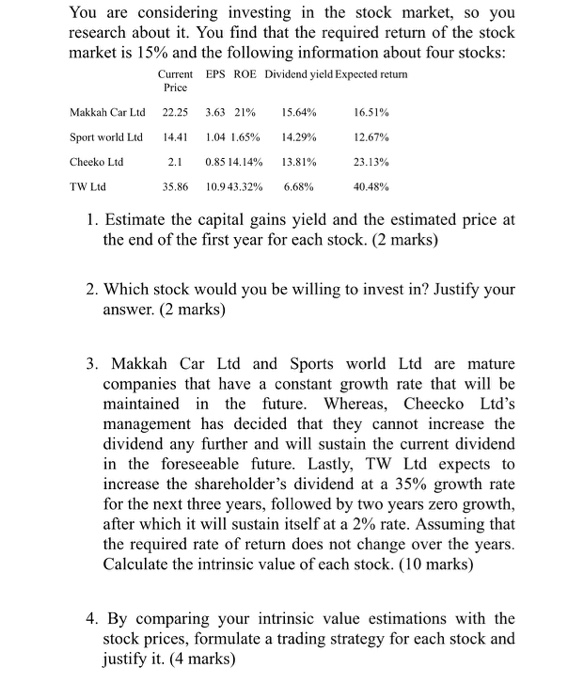

You are considering investing in the stock market, so you research about it. You find that the required return of the stock market is 15% and the following information about four stocks: Current EPS ROE Dividend yield Expected retum Price 22.25 3.63 21% 15.64% 16.51% 14.41 1.04 1.65% 14.29% 12.67% Makkah Car Ltd Sport world Ltd Cheeko Ltd TW Ltd 13.81% 2.1 0.85 14.14% 35.86 10.943.32% 23.13% 40.48% 6.68% 1. Estimate the capital gains yield and the estimated price at the end of the first year for each stock. (2 marks) 2. Which stock would you be willing to invest in? Justify your answer. (2 marks) 3. Makkah Car Ltd and Sports world Ltd are mature companies that have a constant growth rate that will be maintained in the future. Whereas, Cheecko Ltd's management has decided that they cannot increase the dividend any further and will sustain the current dividend in the foreseeable future. Lastly, TW Ltd expects to increase the shareholder's dividend at a 35% growth rate for the next three years, followed by two years zero growth, after which it will sustain itself at a 2% rate. Assuming that the required rate of return does not change over the years. Calculate the intrinsic value of each stock. (10 marks) 4. By comparing your intrinsic value estimations with the stock prices, formulate a trading strategy for each stock and justify it. (4 marks) You are considering investing in the stock market, so you research about it. You find that the required return of the stock market is 15% and the following information about four stocks: Current EPS ROE Dividend yield Expected retum Price 22.25 3.63 21% 15.64% 16.51% 14.41 1.04 1.65% 14.29% 12.67% Makkah Car Ltd Sport world Ltd Cheeko Ltd TW Ltd 13.81% 2.1 0.85 14.14% 35.86 10.943.32% 23.13% 40.48% 6.68% 1. Estimate the capital gains yield and the estimated price at the end of the first year for each stock. (2 marks) 2. Which stock would you be willing to invest in? Justify your answer. (2 marks) 3. Makkah Car Ltd and Sports world Ltd are mature companies that have a constant growth rate that will be maintained in the future. Whereas, Cheecko Ltd's management has decided that they cannot increase the dividend any further and will sustain the current dividend in the foreseeable future. Lastly, TW Ltd expects to increase the shareholder's dividend at a 35% growth rate for the next three years, followed by two years zero growth, after which it will sustain itself at a 2% rate. Assuming that the required rate of return does not change over the years. Calculate the intrinsic value of each stock. (10 marks) 4. By comparing your intrinsic value estimations with the stock prices, formulate a trading strategy for each stock and justify it. (4 marks)