Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering investing in a new airline, known as the Western Australia Airlines (WAA) when the airline is listed in the Australian Stock

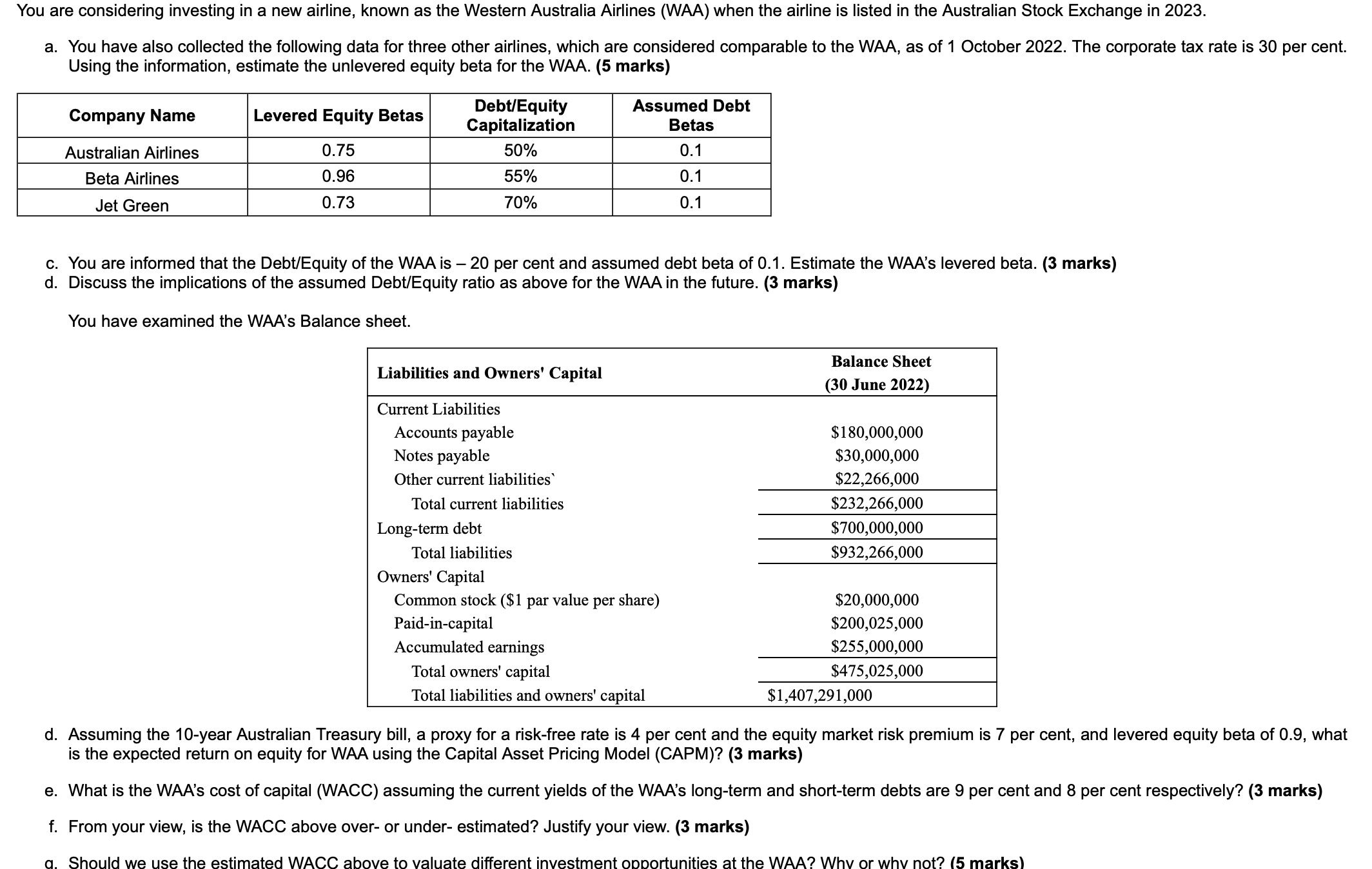

You are considering investing in a new airline, known as the Western Australia Airlines (WAA) when the airline is listed in the Australian Stock Exchange in 2023. a. You have also collected the following data for three other airlines, which are considered comparable to the WAA, as of 1 October 2022. The corporate tax rate is 30 per cent. Using the information, estimate the unlevered equity beta for the WAA. (5 marks) Company Name Levered Equity Betas 0.75 Australian Airlines Beta Airlines Jet Green 0.96 0.73 Debt/Equity Capitalization Assumed Debt Betas 50% 0.1 55% 70% 0.1 0.1 c. You are informed that the Debt/Equity of the WAA is - 20 per cent and assumed debt beta of 0.1. Estimate the WAA's levered beta. (3 marks) d. Discuss the implications of the assumed Debt/Equity ratio as above for the WAA in the future. (3 marks) You have examined the WAA's Balance sheet. Liabilities and Owners' Capital Current Liabilities Accounts payable Notes payable Other current liabilities' Balance Sheet (30 June 2022) $180,000,000 $30,000,000 $22,266,000 Total current liabilities $232,266,000 Long-term debt $700,000,000 Total liabilities $932,266,000 Common stock ($1 par value per share) $20,000,000 $200,025,000 $255,000,000 $475,025,000 Owners' Capital Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital $1,407,291,000 d. Assuming the 10-year Australian Treasury bill, a proxy for a risk-free rate is 4 per cent and the equity market risk premium is 7 per cent, and levered equity beta of 0.9, what is the expected return on equity for WAA using the Capital Asset Pricing Model (CAPM)? (3 marks) e. What is the WAA's cost of capital (WACC) assuming the current yields of the WAA's long-term and short-term debts are 9 per cent and 8 per cent respectively? (3 marks) f. From your view, is the WACC above over- or under- estimated? Justify your view. (3 marks) a. Should we use the estimated WACC above to valuate different investment opportunities at the WAA? Why or why not? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started