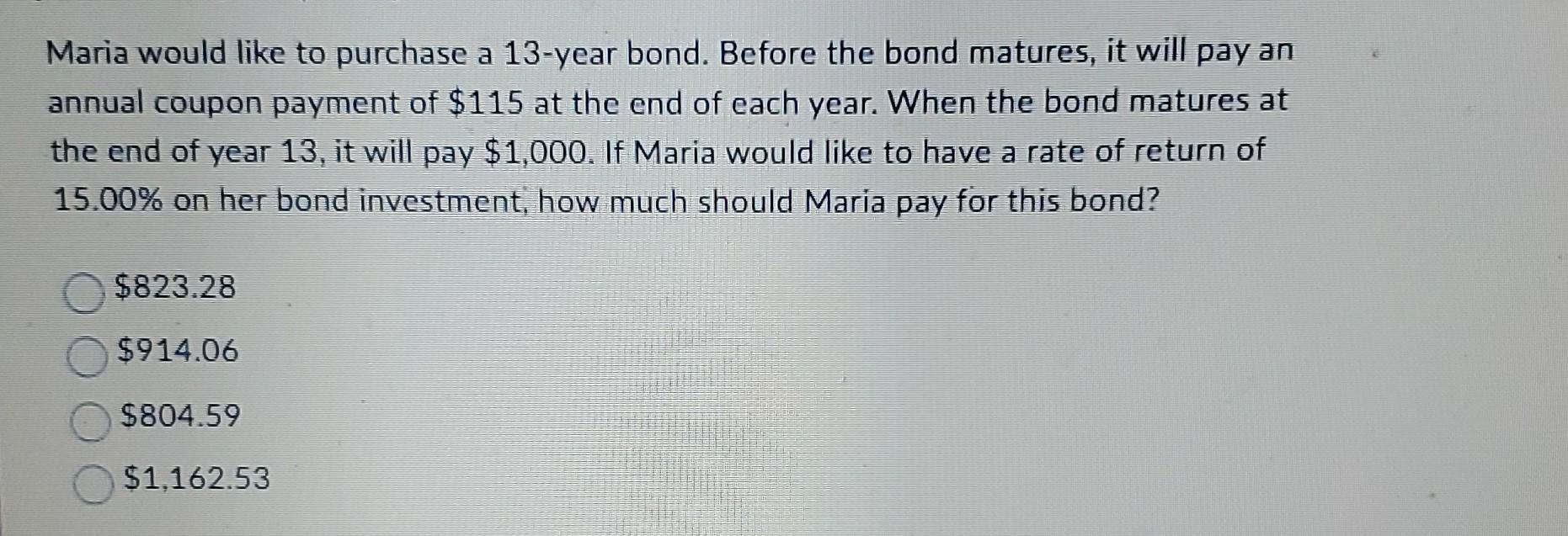

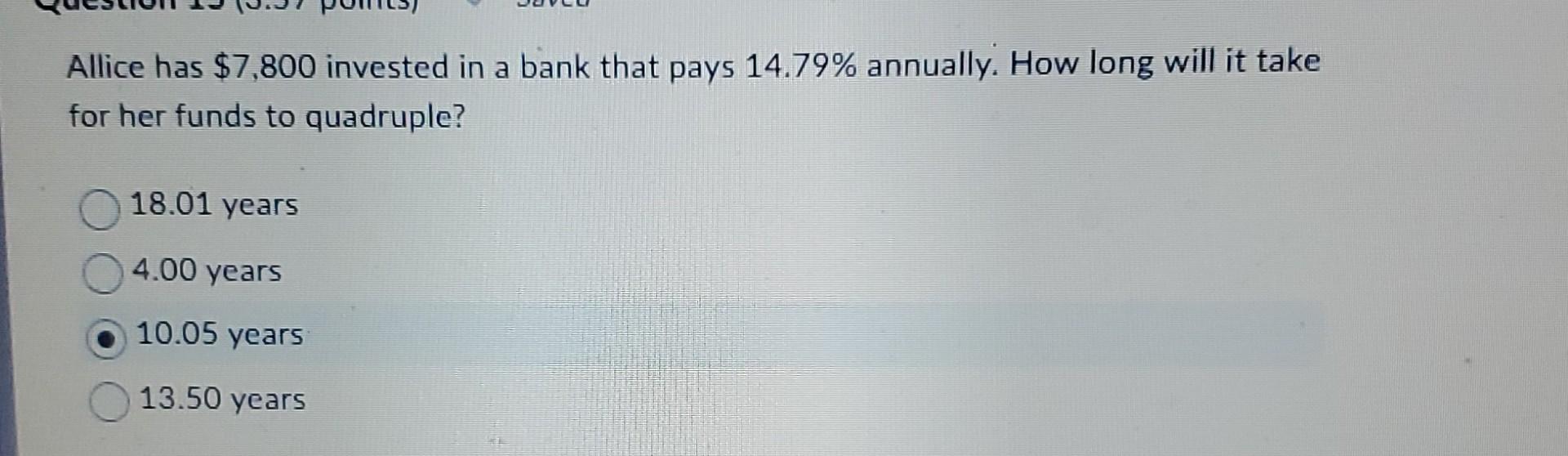

You are considering an investment in a Third World bank account that pays a monthly rate of 1.5%, compounded monthly. If you invest $5,000 at the beginning of each month, what will you have after 38 months from now (i.e., your account balance at the end of 38 th month). $253,599.43 $257,403.42 $190,000.00 $199,500.00 Teddy just received $20,000 for his 30 th birthday. He plans to make a $9,000 annual contribution to his "early retirement fund" on his birthday, beginning a year from today. Teddy invested in the New Issue Bio-Tech Fund, which invests in small, newly issued bio-tech stocks and whose investors have earned an average of 15.8% per year in the fund's relatively short history. If the fund earns the same return in the future as in the past, how old will Teddy be when he reaches $100 million? (Reference: Review and Q\&A Session slides) 58 years old 44 years old 79 years old 74 years old Maria would like to purchase a 13 -year bond. Before the bond matures, it will pay an annual coupon payment of $115 at the end of each year. When the bond matures at the end of year 13 , it will pay $1,000. If Maria would like to have a rate of return of 15.00% on her bond investment, how much should Maria pay for this bond? $823.28 $914.06 $804.59 $1,162.53 Allice has $7,800 invested in a bank that pays 14.79% annually. How long will it take for her funds to quadruple? 18.01 years 4.00 years 10.05 years 13.50 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started