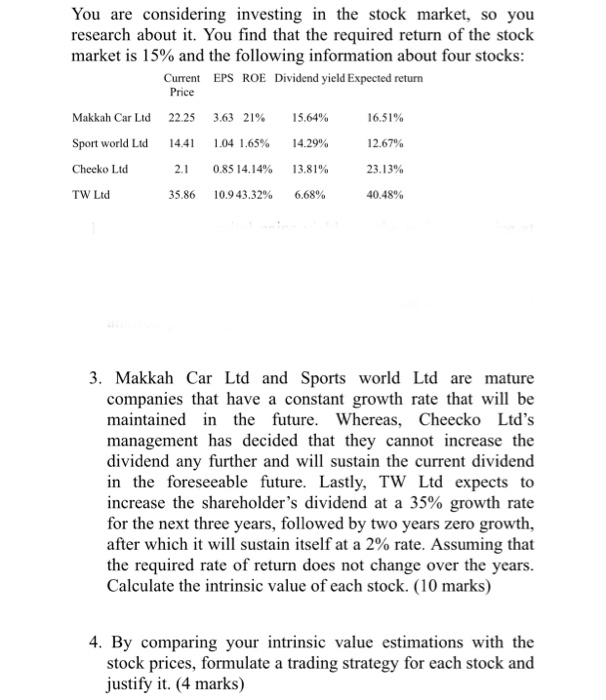

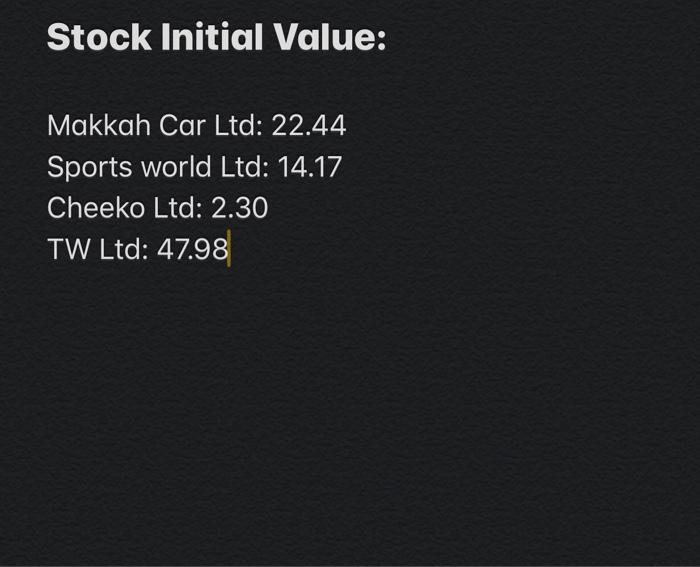

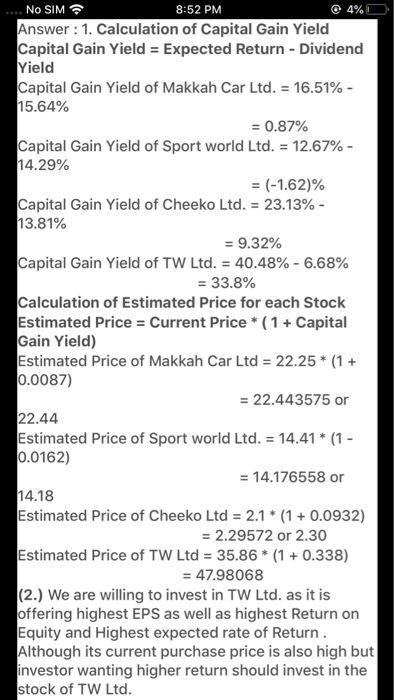

You are considering investing in the stock market, so you research about it. You find that the required return of the stock market is 15% and the following information about four stocks: Current EPS ROE Dividend yield Expected return Price Makkah Car Lid 22.25 3.63 21% 15.64% 16.51% Sport world Lid 14.41 1.04 1.65% 14.29% 12.67% Cheeko Ltd 0.85 14.14% 13.81% 23.13% TW Ltd 40.48% 2.1 35.86 10.943.32% 6.68% 3. Makkah Car Ltd and Sports world Ltd are mature companies that have a constant growth rate that will be maintained in the future. Whereas, Cheecko Ltd's management has decided that they cannot increase the dividend any further and will sustain the current dividend in the foreseeable future. Lastly, TW Ltd expects to increase the shareholder's dividend at a 35% growth rate for the next three years, followed by two years zero growth, after which it will sustain itself at a 2% rate. Assuming that the required rate of return does not change over the years. Calculate the intrinsic value of each stock. (10 marks) 4. By comparing your intrinsic value estimations with the stock prices, formulate a trading strategy for each stock and justify it. (4 marks) Stock Initial Value: Makkah Car Ltd: 22.44 Sports world Ltd: 14.17 Cheeko Ltd: 2.30 TW Ltd: 47.98 4% No SIM 8:52 PM Answer : 1. Calculation of Capital Gain Yield Capital Gain Yield = Expected Return - Dividend Yield Capital Gain Yield of Makkah Car Ltd. = 16.51%- 15.64% = 0.87% Capital Gain Yield of Sport world Ltd. = 12.67%- 14.29% = (-1.62)% Capital Gain Yield of Cheeko Ltd. = 23.13% - 13.81% = 9.32% Capital Gain Yield of TW Ltd. = 40.48% - 6.68% = 33.8% Calculation of Estimated Price for each Stock Estimated Price = Current Price *(1 + Capital Gain Yield) Estimated Price of Makkah Car Ltd = 22.25* (1 + 0.0087) = 22.443575 or 22.44 Estimated Price of Sport world Ltd. = 14.41* (1 - 0.0162) = 14.176558 or 14.18 Estimated Price of Cheeko Ltd = 2.1 * (1 + 0.0932) = 2.29572 or 2.30 Estimated Price of TW Ltd = 35.86 * (1 + 0.338) = 47.98068 (2.) We are willing to invest in TW Ltd. as it is offering highest EPS as well as highest Return on Equity and Highest expected rate of Return. Although its current purchase price is also high but investor