Question

You are considering investing RM64000 in new equipment. You estimate that the net cash flows will be RM14000 during the first year, but will

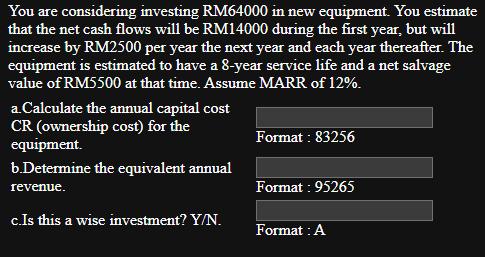

You are considering investing RM64000 in new equipment. You estimate that the net cash flows will be RM14000 during the first year, but will increase by RM2500 per year the next year and each year thereafter. The equipment is estimated to have a 8-year service life and a net salvage value of RM5500 at that time. Assume MARR of 12%. a Calculate the annual capital cost CR (ownership cost) for the equipment. b.Determine the equivalent annual revenue. c. Is this a wise investment? Y/N. Format : 83256 Format : 95265 Format : A

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the annual capital cost CR for the equipment we need to determine the present value of the investment including the initial cost net salv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App