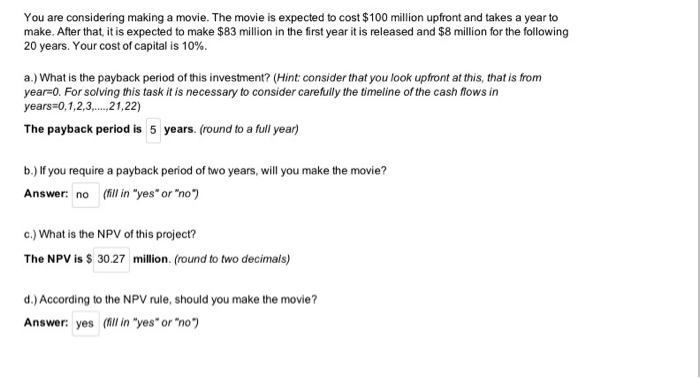

You are considering making a movie. The movie is expected to cost $100 million upfront and takes a year to make. After that, it is expected to make $83 million in the first year it is released and $8 million for the following 20 years. Your cost of capital is 10%. a.) What is the payback period of this investment? (Hint consider that you look upfront at this, that is from year=0. For solving this task it is necessary to consider carefully the timeline of the cash flows in years=0,1,2,3,...,21,22) The payback period is 5 years. (round to a full year) b.) If you require a payback period of two years, will you make the movie? Answer: no (fill in "yes" or "no") c.) What is the NPV of this project? The NPV is $ 30.27 million. (round to two decimals) d.) According to the NPV rule, should you make the movie? Answer: yes (all in "yes" or "no") Task 6a v5 Stefan Ingves, governor of the Swedish National Bank (Riksbanken), reportedly was paid 8 million SEK in advance to write his book How we boosted inflation. The book took three years to write. In the time he spent writing, Stefan could have been paid to work as a professor and give speeches as an economic commentator in TV shows. Given his knowledge and experience, assume that he could have earned 8 million SEK per year (paid at the end of the year) working and commenting instead of writing the book. Assume his cost of capital is 14% per year. a. What is the NPV of agreeing to write the book (ignoring any royalty payments)? The NPV is -10573056.22 million SEK. (Round to three decimals) b. Assume that, once the book is finished, it is expected to generate royalties of $5 million in the first year (paid at the end of the year) and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments ? The NPV of the book with the royalty payments is -2503380.92 million SEK. (Round to three decimals, DO NOT ROUND THE RESULT FROM (a)) c. How many IRRs are there in part (a)? The number of IRR IS 1 Does the IRR rule give the right answer in this case? Fill in "yes" or "no" no d. How many IRRs are there in part (b)? The number of IRRS is 2 Does the IRR rule give the right answer in this case? Fill in "yes" or "no" no