Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering investing in a gold mining venture. The price of gold is currently $2,000 per oz. The mine will have a life of

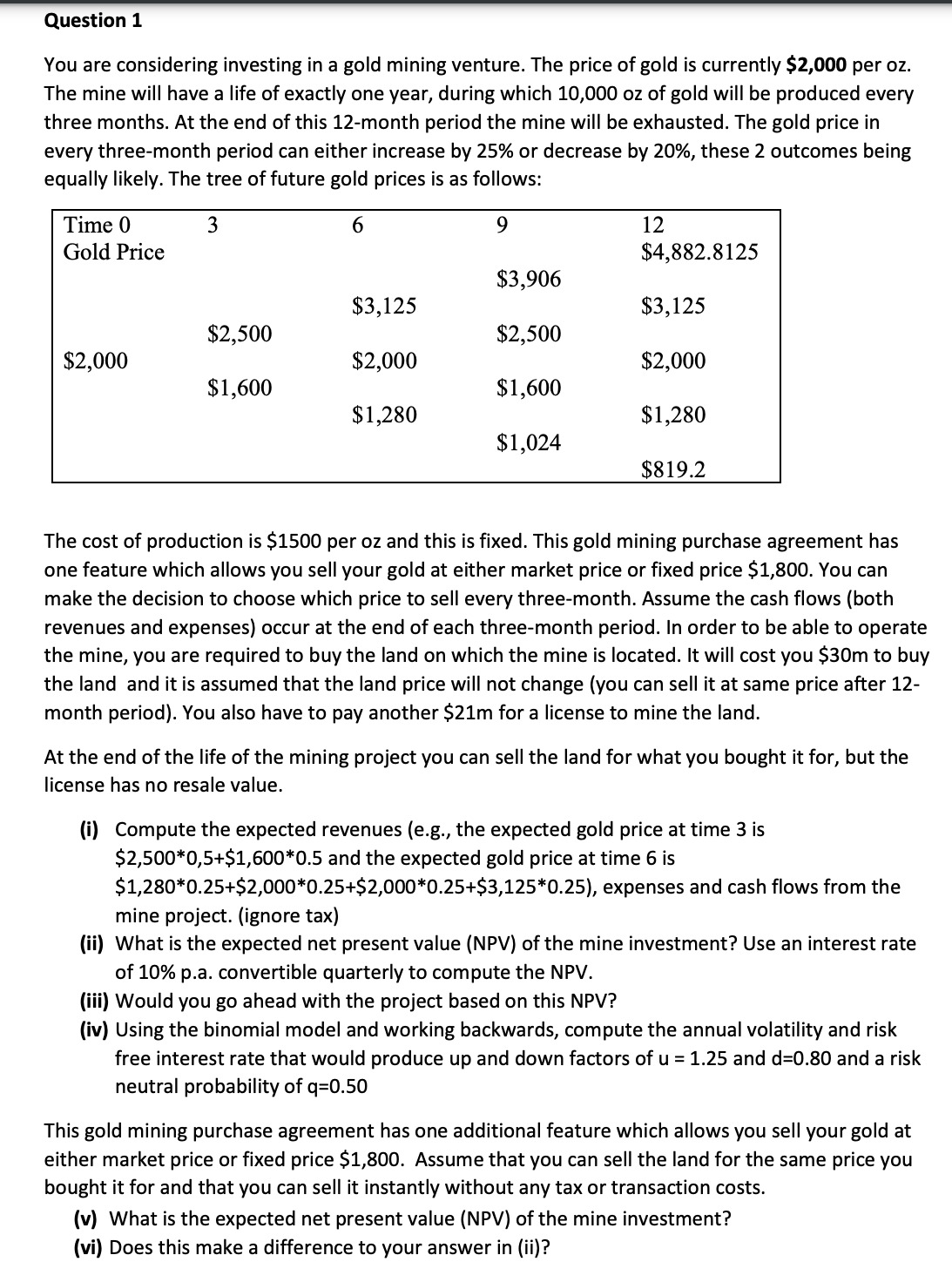

You are considering investing in a gold mining venture. The price of gold is currently $2,000 per oz. The mine will have a life of exactly one year, during which 10,000 oz of gold will be produced every three months. At the end of this 12-month period the mine will be exhausted. The gold price in every three-month period can either increase by 25% or decrease by 20%, these 2 outcomes being equally likely. The tree of future gold prices is as follows: The cost of production is $1500 per oz and this is fixed. This gold mining purchase agreement has one feature which allows you sell your gold at either market price or fixed price $1,800. You can make the decision to choose which price to sell every three-month. Assume the cash flows (both revenues and expenses) occur at the end of each three-month period. In order to be able to operate the mine, you are required to buy the land on which the mine is located. It will cost you $30m to buy the land and it is assumed that the land price will not change (you can sell it at same price after 12month period). You also have to pay another $21m for a license to mine the land. At the end of the life of the mining project you can sell the land for what you bought it for, but the license has no resale value. (i) Compute the expected revenues (e.g., the expected gold price at time 3 is $2,5000,5+$1,6000.5 and the expected gold price at time 6 is $1,2800.25+$2,0000.25+$2,0000.25+$3,1250.25), expenses and cash flows from the mine project. (ignore tax) (ii) What is the expected net present value (NPV) of the mine investment? Use an interest rate of 10% p.a. convertible quarterly to compute the NPV. (iii) Would you go ahead with the project based on this NPV? (iv) Using the binomial model and working backwards, compute the annual volatility and risk free interest rate that would produce up and down factors of u=1.25 and d=0.80 and a risk neutral probability of q=0.50 This gold mining purchase agreement has one additional feature which allows you sell your gold at either market price or fixed price $1,800. Assume that you can sell the land for the same price you bought it for and that you can sell it instantly without any tax or transaction costs. (v) What is the expected net present value (NPV) of the mine investment? (vi) Does this make a difference to your answer in (ii)

