Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering investing in a new machine for your processing ant. The purchase price of the machine is $275,000. You will borrow the

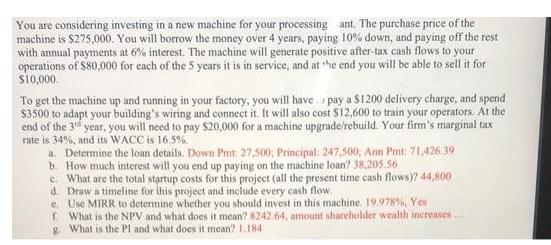

You are considering investing in a new machine for your processing ant. The purchase price of the machine is $275,000. You will borrow the money over 4 years, paying 10% down, and paying off the rest with annual payments at 6% interest. The machine will generate positive after-tax cash flows to your operations of $80,000 for each of the 5 years it is in service, and at the end you will be able to sell it for $10,000. To get the machine up and running in your factory, you will have pay a $1200 delivery charge, and spend $3500 to adapt your building's wiring and connect it. It will also cost $12,600 to train your operators. At the end of the 3rd year, you will need to pay $20,000 for a machine upgrade/rebuild. Your firm's marginal tax rate is 34%, and its WACC is 16.5%. a. Determine the loan details. Down Pmt: 27,500, Principal: 247,500, Ann Pmt: 71,426 39 b. How much interest will you end up paying on the machine loan? 38,205.56 c. What are the total startup costs for this project (all the present time cash flows)? 44,800 d. Draw a timeline for this project and include every cash flow. e. Use MIRR to determine whether you should invest in this machine. 19.978%, Yes What is the NPV and what does it mean? 8242.64, amount shareholder wealth increases... g. What is the PI and what does it mean? 1.184

Step by Step Solution

★★★★★

3.52 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

You are considering investing in a new machine for your processing ant The purchase price of the mac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started