wanting higher return should invest in the stock of TW Ltd. You are considering investing in the stock market, so you research about it. You find that the required return of the stock market is 15% and the following information about four stocks: Current EPS ROE Dividend yield Expected return Price Makkah Car Lid 22.25 3.63 21% 15.64% 16.51% Sport world Lid 14.41 1.04 1.65% 14.29% 12.67% Cheeko Ltd 0.85 14.14% 13.81% 23.13% TW Ltd 40.48% 2.1 35.86 10.943.32% 6.68% 3. Makkah Car Ltd and Sports world Ltd are mature companies that have a constant growth rate that will be maintained in the future. Whereas, Cheecko Ltd's management has decided that they cannot increase the dividend any further and will sustain the current dividend in the foreseeable future. Lastly, TW Ltd expects to increase the shareholder's dividend at a 35% growth rate for the next three years, followed by two years zero growth, after which it will sustain itself at a 2% rate. Assuming that the required rate of return does not change over the years. Calculate the intrinsic value of each stock. (10 marks) 4. By comparing your intrinsic value estimations with the stock prices, formulate a trading strategy for each stock and justify it. (4 marks) Stock Initial Value: Makkah Car Ltd: 22.44 Sports world Ltd: 14.17 Cheeko Ltd: 2.30 TW Ltd: 47.98 4% No SIM 8:52 PM Answer : 1. Calculation of Capital Gain Yield Capital Gain Yield = Expected Return - Dividend Yield Capital Gain Yield of Makkah Car Ltd. = 16.51%- 15.64% = 0.87% Capital Gain Yield of Sport world Ltd. = 12.67%- 14.29% = (-1.62)% Capital Gain Yield of Cheeko Ltd. = 23.13% - 13.81% = 9.32% Capital Gain Yield of TW Ltd. = 40.48% - 6.68% = 33.8% Calculation of Estimated Price for each Stock Estimated Price = Current Price *(1 + Capital Gain Yield) Estimated Price of Makkah Car Ltd = 22.25* (1 + 0.0087) = 22.443575 or 22.44 Estimated Price of Sport world Ltd. = 14.41* (1 - 0.0162) = 14.176558 or 14.18 Estimated Price of Cheeko Ltd = 2.1 * (1 + 0.0932) = 2.29572 or 2.30 Estimated Price of TW Ltd = 35.86 * (1 + 0.338) = 47.98068 (2.) We are willing to invest in TW Ltd. as it is offering highest EPS as well as highest Return on Equity and Highest expected rate of Return. Although its current purchase price is also high but investor wanting higher return should invest in the stock of TW Ltd