You are considering investing in a gold mining venture. The price of gold is currently $2,000 per oz. The mine will have a life of exactly one year, during which 10,000 oz of gold will be produced every three months. At the end of this 12-month period the mine will be exhausted. The gold price in every three-month period can either increase by 25% or decrease by 20%, these 2 outcomes being equally likely. The tree of future gold prices is as follows: The cost of production is $1500 per oz and this is fixed. This gold mining purchase agreement has one feature which allows you sell your gold at either market price or fixed price $1,800. You can make the decision to choose which price to sell every three-month. Assume the cash flows (both revenues and expenses) occur at the end of each three-month period. In order to be able to operate the mine, you are required to buy the land on which the mine is located. It will cost you $30m to buy the land and it is assumed that the land price will not change (you can sell it at same price after 12month period). You also have to pay another $21m for a license to mine the land. At the end of the life of the mining project you can sell the land for what you bought it for, but the license has no resale value. (i) Compute the expected revenues (e.g., the expected gold price at time 3 is $2,5000,5+$1,6000.5 and the expected gold price at time 6 is $1,2800.25+$2,0000.25+$2,0000.25+$3,1250.25), expenses and cash flows from the mine project. (ignore tax) (ii) What is the expected net present value (NPV) of the mine investment? Use an interest rate of 10% p.a. convertible quarterly to compute the NPV. (iii) Would you go ahead with the project based on this NPV? (iv) Using the binomial model and working backwards, compute the annual volatility and risk free interest rate that would produce up and down factors of u=1.25 and d=0.80 and a risk neutral probability of q=0.50 This gold mining purchase agreement has one additional feature which allows you sell your gold at either market price or fixed price $1,800. Assume that you can sell the land for the same price you bought it for and that you can sell it instantly without any tax or transaction costs. (v) What is the expected net present value (NPV) of the mine investment? (vi) Does this make a difference to your answer in (ii) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started